How Does Tax Affect Consumer Surplus

Consumer surplus is defined as the difference between the total amount that consumers are willing and able to pay for a good or service indicated by the demand curve and the total amount that they actually do pay i e. How can taxes on a good affect both consumer surplus producer surplus.

Effect Of Sales Tax On Economic Surplus Market

Effect Of Sales Tax On Economic Surplus Market

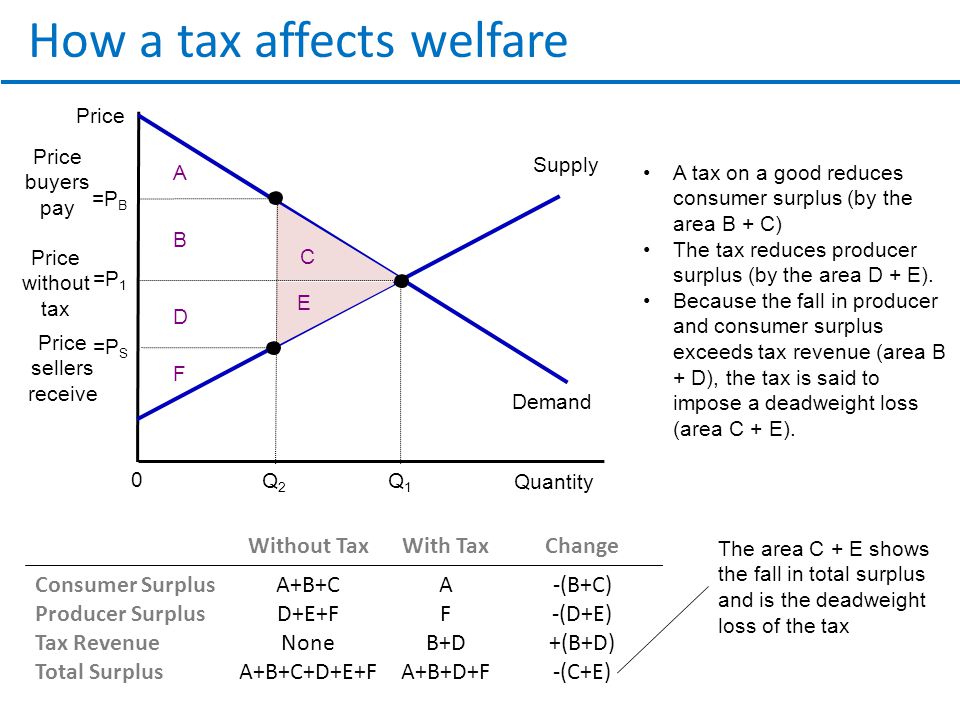

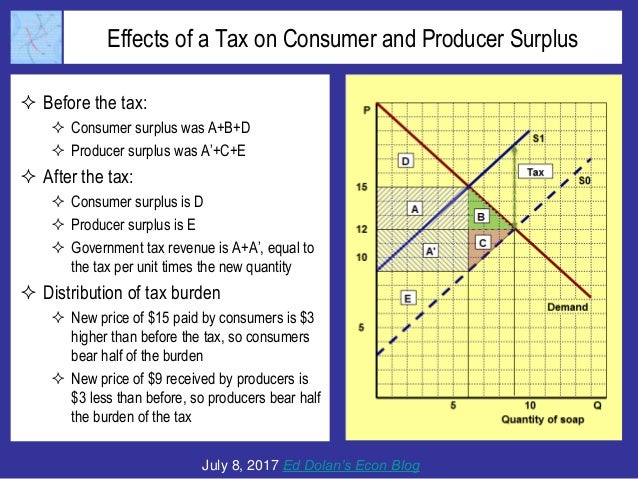

What happens to a consumer and a producer s surplus when a good is taxed.

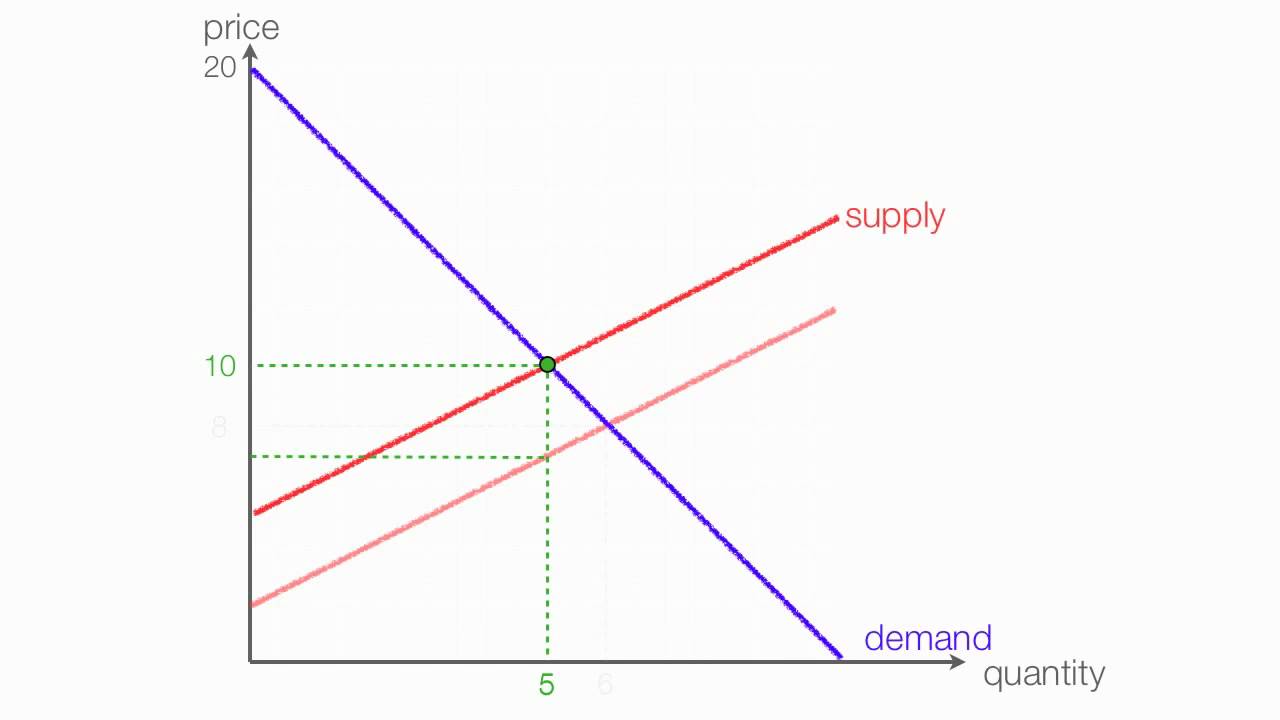

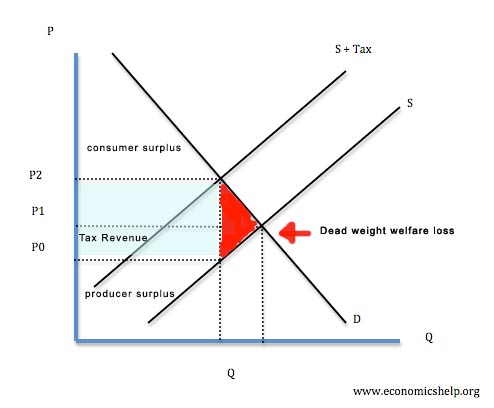

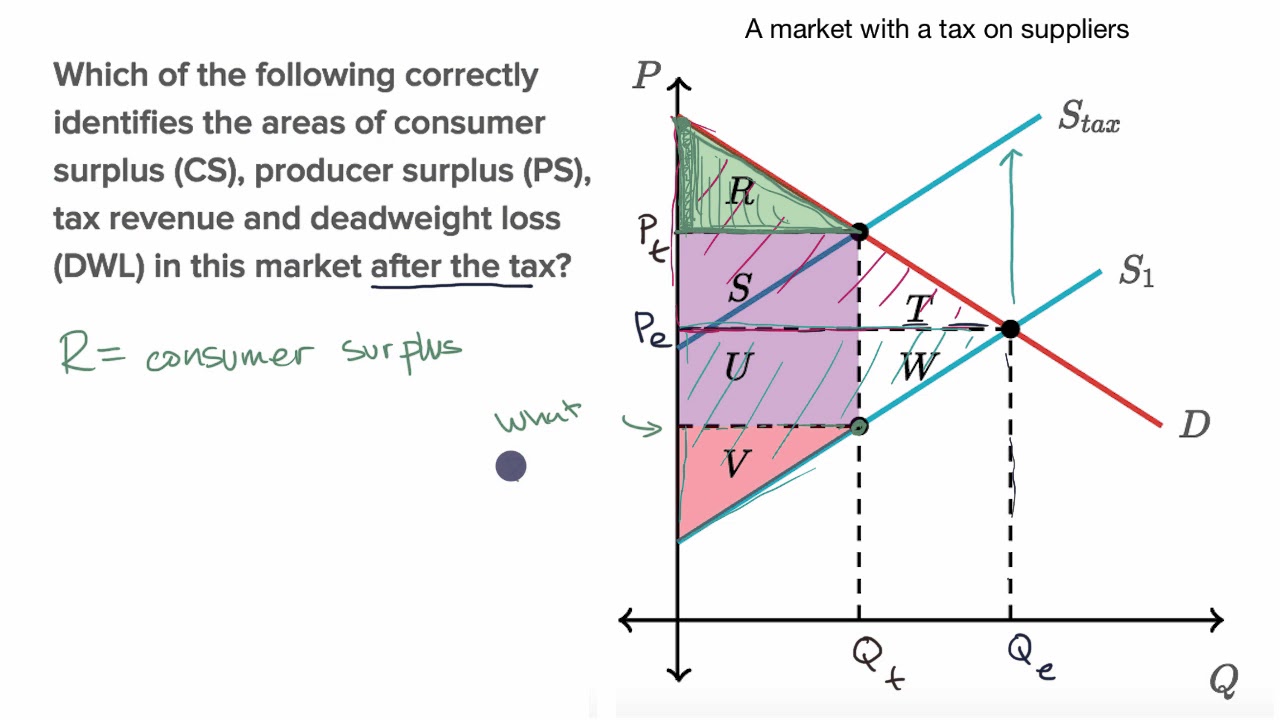

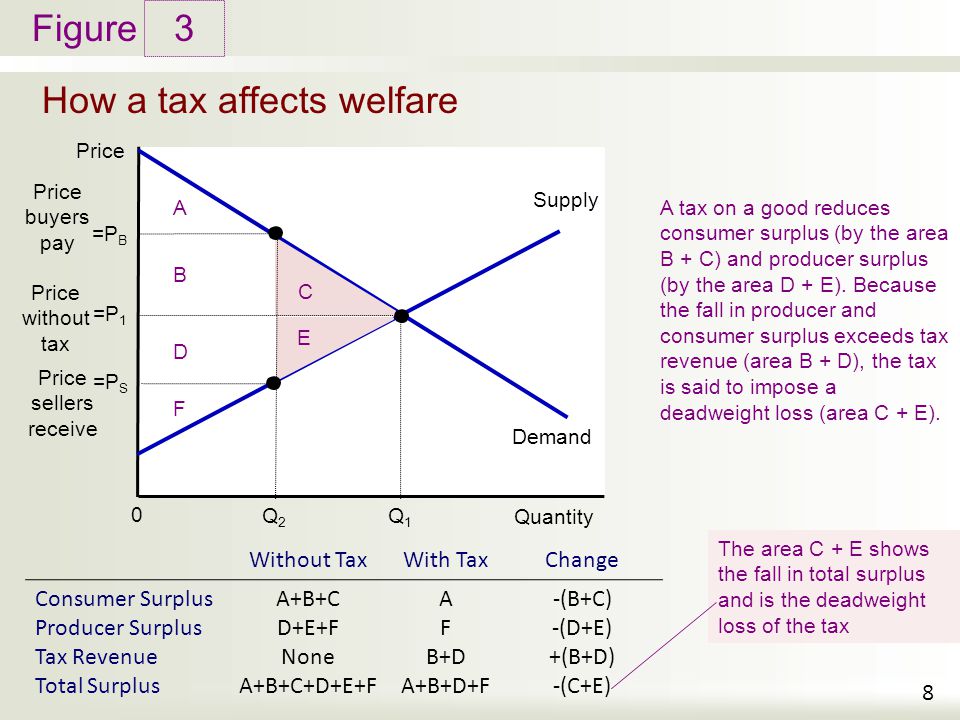

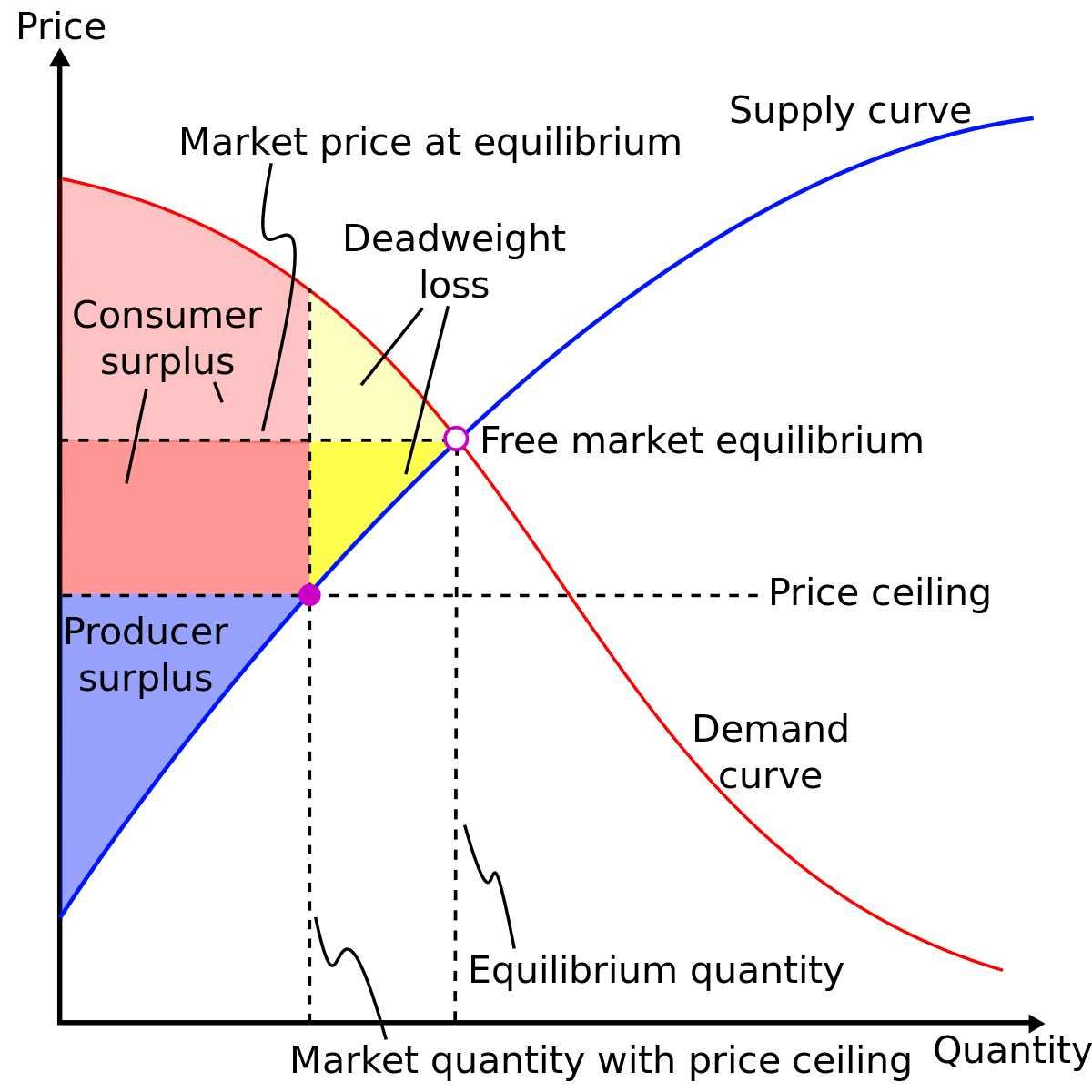

How does tax affect consumer surplus. In economics consumer surplus refers to the net gain that a customer receives when she purchases a. 3 1 consumer surplus goes down. Consumer surplus falls because the price to the buyer rises and producer surplus profit falls because the price to the seller falls.

In fact this. A vat tax or value added tax is a series of taxes imposed on the production of products all through the process with the customer paying the final tax. Consumer surplus and economic welfare.

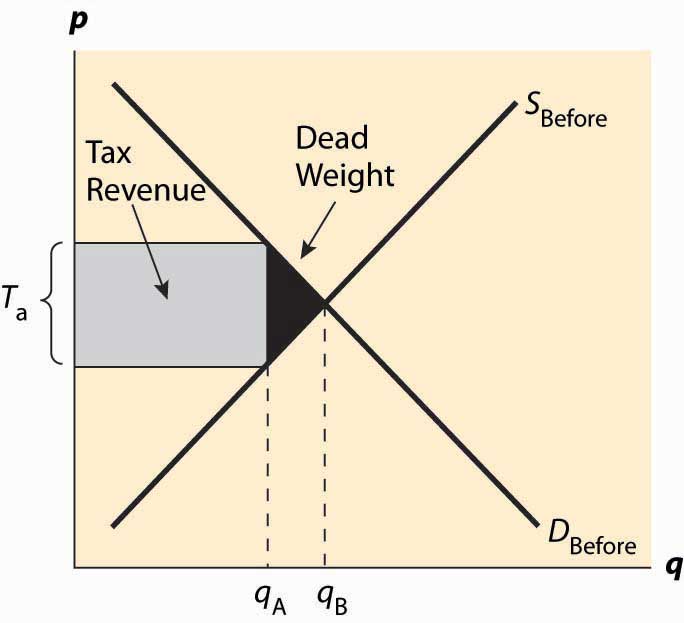

With the introduction of a tax the consumer and producer surplus could both fall. Consumer surplus is a measure of the welfare that people gain from consuming goods and services. Total surplus is reduced no matter where the incidence of it is applied.

A vat is different from sales tax because the only one paying sales tax is the consumer. Tutorial showing how taxes reduce consumer surplus producer surplus and causes society to have a deadweight loss. The resultant loss is known as a deadweight loss which comes about because the tax causes the price of.

The effect of taxes. 4 effects of sales tax meant to correct externalities. 3 effects of sales tax on a single good in a monopolist controlled market.

3 3 total economic surplus goes down. Consumer surplus is the difference between the amount that a buyer is willing to pay and the actual. Producer surplus represents the benefit the seller gains from selling a good at a.

Vat taxes are common in europe and other countries but aren t used in the u s. And we can clearly see that with the tax the consumer surplus is smaller and of course it has to be smaller because the consumers are paying a higher price and they are purchasing a smaller quantity the equilibrium quantity is of course less than 500 units maybe it s something like 450 units. Proposition 3 also reveals that although information sharing affects the consumer surplus for the retailer as shown in proposition 2 when the carbon tax is low 0 τ 2 k this effect is converse to that for the manufacturer because the low carbon tax plays a minimal role in reducing the manufacturer s carbon emissions.

3 2 producer surplus goes down and in fact producer surplus government surplus stays the same or goes down. In addition a tax reduces the quantity traded thereby reducing some of the gains from trade. Includes how taxes are shared between consumer and producer.

Deadweight Loss Examples How To Calculate Deadweight Loss

Deadweight Loss Examples How To Calculate Deadweight Loss

The Effects Of A Tax Supply Demand Price Size Of Tax Per Unit

The Effects Of A Tax Supply Demand Price Size Of Tax Per Unit

Price Changes And Producer Surplus Economics Tutor2u

Price Changes And Producer Surplus Economics Tutor2u

Price Changes And Consumer Surplus Economics Tutor2u

Price Changes And Consumer Surplus Economics Tutor2u

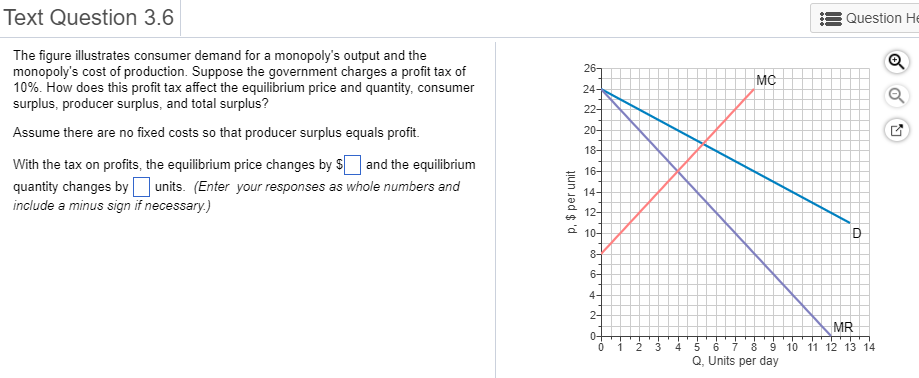

Solved The Figure Illustrates Consumer Demand For A Mono

Solved The Figure Illustrates Consumer Demand For A Mono

4 7 Taxes And Subsidies Principles Of Microeconomics

4 7 Taxes And Subsidies Principles Of Microeconomics

P Q 0 Excise Tax Analysis Of A 1 Unit Excise Tax S D Pe Qe

P Q 0 Excise Tax Analysis Of A 1 Unit Excise Tax S D Pe Qe

Consumer Surplus And Producer Surplus Are Maximised

Consumer Surplus And Producer Surplus Are Maximised

4 7 Taxes And Subsidies Principles Of Microeconomics

4 7 Taxes And Subsidies Principles Of Microeconomics

1 Consumer Surplus Chapter 7 7th Edition

Taxation And Government Intervention Ppt Video Online Download

Taxation And Government Intervention Ppt Video Online Download

A Consumer Surplus After The Imposition Of The Tax Is B

A Consumer Surplus After The Imposition Of The Tax Is B

How To Calculate Changes In Consumer And Producer Surplus With

How To Calculate Changes In Consumer And Producer Surplus With

Application The Costs Of Taxation Ppt Video Online Download

Application The Costs Of Taxation Ppt Video Online Download

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsy6ahxaworkouzjaiywraqutxigpaqup3uibldsfptzwaeeupo Usqp Cau

Econowaugh Ap 2009 Microeconomics Frq 2

Econowaugh Ap 2009 Microeconomics Frq 2

Example Breaking Down Tax Incidence Video Khan Academy

Example Breaking Down Tax Incidence Video Khan Academy

Consumer Surplus Producer Surplus Economics Online Economics

Consumer Surplus Producer Surplus Economics Online Economics

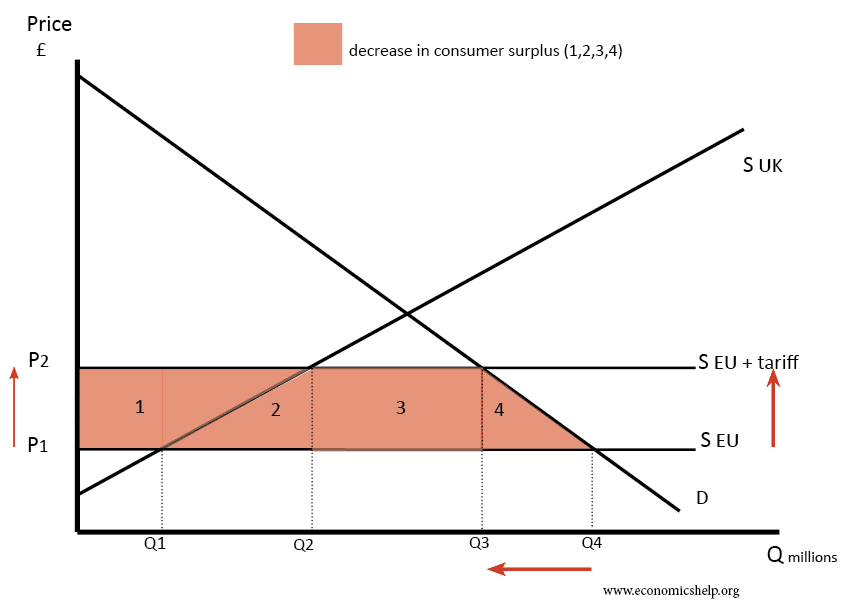

Benefits And Costs Of Tariffs Economics Help

Benefits And Costs Of Tariffs Economics Help

Taxes Dead Weight Loss Consumer Surplus Youtube

Taxes Dead Weight Loss Consumer Surplus Youtube

Application The Costs Of Taxation Ppt Download

Application The Costs Of Taxation Ppt Download

4 7 Taxes And Subsidies Principles Of Microeconomics

4 7 Taxes And Subsidies Principles Of Microeconomics

Price Changes And Producer Surplus Economics Tutor2u

Price Changes And Producer Surplus Economics Tutor2u

How To Calculate Excise Tax And The Impact On Consumer And

How To Calculate Excise Tax And The Impact On Consumer And

Animation On How To Calculate Consumer Surplus Producer Surplus

Animation On How To Calculate Consumer Surplus Producer Surplus

Surplus Taxes And Subsidies Youtube

Surplus Taxes And Subsidies Youtube

Deadweight Welfare Loss Of Tax Economics Help

Deadweight Welfare Loss Of Tax Economics Help

Price Changes And Consumer Surplus Economics Tutor2u

Price Changes And Consumer Surplus Economics Tutor2u

4 7 Taxes And Subsidies Principles Of Microeconomics

4 7 Taxes And Subsidies Principles Of Microeconomics

Taxes Dead Weight Loss Consumer Surplus Youtube

Taxes Dead Weight Loss Consumer Surplus Youtube

Tax Incidence And Consumer And Producer Surplus Youtube

Tax Incidence And Consumer And Producer Surplus Youtube

How To Calculate The Impact Of Export Tax Consumer And Producer

How To Calculate The Impact Of Export Tax Consumer And Producer

Example Breaking Down Tax Incidence Video Khan Academy

Example Breaking Down Tax Incidence Video Khan Academy

Application The Costs Of Taxation Ppt Video Online Download

Application The Costs Of Taxation Ppt Video Online Download

Posting Komentar

Posting Komentar