Who Qualifies For Home Heating Credit In Michigan

You own or were contracted to pay rent and occupied a michigan homestead you were not a full time student who was claimed as a dependent on another person s return you did not live in college or university operated housing for the entire year. If you own your home your taxable value was 135 000 or less.

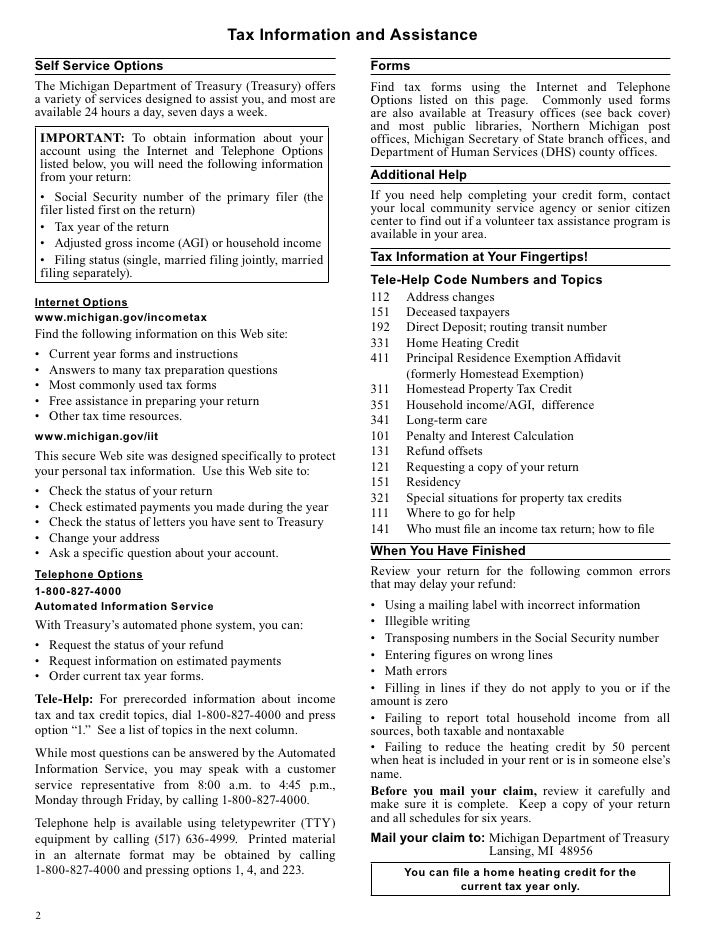

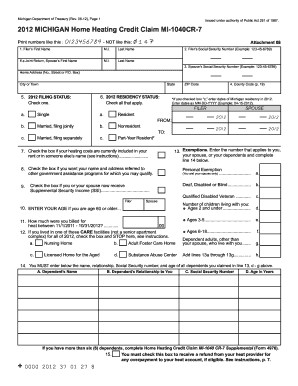

To get an applications for the home heating credit form mi 1040cr 7 you can.

Who qualifies for home heating credit in michigan. You own or were contracted to pay rent and occupied a michigan homestead for at least 6 months during the year on which property taxes and or service fees were levied. You may qualify for a homestead property tax credit if all of the following apply. You may qualify for a home heating credit if all of the following apply.

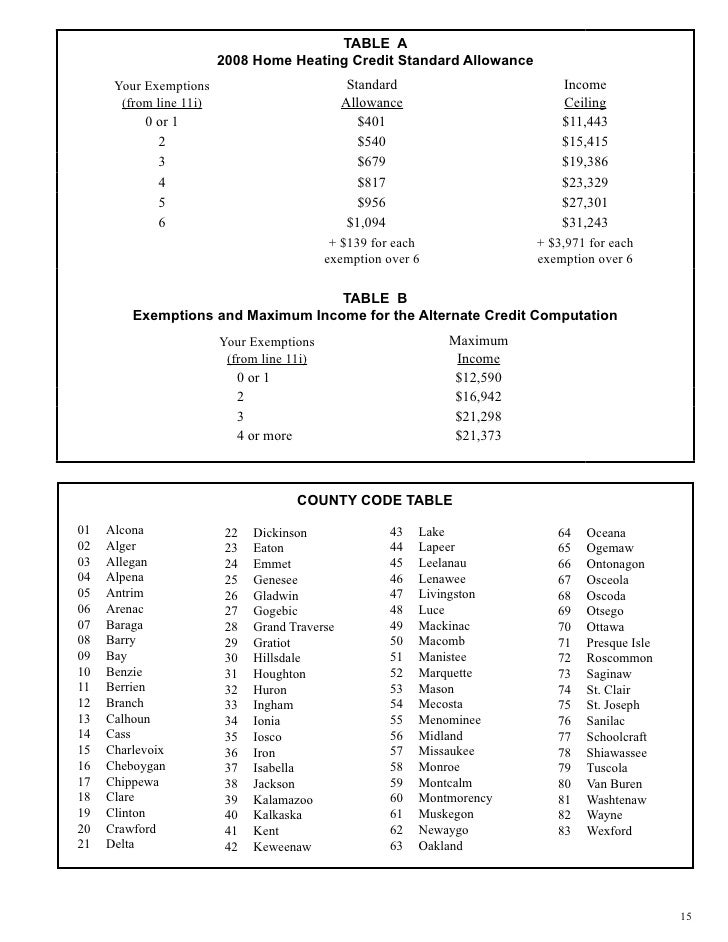

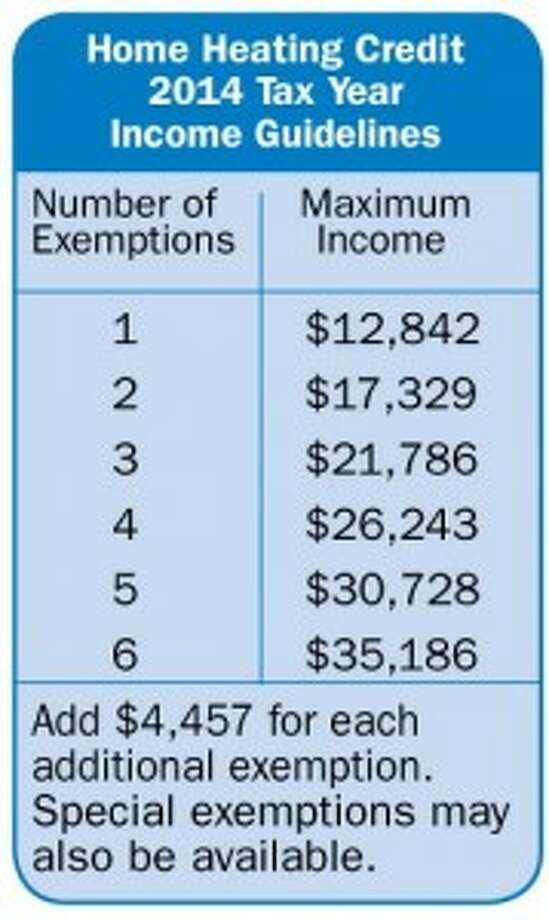

2019 home heating credit mi 1040cr 7 standard allowance. You occupy a michigan homestead you own your home or are contracted to pay rent you were not a full time student who was claimed as a dependent on another person s return you did not live in college or university operated housing for the entire year you did not. There are a number of ways you can apply for the home heating credit and you don t need to file a michigan tax return to do so.

If you lived in your homestead for less than 12 months you must prorate your standard allowance see instructions in the mi 1040cr 7 booklet. Department of health and human services. You can apply for a home heating credit by filing your application with the michigan department of treasury before sept.

Special situations include shared housing partial year michigan residency claiming the credit on behalf of a deceased resident or disability. The home heating credit provides assistance to help pay for heating expenses if you are a qualified michigan homeowner or renter. You did not live in college or university operated housing for the entire year.

The program that is formally known as the home heating credit hhc was created by the state of michigan in partnership with gas and utility companies to help low and moderate income individuals and families living in michigan with paying for the cost of their home heating bills. The michigan hhc program is also provided with federal government funds through the low income home energy assistance program known as liheap which is run by the u s. Visit the michigan department of treasury website at michigan gov treasury and enter home heating credit in the search box.

You own or were contracted to pay rent and occupied a michigan homestead. You may claim a home heating credit if all of the following apply. You were not a full time student who was claimed as a dependent on another person s income tax return.

Michigan residents over age 65 are eligible regardless of income but need to meet eligibility guidelines. You may qualify for a home heating credit if all of the following apply. Who may file a home heating credit claim.

Home Heating Credit Claim Instruction Book

Home Heating Credit Claim Instruction Book

Taxes Forms For Home Heating 2019 Fill Online Printable

Taxes Forms For Home Heating 2019 Fill Online Printable

Michigan Department Of Treasury On Twitter Treasury Less Than A

Michigan Department Of Treasury On Twitter Treasury Less Than A

Treasury Less Than A Week To Apply For Home Heating Credit

Treasury Less Than A Week To Apply For Home Heating Credit

See If You Qualify For Michigan S Home Heating Credit

See If You Qualify For Michigan S Home Heating Credit

Home Heating Credit Provides Help For Qualifying Michigan

Home Heating Credit Provides Help For Qualifying Michigan

Summer Heat Is A Good Reminder To Claim The Michigan Home Heating

Michigan Processing Home Heating Credit Applications

Michigan Processing Home Heating Credit Applications

Who Is Eligible For Michigan S Home Heating Tax Credit Kershaw

Who Is Eligible For Michigan S Home Heating Tax Credit Kershaw

Fillable Online Michigan 2014 Michigan Home Heating Credit Claim

Fillable Online Michigan 2014 Michigan Home Heating Credit Claim

Home Heating Credit Claim Instruction Book

Home Heating Credit Claim Instruction Book

Michigan Processing Home Heating Credit Applications Wkar

Michigan Processing Home Heating Credit Applications Wkar

Consumers Energy Encourages Qualifying Residents To Apply For

Consumers Energy Encourages Qualifying Residents To Apply For

Michigan Home Heating Credit Form 2009 Fill Online Printable

Michigan Home Heating Credit Form 2009 Fill Online Printable

Michigan S Home Heating Credit Are You Eligible Cedam

Still Time To Apply For Michigan Home Heating Credit Consumers

Still Time To Apply For Michigan Home Heating Credit Consumers

Deadline Looms For Michigan Home Heating Credit Public News Service

Time Running Out To Sign Up For Home Heating Credit Superior

Time Running Out To Sign Up For Home Heating Credit Superior

Michigan Processing Home Heating Credit Applications Wgvu

Michigan Processing Home Heating Credit Applications Wgvu

Form Mi 1040cr 7 2011 Michigan Home Heating Credit Claim

Important Tax Credits Michigan Free Tax Help

.jpg) Michigan Processing Home Heating Credit Applications

Michigan Processing Home Heating Credit Applications

288 000 Michigan Residents To Receive Additional Home Heating

288 000 Michigan Residents To Receive Additional Home Heating

288k Michigan Residents To Receive Additional Home Heating Credit

Michigan Home Heating Credit May Still Be Available To Some

Michigan Home Heating Credit May Still Be Available To Some

Https Www Michigan Gov Documents Mpsc Home Heating Credit 361574 7 Pdf

1999 Form Mi Mi 1040cr 7 Fill Online Printable Fillable Blank

1999 Form Mi Mi 1040cr 7 Fill Online Printable Fillable Blank

Michigan Home Heating Credit Refresher Maximizing Resident

Michigan Home Heating Credit Refresher Maximizing Resident

Deadline For Home Heating Credit Monday News Talk 94 9 Wsjm

Deadline For Home Heating Credit Monday News Talk 94 9 Wsjm

Michigan Processing Home Heating Credit Applications

Michigan Processing Home Heating Credit Applications

Michigan Processing Home Heating Credit Applications

Michigan Processing Home Heating Credit Applications

Https Www Michigan Gov Documents Taxes Mi 1040cr7 Book 642714 7 Pdf

Form Mi 1040cr 7 2011 Michigan Home Heating Credit Claim

Deadline Approaches To Claim Michigan Home Heating Credit News

Deadline Approaches To Claim Michigan Home Heating Credit News

Https Pdf4pro Com Cdn Michigan 2017 Credit Claim 31c032 Pdf

Home Heating Credit Claim Instruction Book

Home Heating Credit Claim Instruction Book

Posting Komentar

Posting Komentar