Levered Free Cash Flow Formula Investopedia

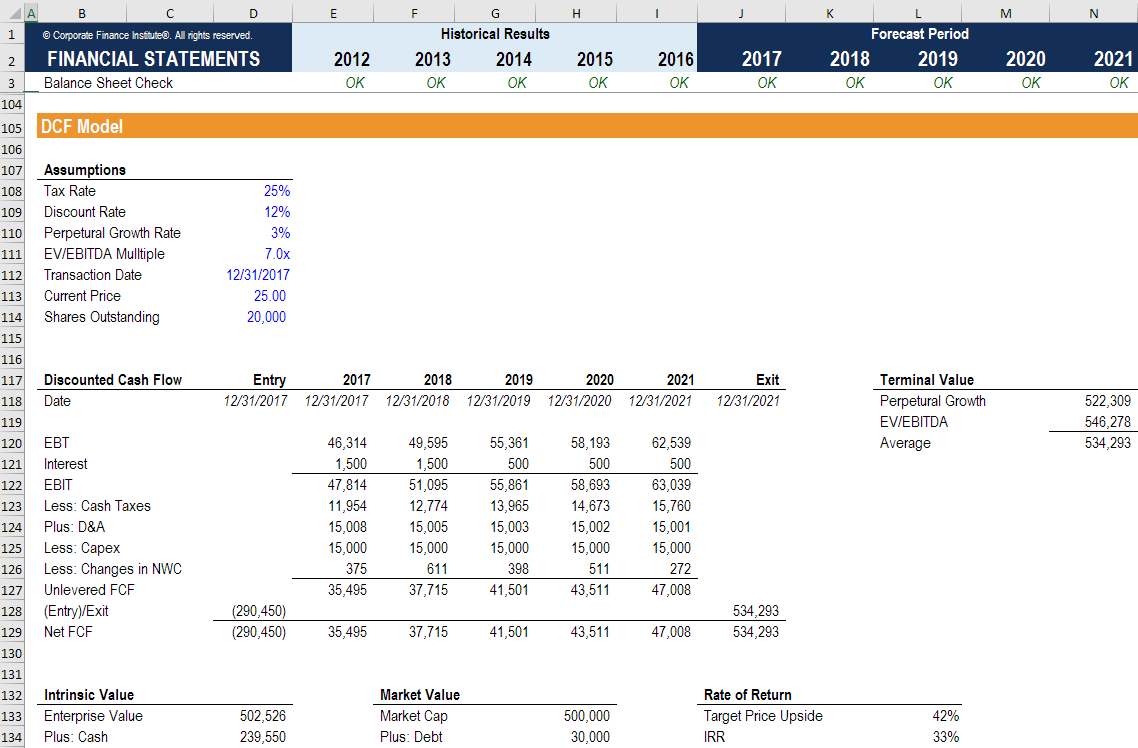

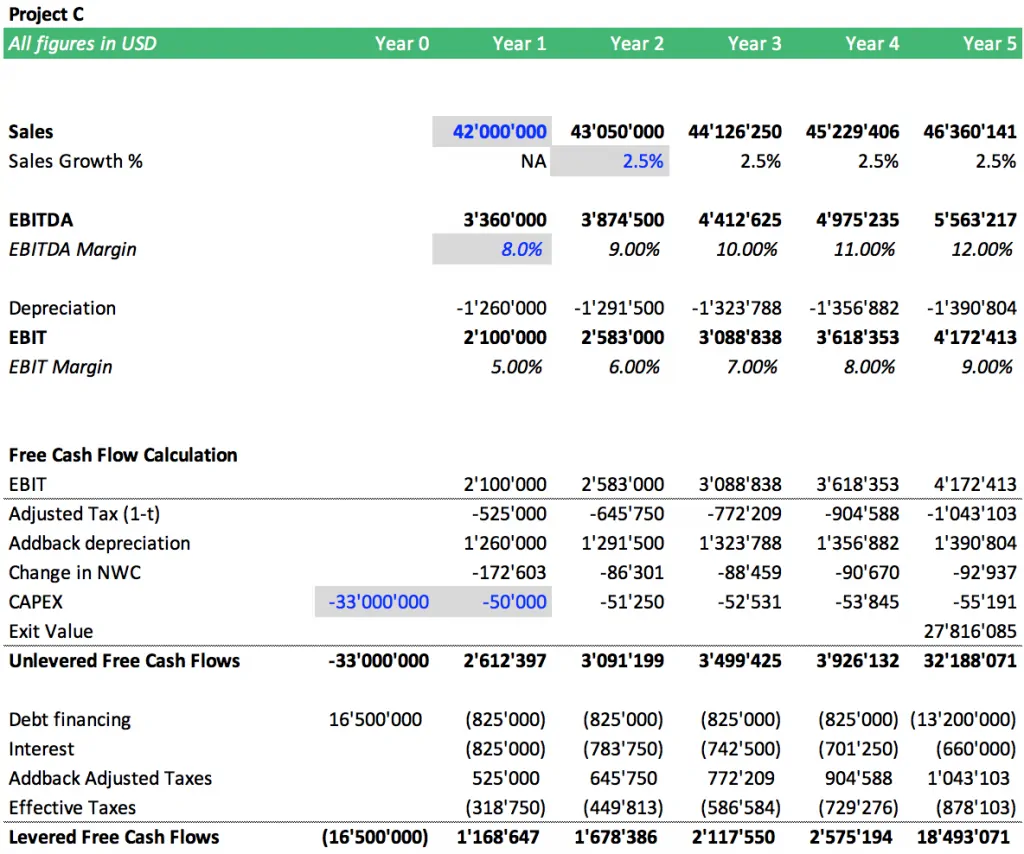

When using unlevered free cash flow to determine the enterprise value ev enterprise value enterprise value or firm value is the entire value of a firm equal to its equity value plus net debt plus any minority interest used in valuation. Once you calculate the terminal value then find the present value of the terminal value.

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg) Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield The Best Fundamental Indicator

It looks at the entire market value rather than just the equity value so all ownership interests and asset claims from both.

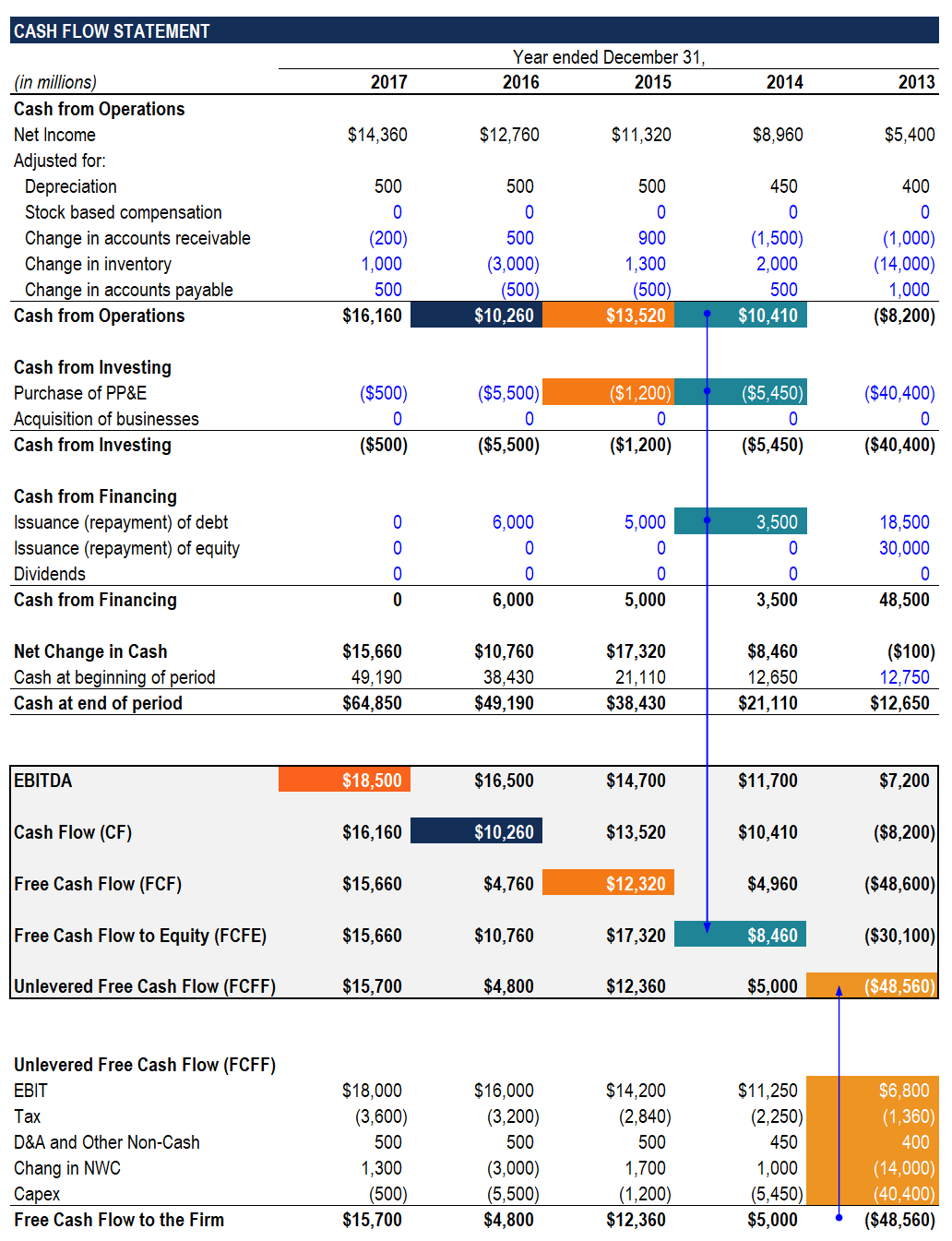

Levered free cash flow formula investopedia. Levered free cash flow is the amount of cash a company has left remaining after paying all its financial obligations. In corporate finance free cash flow fcf or free cash flow to firm fcff is a way of looking at a business s cash flow to see what is available for distribution among all the securities holders of a corporate entity this may be useful to parties such as equity holders debt holders preferred stock holders and convertible security holders when they want to see how much cash can be. Similarly if ebit is in the denominator enterprise value would be used in the numerator and if net income is in the denominator equity.

The levered cash flow decreased by 24 7 yoy due to a decrease in net income by 36 9 and an increase in capital expenditures by 45 2. Then he identifies the interest expense on the income statement and the capital expenditures on the cash flow statement. The formula for terminal value using free cash flow to equity is fcff 2022 x 1 growth keg the growth rate is the perpetuity growth of free cash flow to equity.

Investment bankers and financial commentators pay attention to levered free cash flow to see if a borrowing entity can still be. In other words it shows the net cash balance a company hoards after making all debt related remittances. Each company is a bit different but a formula for unlevered free cash flow would look like this.

Unlevered free cash flow formula. Levered free cash flow is important to both investors and company management. Unlevered free cash flow is the gross free cash flow generated by a company.

In our model we have assumed this growth rate to be 3. Arriving at equity value. Multiply by 1 tax rate to get the company s net operating profit after taxes or nopat.

Levered free cash flow is unlevered free cash flow minus interest and mandatory principal repayments. Now john can calculate the levered free cash flow as follows. Start with operating income ebit on the company s income statement.

Leverage is another name for debt and if cash flows are levered that means they are net of interest payments. However equity value is used with levered free cash flow as levered free cash flow includes the impact of interest expense and mandatory debt repayments and therefore belongs to only equity investors.

:max_bytes(150000):strip_icc()/shutterstock_112522391-5bfc2b9846e0fb0051bde2d3.jpg) Levered Free Cash Flow Lfcf Definition

Levered Free Cash Flow Lfcf Definition

Understanding Free Cash Flow Youtube

Understanding Free Cash Flow Youtube

Unlevered Free Cash Flow Yield Formula

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg) Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield The Best Fundamental Indicator

Fcf Formula Formula For Free Cash Flow Examples And Guide

Fcf Formula Formula For Free Cash Flow Examples And Guide

What Is The Difference Between Free Cash Flow To Equity And Free

Paper Lbo Example Walk Through For Pe Interview Standard

Paper Lbo Example Walk Through For Pe Interview Standard

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

:max_bytes(150000):strip_icc()/GettyImages-612737000-005e93c7d1614e3dbfd3b424f0570349.jpg) Levered Free Cash Flow Lfcf Definition

Levered Free Cash Flow Lfcf Definition

Fcf Formula Formula For Free Cash Flow Examples And Guide

Fcf Formula Formula For Free Cash Flow Examples And Guide

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow From Cfo

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcff Vs Fcfe Differences Valuation Multiples Discount Rates

Fcff Vs Fcfe Differences Valuation Multiples Discount Rates

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Definition Examples Formula

Levered Vs Unlevered Free Cash Flow Difference

Levered Vs Unlevered Free Cash Flow Difference

What Is The Difference Between Free Cash Flow To Equity And Free

:max_bytes(150000):strip_icc()/xom_cf_march_31_2018_inv-5bfd869dc9e77c0051d9b908-5c5e030846e0fb000158752d.jpg) Free Cash Flow To The Firm Fcff Definition

Free Cash Flow To The Firm Fcff Definition

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg) Comparing Free Cash Flow Vs Operating Cash Flow

Comparing Free Cash Flow Vs Operating Cash Flow

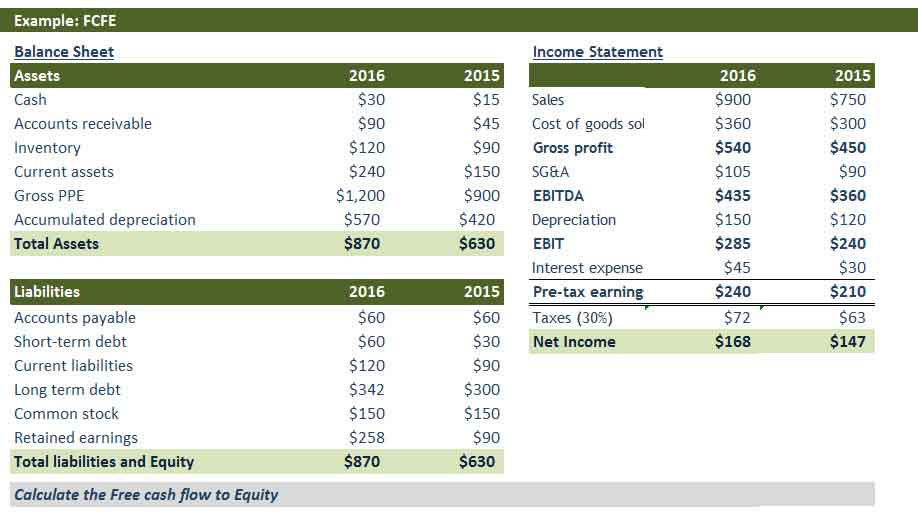

Free Cash Flow To Equity Fcfe Learn How To Calculate Fcfe

Free Cash Flow To Equity Fcfe Learn How To Calculate Fcfe

:max_bytes(150000):strip_icc()/144295606-5bfc3d8bc9e77c0026b9791a.jpg) Levered Free Cash Flow Lfcf Definition

Levered Free Cash Flow Lfcf Definition

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg) Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield The Best Fundamental Indicator

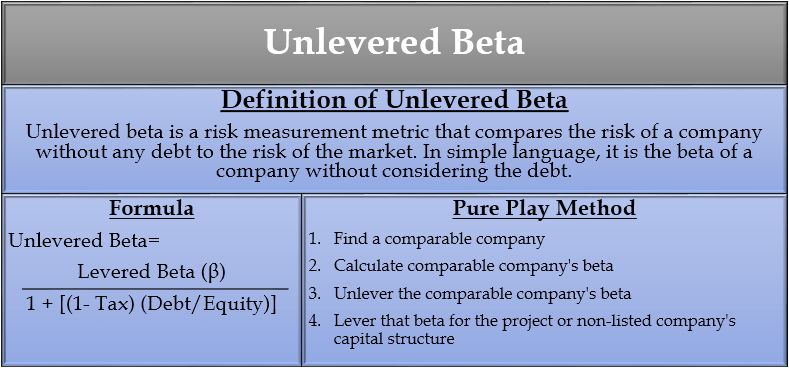

Unlevered Beta Definition Vs Levered Beta Formula Pure Play

Unlevered Beta Definition Vs Levered Beta Formula Pure Play

Unlevered Firm Investopedia About Investments

Stock Screen Strong Altman Z Score

Stock Screen Strong Altman Z Score

Https Samples Breakingintowallstreet Com S3 Amazonaws Com Ibig 04 04 Equity Value Enterprise Value Metrics Multiples Pdf

Irr Levered Vs Unlevered An Internal Rate Of Return Example

Irr Levered Vs Unlevered An Internal Rate Of Return Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Understanding Levered Vs Unlevered Free Cash Flow

Understanding Levered Vs Unlevered Free Cash Flow

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcfe Calculate Free Cash Flow To Equity Formula Example

Fcfe Calculate Free Cash Flow To Equity Formula Example

Levered Vs Unlevered Free Cash Flow Difference

Levered Vs Unlevered Free Cash Flow Difference

What Is The Difference Between Free Cash Flow To Equity And Free

What Is The Difference Between Free Cash Flow To Equity And Free

Posting Komentar

Posting Komentar