Levered Free Cash Flow Formula

Abbreviated it looks like this. The simplified formula is.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

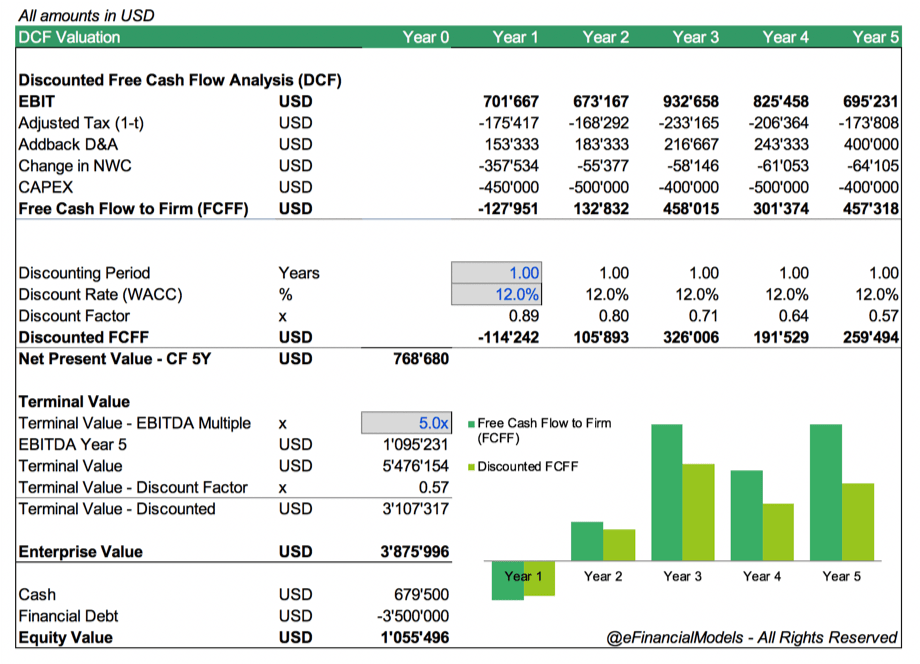

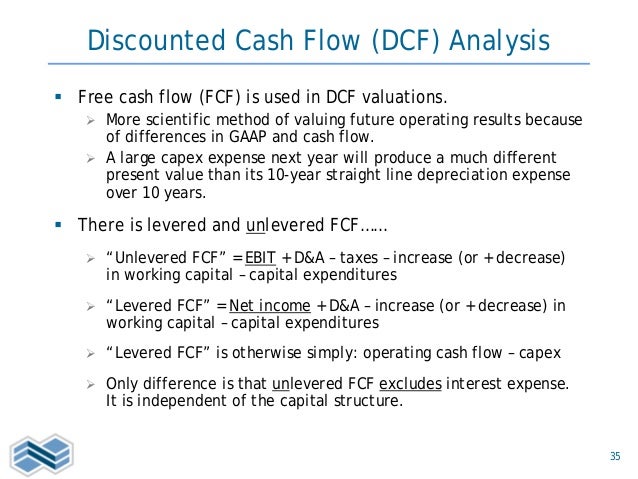

Unlevered free cash flow ufcf is a company s cash flow before taking interest payments into account.

Levered free cash flow formula. You have operating cash flow discounted free cash flow and both levered and unlevered free cash flow. Each company is a bit different but a formula for unlevered free cash flow would look like this. The lfcf formula is as follows.

Levered free cash flow is the amount of cash a company has left remaining after paying all its financial obligations. Start with operating income ebit on the company s income statement. Levered free cash flow is relatively simple to work out although you will need to know a couple of key pieces of information beforehand.

Multiply by 1 tax rate to get the company s net operating profit after taxes or nopat. But levered free cash flow is more accurate. Unlevered free cash flow formula.

Fcf cash from operations capex levered and unlevered free cash flow when corporate finance professionals refer to free cash flow they also may be referring to unlevered free cash flow. When a firm seeks expansion into a new market or the development of a new product it needs additional cash. Below we ll be looking at unlevered free cash flow what it is why it s important and how to calculate it.

Levered free cash flow earned income before interest taxes depreciation and amortization change in net working capital capital expenditures mandatory debt payments. Cash flow is more complex than that too. Small businesses are often capable of financing their operations without raising additional capital.

Levered free cash flow formula. Unlevered free cash flow can be reported in a company s. A common measure is to take the earnings before interest and taxes multiplied by 1 tax rate add depreciation and amortization and then subtract changes in working capital and capital expenditure.

Unlevered free cash flow formula. The levered free cash flow formula is as follows. Levered free cash flow is important to both investors and company management.

Lfcf ebitda mandatory debt payments change in net working capital capital expenditures. Depending on the audience a number of refinements and adjustments may also be made to try to eliminate distortions. How to calculate levered free cash flow.

Unlevered free cash flow ufcf. The levered free cash flow is an important measure of a firm s ability to grow.

When Should I Use Unlevered Vs Levered Free Cash Flows In A

Free Cash Flow Formula Top 3 Fcff Formula You Must Know Youtube

Free Cash Flow Formula Top 3 Fcff Formula You Must Know Youtube

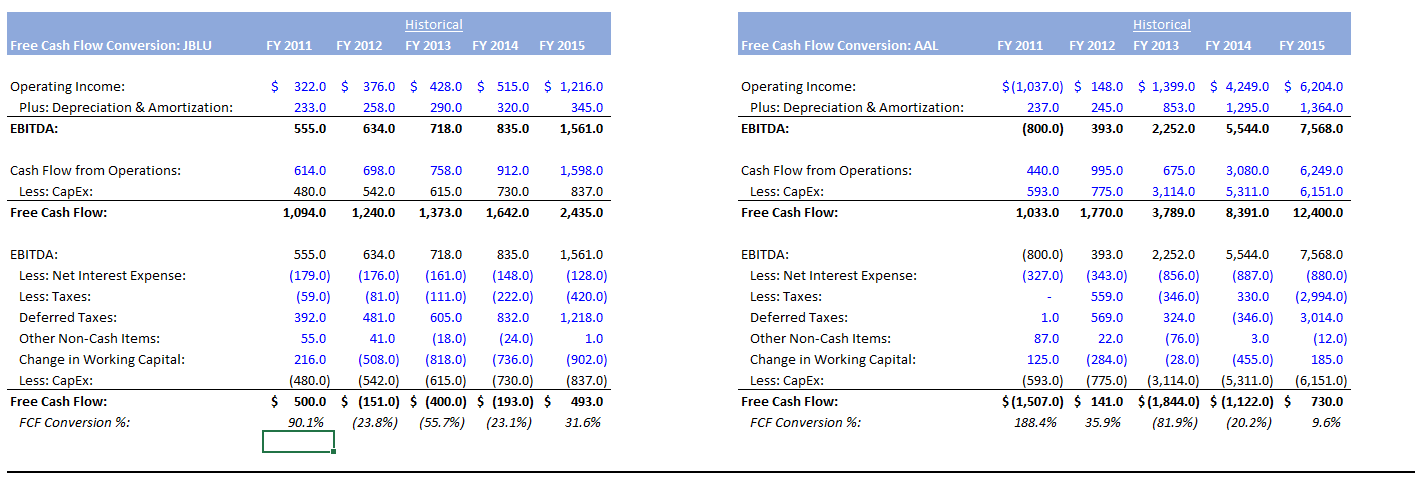

Free Cash Flow Conversion Percentages Choppy For Jetblue And

Free Cash Flow Conversion Percentages Choppy For Jetblue And

Unlevered Free Cash Flow Youtube

Unlevered Free Cash Flow Youtube

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Discounted Cash Flow Analysis Street Of Walls

Levered Free Cash Flow Lfcf Lumovest

Levered Free Cash Flow Lfcf Lumovest

Levered Vs Unlevered Free Cash Flow Difference

Levered Vs Unlevered Free Cash Flow Difference

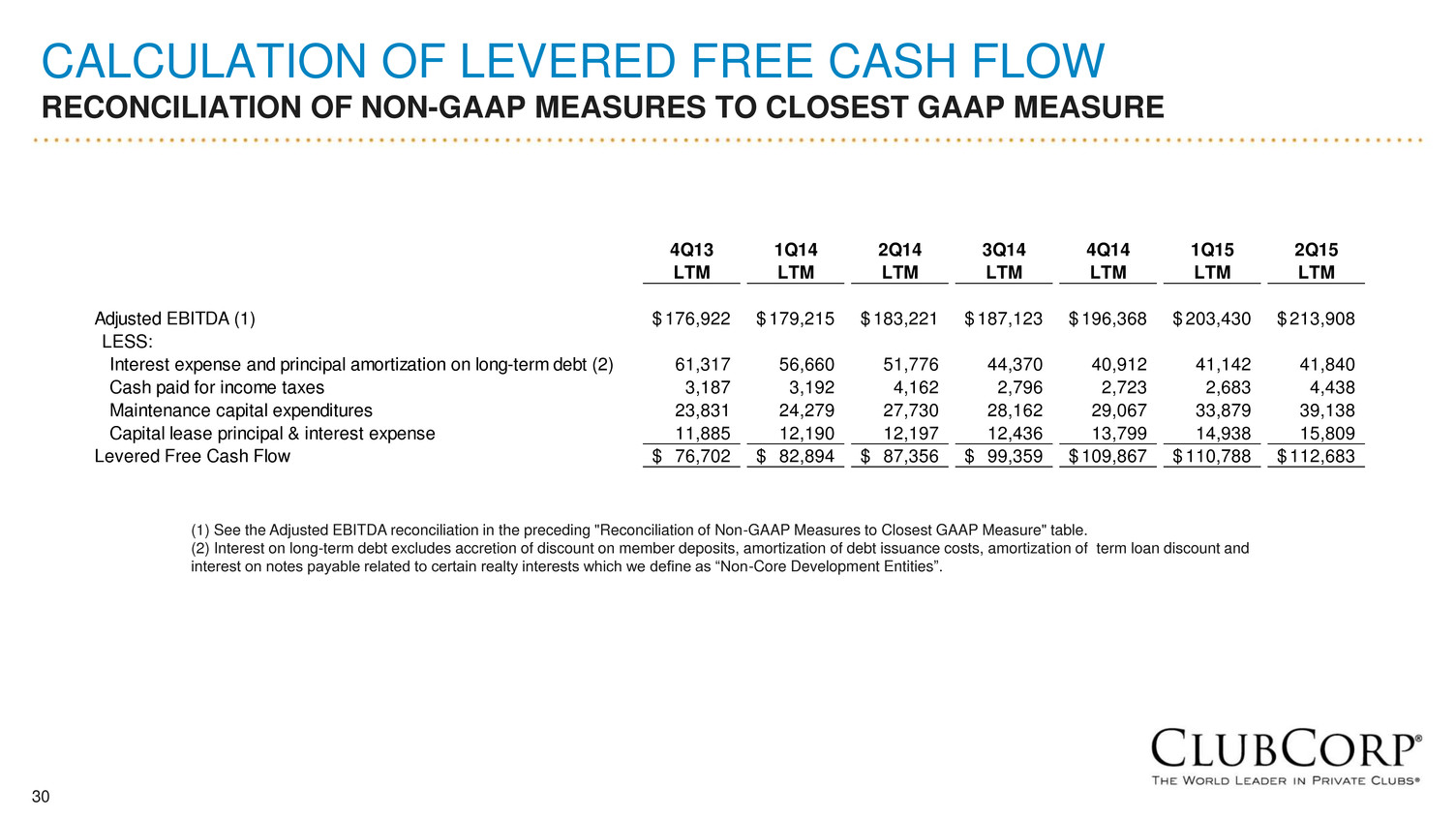

Form 8 K Clubcorp Holdings Inc For Jul 23

Form 8 K Clubcorp Holdings Inc For Jul 23

Understanding Levered Vs Unlevered Free Cash Flow

Understanding Levered Vs Unlevered Free Cash Flow

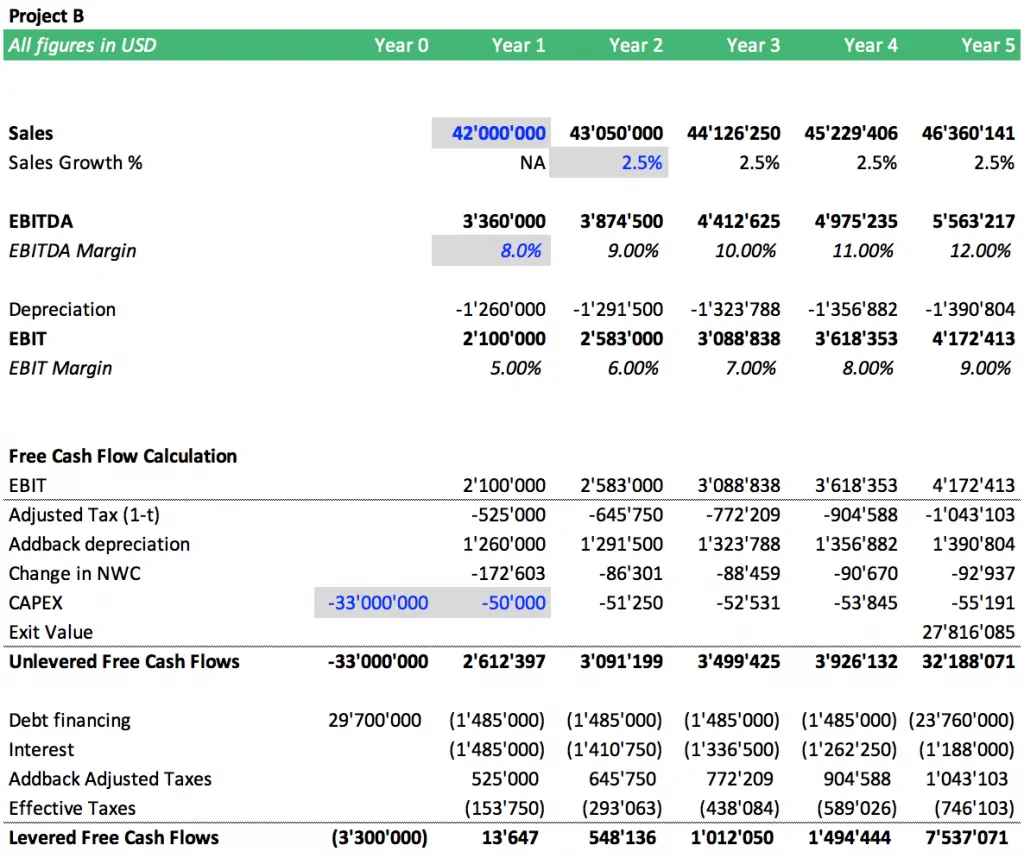

Irr Levered Vs Unlevered An Internal Rate Of Return Example

Irr Levered Vs Unlevered An Internal Rate Of Return Example

Paper Lbo Model Example Street Of Walls

Free Cash Flow Fcf Definition Formula And How To Calculate

Free Cash Flow Fcf Definition Formula And How To Calculate

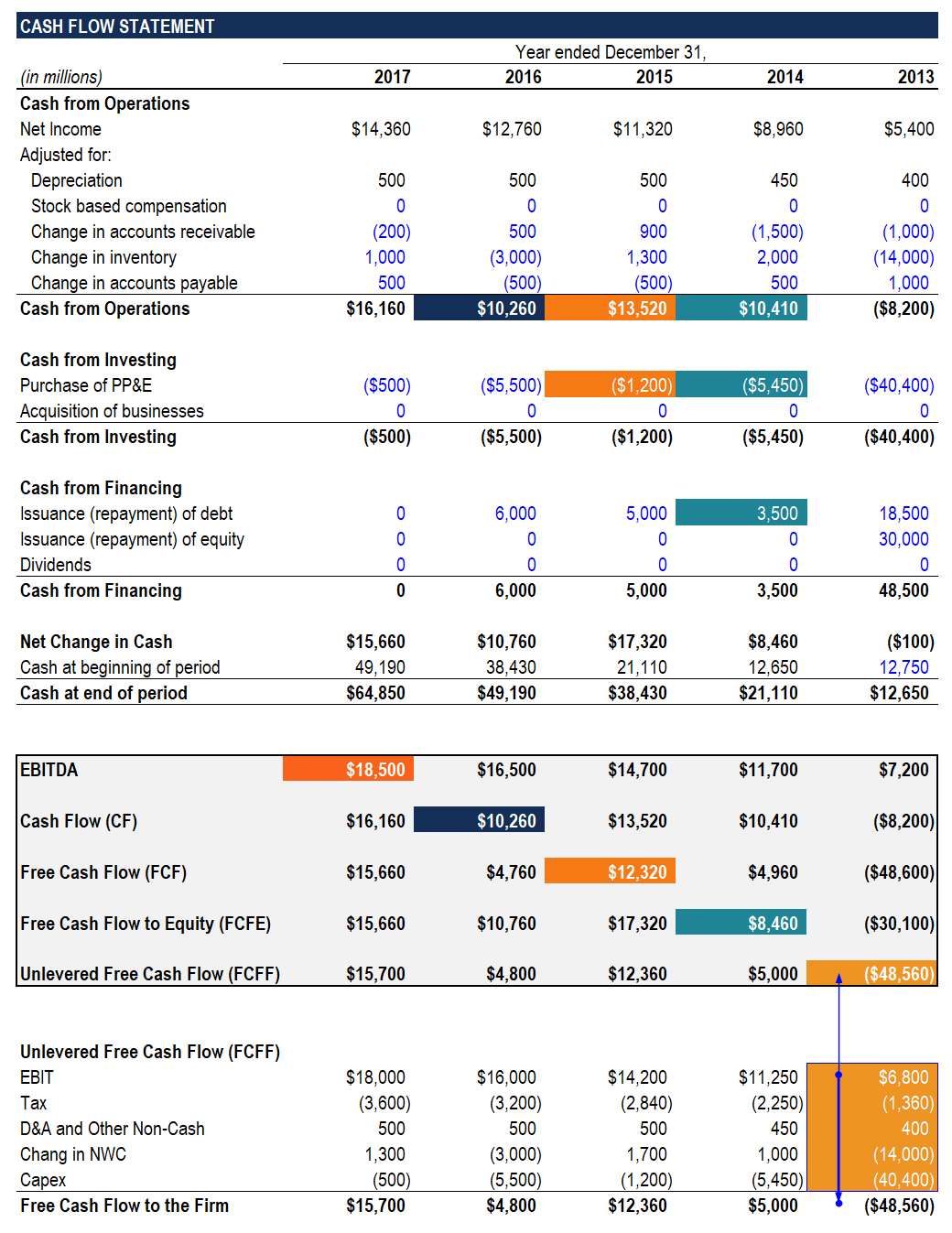

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf Fcff

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf Fcff

How To Calculate Unlevered Free Cash Flow In A Dcf

How To Calculate Unlevered Free Cash Flow In A Dcf

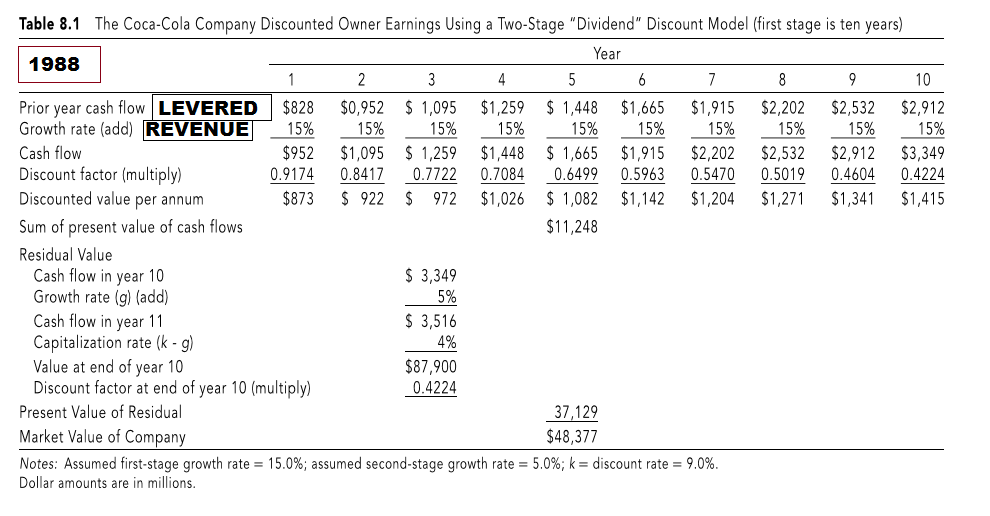

How To Use Levered Free Cash Flow And Revenue Growth To Analyze

How To Use Levered Free Cash Flow And Revenue Growth To Analyze

What Is Levered Free Cash Flow Definition Meaning Example

What Is Levered Free Cash Flow Definition Meaning Example

Unlevered Free Cash Flow Yield Formula

Discounted Cash Flow Dcf Analysis Of Verizon Simple Example

Discounted Cash Flow Dcf Analysis Of Verizon Simple Example

Business Valuation Models Two Methods 1 Discounted Cash Flow 2

Business Valuation Models Two Methods 1 Discounted Cash Flow 2

Fcf Formula Formula For Free Cash Flow Examples And Guide

Fcf Formula Formula For Free Cash Flow Examples And Guide

Free Cash Flow To Firm Fcff Formulas Definition Example

Free Cash Flow To Firm Fcff Formulas Definition Example

Levered Free Cash Flow Calculation Wall Street Oasis

Levered Free Cash Flow Calculation Wall Street Oasis

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Http New Tutorials Breakingintowallstreet Com S3 Amazonaws Com 07 Biws Fcf Quick Reference Pdf

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf Fcff

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf Fcff

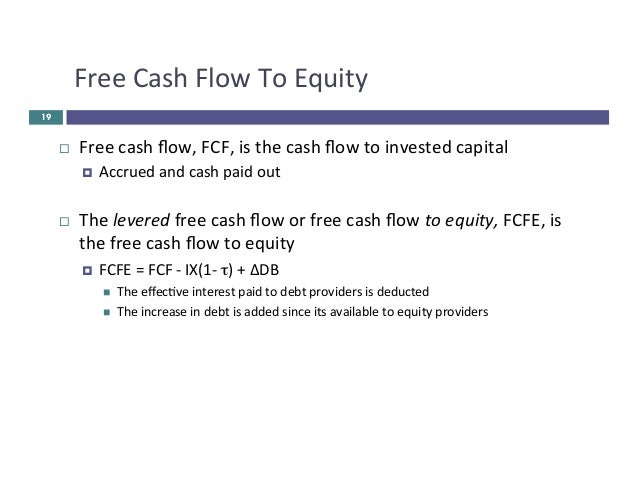

Cash Flow And Cost Of Capital Pdf

Cash Flow And Cost Of Capital Pdf

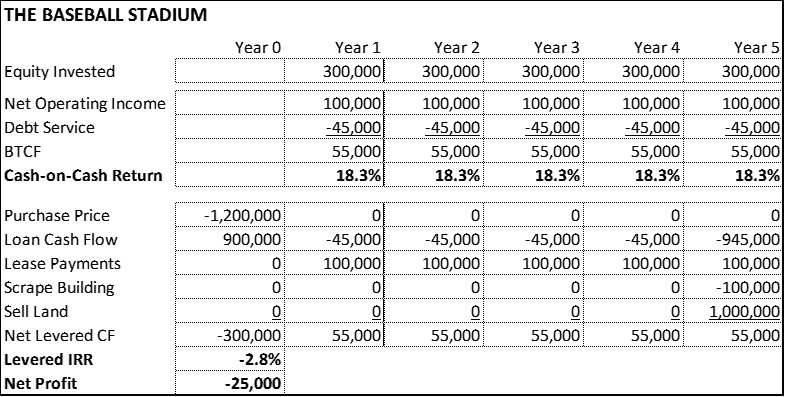

60 Second Knowledge Bite Levered Vs Unlevered Cash On Cash

60 Second Knowledge Bite Levered Vs Unlevered Cash On Cash

Discounted Cash Flow Analysis Street Of Walls

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Definition Examples Formula

Paper Lbo Example Walk Through For Pe Interview Standard

Paper Lbo Example Walk Through For Pe Interview Standard

Using The Cash On Cash Return In Real Estate Analysis A Cre

Using The Cash On Cash Return In Real Estate Analysis A Cre

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Definition Examples Formula

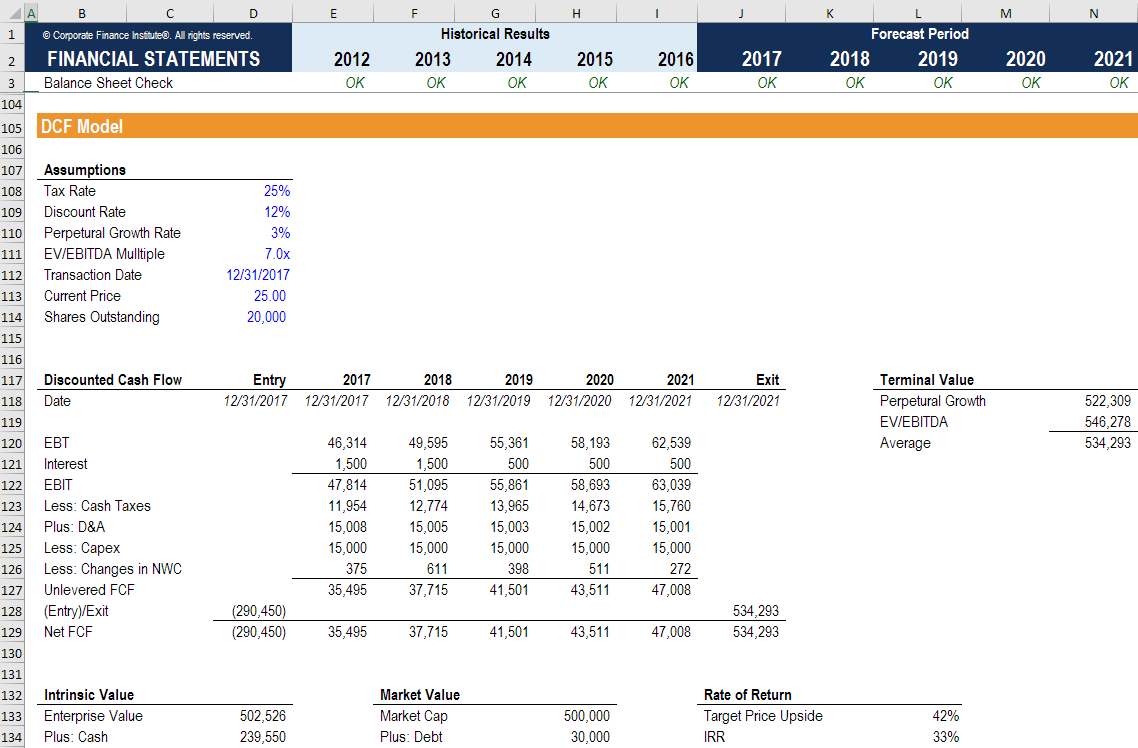

Dcf Model Calculating Discounted Cash Flows

Dcf Model Calculating Discounted Cash Flows

Posting Komentar

Posting Komentar