Four Cs Of Credit Have To Do With Earning Potential And Available Cash

Five cs of credit. These four areas are known as the four c s and stand for.

Shells skins and minted coins.

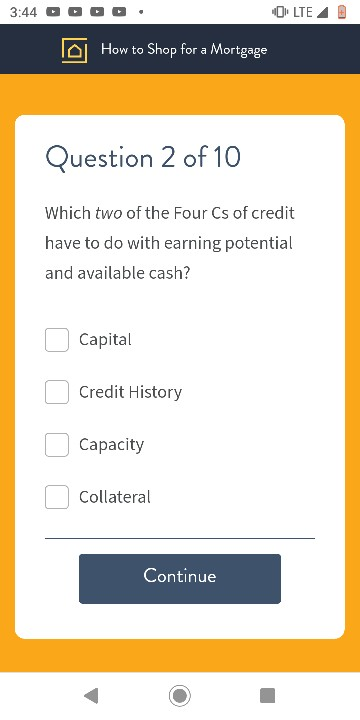

Four cs of credit have to do with earning potential and available cash. The four cs of credit are. Pick correct statement a. Which two of the four cs of credit have to do with earning potential and available cash.

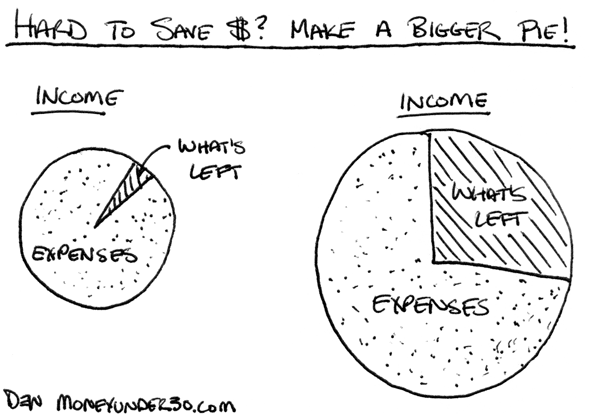

It is the assessment the of the ability of any business to pay bills and maintain the cash flow. Capacity refers to a borrower s ability to pay back his her loan. Cash will soon become extinct as it happened with the first money.

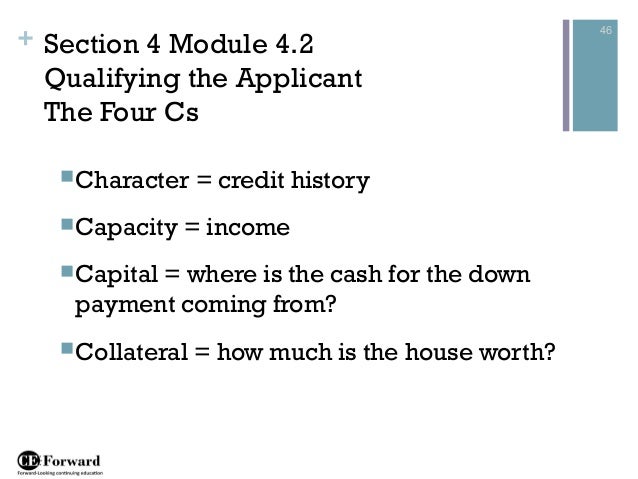

1 credit 2 capacity 3 capital 4 collateral here is a summary of each c and how they impact the loan approval. Prequalification is a lender s estimated of how much you can afford to borrow bases on. Of the four c s of credit capacity is often the most important.

It contains in it the. Is used in modern life less and less. The system weighs five characteristics of the borrower and conditions of.

Lenders typically require 12 18 months of positive history. Answer to which two of the four cs of credit have to do with earning potential and available cash. When you take out a mortgage your home becomes collateral.

Out of the 4 cs of credit the two cs that deal with the earning potential and available cash are capacity and capital. True or false 3. A high personal credit score over 700 may be the most important factor in getting a business loan.

The five c s of credit is a system used by lenders to gauge the creditworthiness of potential borrowers. Your credit history is an overview of how much you use credit and how well you pay your bills. Obviously your ability to pay back a loan is an important factor for a lender when considering you for a loan but different lenders will measure this ability in different ways.

It s hard evidence that you don t spend more than you earn use credit in moderation and pay bills regularly and promptly. Factors that will affect your credit score include. The fewer the problems the higher the credit score.

Credit capital capacity collateral. Character is most often determined by looking at the credit history particularly as it is stated in the credit score fico score. Are there 3 4 5 or 6 cs of credit.

What do they mean. The information that is being gathered could be getting strewn and scattered all over the place. Character capacity or cashflow capital and conditions.

Which two of the four cs of credit have to do with earning potential and avaliable cash. In evaluating a loan application to determine whether or not an applicant qualifies for a mortgage lenders look at four areas. Modest balances no late or missed.

The 4 cs of credit helps in making the evaluation. What are the 4 cs of credit. Credit investigation could get intricate and dense.

How To Make Extra Money 23 Easy Ways Clark Howard

How To Make Extra Money 23 Easy Ways Clark Howard

Https Www Firstfcu Org Images Fourcs Pdf

Your Guide To The Chase Ink Business Credit Cards

Your Guide To The Chase Ink Business Credit Cards

The Storm Before The Storm Us Banks Use Q1 To Prepare For Worse

The Storm Before The Storm Us Banks Use Q1 To Prepare For Worse

Your Credit What Lenders See Framework

Your Credit What Lenders See Framework

/ExxonBS09-30-2018-5c5dc25646e0fb000144215d.jpg) Financial Statements Definition

Financial Statements Definition

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqurq Lllqnihq675zut9kaoopqt Hqw3mtlutgv5w Usqp Cau

Chapter Fifteen Consumer Loans Credit Cards Real Estate Lending

Chapter Fifteen Consumer Loans Credit Cards Real Estate Lending

Capital One Quicksilverone Card Review Wirecutter

Capital One Quicksilverone Card Review Wirecutter

Bank Of America Cash Rewards Credit Card Great For Gas Wirecutter

Bank Of America Cash Rewards Credit Card Great For Gas Wirecutter

Solved 3 43 Olte How To Shop For A Mortgage Question 1 Of

Solved 3 43 Olte How To Shop For A Mortgage Question 1 Of

Bank Of America Premium Rewards Credit Card Review Wirecutter

Bank Of America Premium Rewards Credit Card Review Wirecutter

The Side Hustle If You Re Unhappy Being Broke Why Don T You Fix It

The Side Hustle If You Re Unhappy Being Broke Why Don T You Fix It

Best Credit Cards For Grocery Delivery Services Wirecutter

Best Credit Cards For Grocery Delivery Services Wirecutter

Getting A Mortgage The Four C S Of Credit Smart Money Mamas

Getting A Mortgage The Four C S Of Credit Smart Money Mamas

Science Asks Do Pretty People Really Make More Money

Science Asks Do Pretty People Really Make More Money

:max_bytes(150000):strip_icc()/prosper-inv-462fe620ddc1495aa4fb452ab913926c.png) Understanding The Five Cs Of Credit

Understanding The Five Cs Of Credit

/GettyImages-1128048513-1a5da9fada6e4af29077018a353fede2.jpg) Understanding The Five Cs Of Credit

Understanding The Five Cs Of Credit

The 5 C S Of Credit What Banks Lenders Actually Look For

The 5 C S Of Credit What Banks Lenders Actually Look For

Your Credit What Lenders See Framework

Your Credit What Lenders See Framework

3 Ways To Prepare For A Potential Coronavirus Recession Wirecutter

3 Ways To Prepare For A Potential Coronavirus Recession Wirecutter

Getting A Mortgage The Four C S Of Credit Smart Money Mamas

Getting A Mortgage The Four C S Of Credit Smart Money Mamas

Residential Mortgage Loan Processing Class

Residential Mortgage Loan Processing Class

Your Credit What Lenders See Framework

Your Credit What Lenders See Framework

Blue Cash Everyday Card From American Express Review Wirecutter

Blue Cash Everyday Card From American Express Review Wirecutter

Your Credit What Lenders See Framework

Your Credit What Lenders See Framework

Best Store Retail Credit Cards That Don T Suck Wirecutter

Best Store Retail Credit Cards That Don T Suck Wirecutter

Your Credit What Lenders See Framework

Your Credit What Lenders See Framework

Your Guide To The Chase Ink Business Credit Cards

Your Guide To The Chase Ink Business Credit Cards

The Best Cash Back Credit Cards Of 2020 Wirecutter

The Best Cash Back Credit Cards Of 2020 Wirecutter

Solved Which Two Of The For C S Of Credit Have Do With Ea

Solved Which Two Of The For C S Of Credit Have Do With Ea

Getting A Mortgage The Four C S Of Credit Smart Money Mamas

Getting A Mortgage The Four C S Of Credit Smart Money Mamas

Bank Of America Premium Rewards Credit Card Review Wirecutter

Bank Of America Premium Rewards Credit Card Review Wirecutter

Best Store Retail Credit Cards That Don T Suck Wirecutter

Best Store Retail Credit Cards That Don T Suck Wirecutter

Covid 19 Covid 19 How The Deadly Virus Hints At A Looming

Covid 19 Covid 19 How The Deadly Virus Hints At A Looming

25 Ways To Make Money Online And Offline Nerdwallet

25 Ways To Make Money Online And Offline Nerdwallet

Basic Cash Flow Statement Video Khan Academy

Basic Cash Flow Statement Video Khan Academy

Citi Double Cash 1 400 Ratings

Citi Double Cash 1 400 Ratings

:max_bytes(150000):strip_icc()/investopedia5cscredit-5c8ffbb846e0fb00016ee129.jpg)

Posting Komentar

Posting Komentar