Does Service Revenue Go On The Balance Sheet

Any help would be great. If they will be earned within one year they should be listed as a current liability.

Accounting Basics Revenues And Expenses Accountingcoach

Accounting Basics Revenues And Expenses Accountingcoach

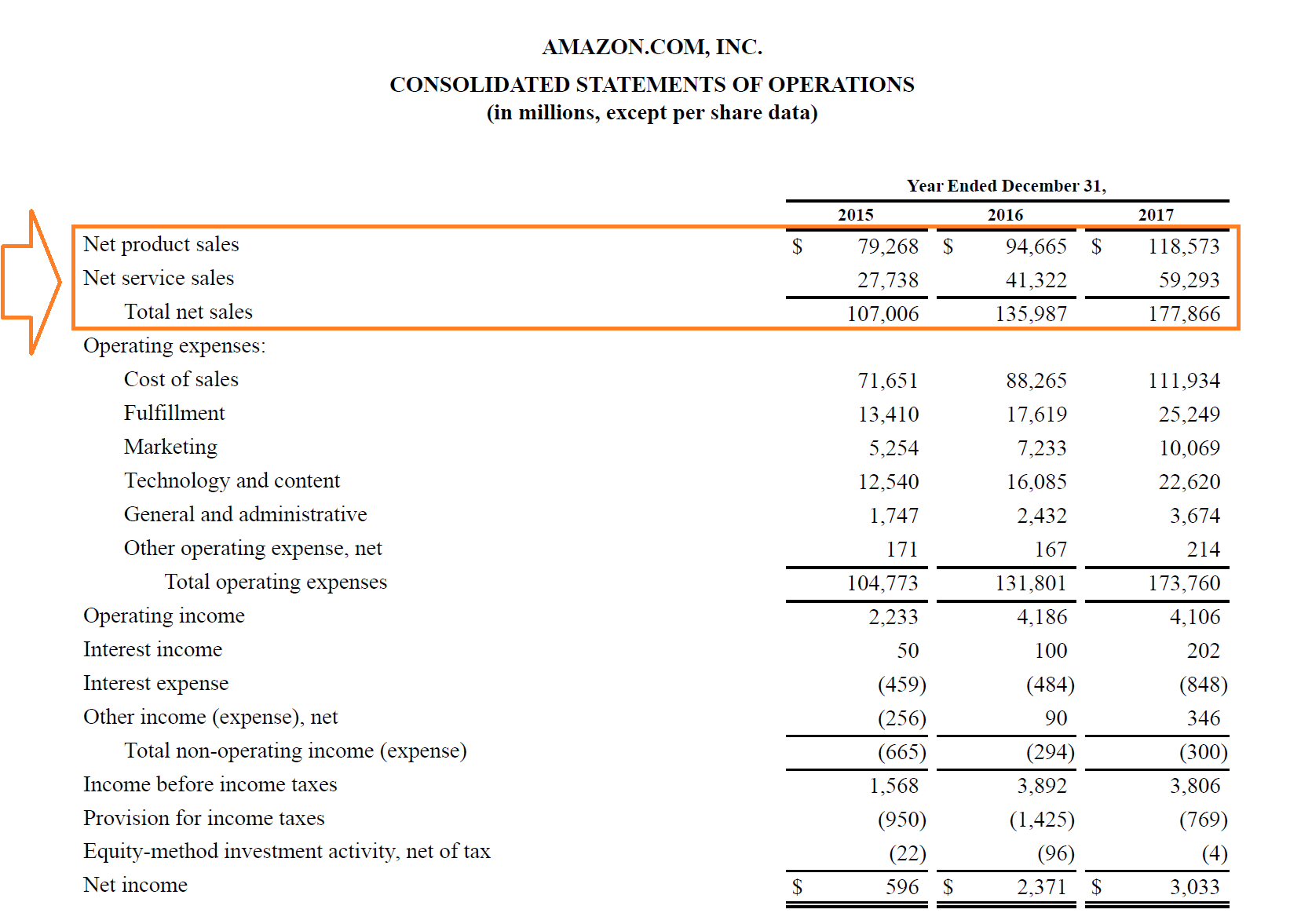

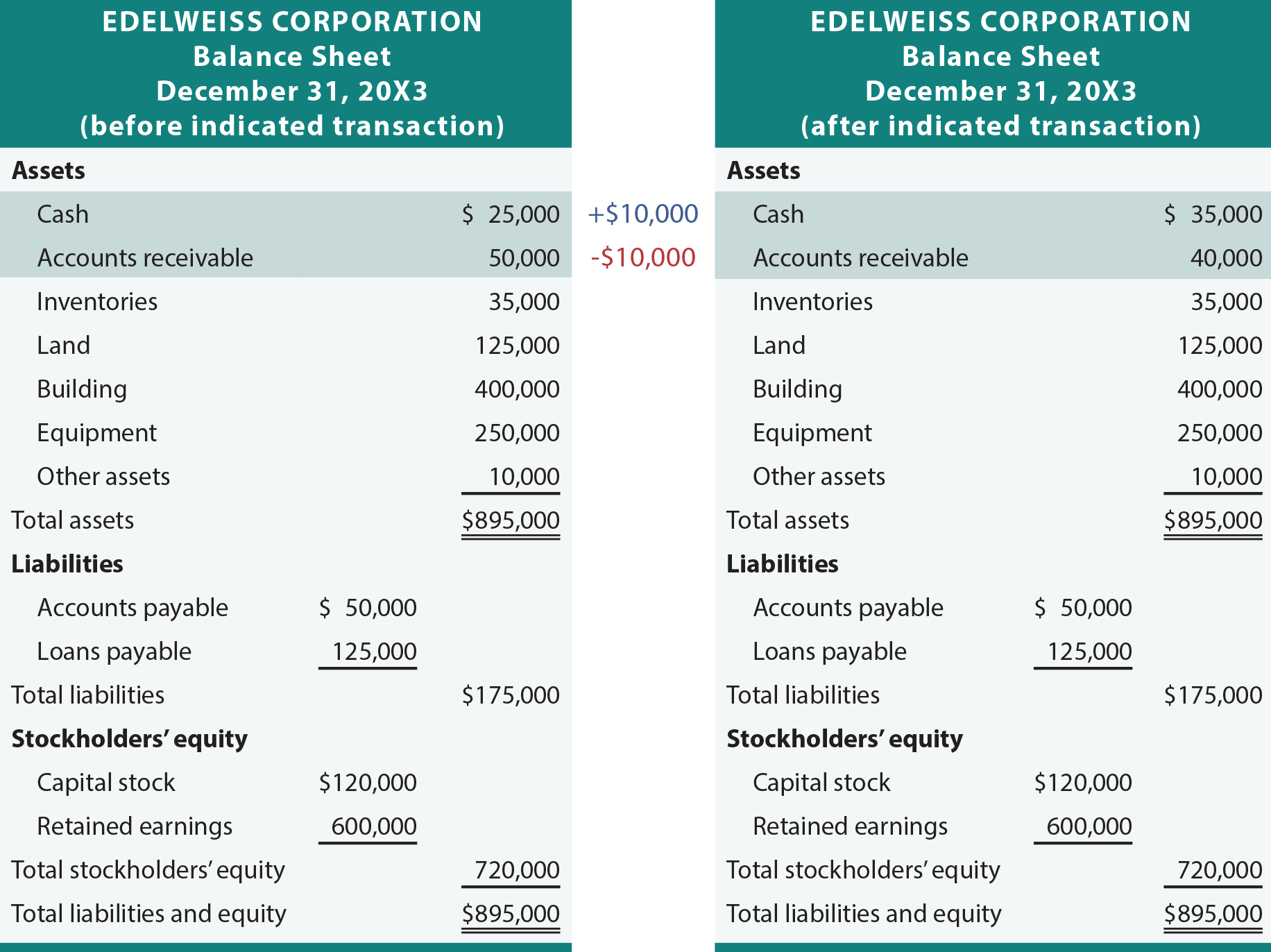

Generally when a corporation earns revenue there is an increase in current assets cash or accounts receivable and an increase in the retained earnings component of stockholders equity.

:max_bytes(150000):strip_icc()/Morningstar_-0a37a99b3a0744b6bdf3986e5bdb325b.png)

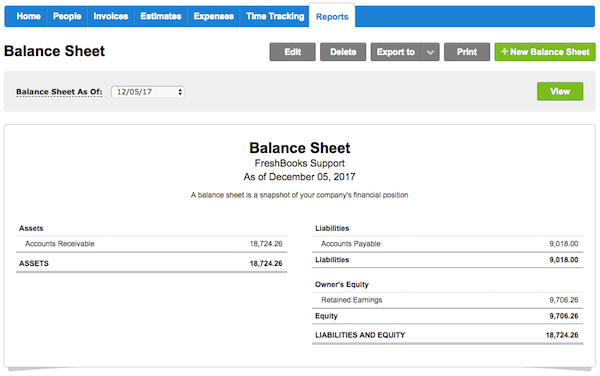

Does service revenue go on the balance sheet. I thought service revenue and expenses went on the income statement. An income statement or profit and loss statement shows how your revenue compares to your expenses during a given period such as a month or a year the top section lists all of your sources of incoming revenue such as wholesale and retail sales or income from interest earned or rent paid. The amount earned through the delivery of the product or service represents earned income which the company reports on the income statement.

When the company delivers all or a portion of the product or service to the customer it reduces the balance owed to the customer. If the payment terms allow credit to customers then revenue creates a corresponding amount of accounts receivable on the balance sheet. Where does revenue received in advance go on a balance sheet.

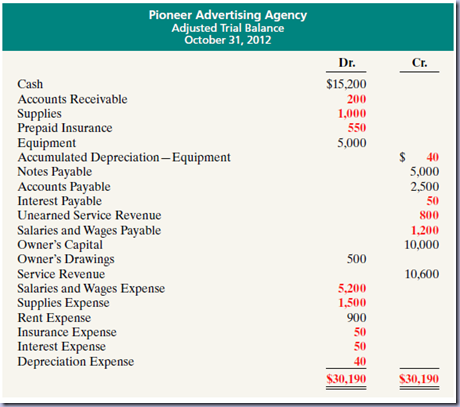

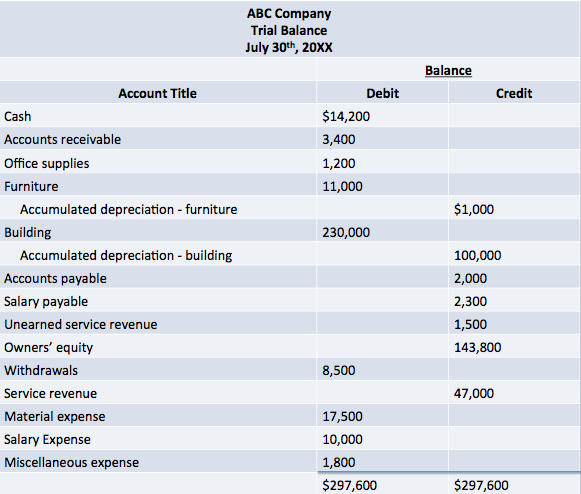

I am doing accounting homework but i am at lost as to where to put the service revenue and expenses on the classified balance sheet. The remaining balance of unearned revenue appears on the balance sheet. Effect of revenue on the balance sheet.

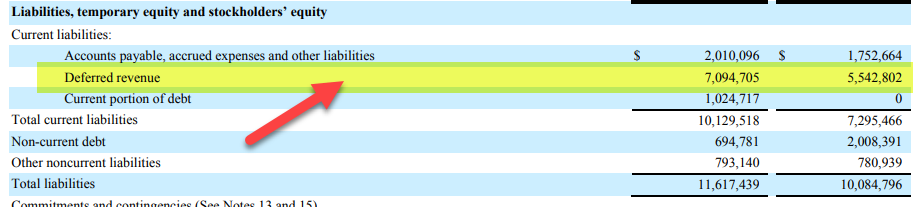

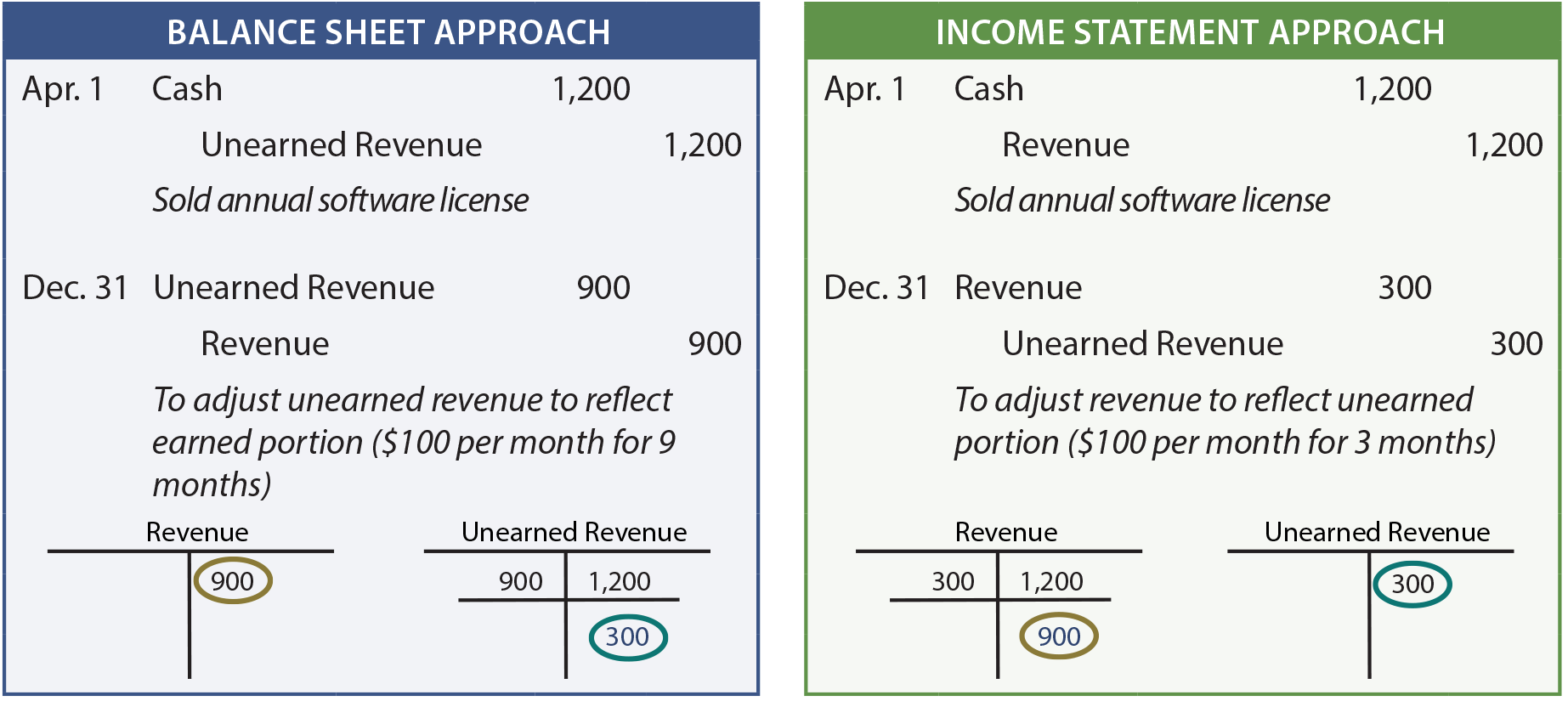

A classified balance sheet presents information about an entity s assets liabilities and shareholders equity that is aggregated or classified into subcategories of accounts it is extremely useful to include classifications since information is then organized into a format that is more readable than a simple listing of all the accounts that comprise a balance sheet. Under the accrual basis of accounting revenues received in advance of being earned are reported as a liability. When a company receives cash for the goods or services that it will provide in future.

Thank you in advance. Revenue normally appears at the top of the income statement however it also has an impact on the balance sheet if a company s payment terms are cash only then revenue also creates a corresponding amount of cash on the balance sheet. How does revenue affect the balance sheet.

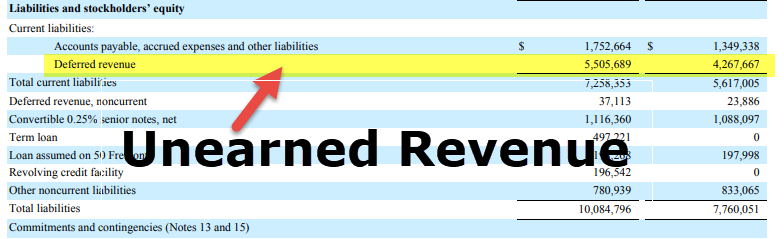

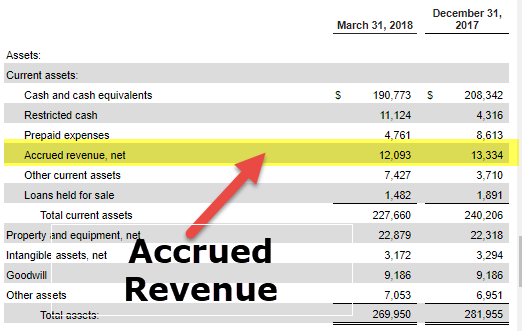

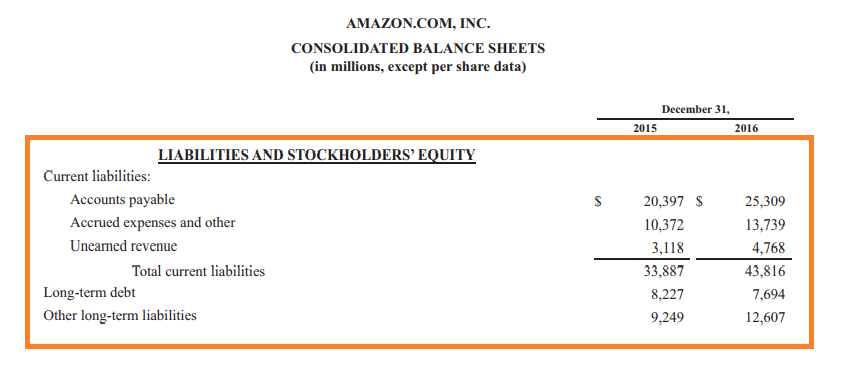

After cash dividends are paid the company s balance sheet does not have any accounts associated with dividends. Deferred revenue is listed as a liability on the balance sheet because under accrual accounting the revenue recognition process has not been completed. Definition of revenue received in advance.

Salesforce sec filings unearned revenue accounting. When a company earns revenue that had been prepaid by a customer the company s balance sheet s liability deferred revenue. It leads to an increase in cash balance of the company since the goods or service is to be provided in future the unearned income is shown as a liability in the balance sheet of the company which resulted in proportional increase on both sides of.

Your sales revenue formula is more directly relevant to your income statement than to your balance sheet. However the company s balance sheet size is reduced as its assets and equity are.

Unearned Revenue On Balance Sheet Definition Examples

Unearned Revenue On Balance Sheet Definition Examples

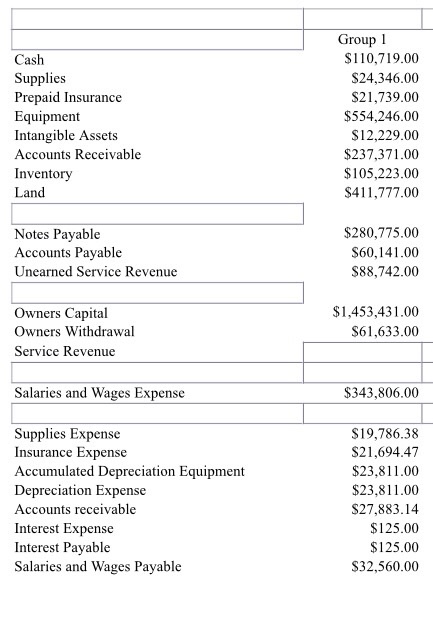

Completing The Accounting Cycle Ppt Download

Completing The Accounting Cycle Ppt Download

Solved The Income Statement Balance Sheet And Additiona

Solved The Income Statement Balance Sheet And Additiona

Intermediate Accounting 3 1 Prepared By Coby Harmon

Intermediate Accounting 3 1 Prepared By Coby Harmon

Chapter 3 Income Statement Concepts Income Revenues And

Chapter 3 Income Statement Concepts Income Revenues And

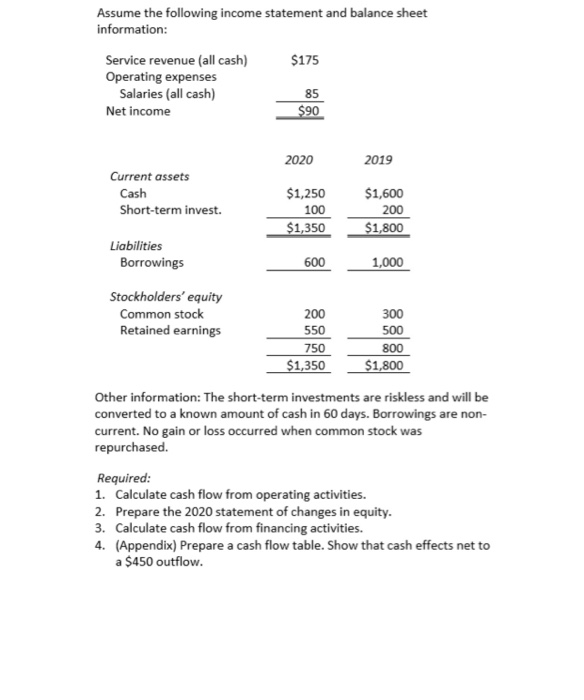

Solved Assume The Following Income Statement And Balance

Solved Assume The Following Income Statement And Balance

Intermediate Accounting Solution March 2016

Intermediate Accounting Solution March 2016

Https Www Harpercollege Edu Academic Support Tutoring Subjects Chapter 201 20review Pdf

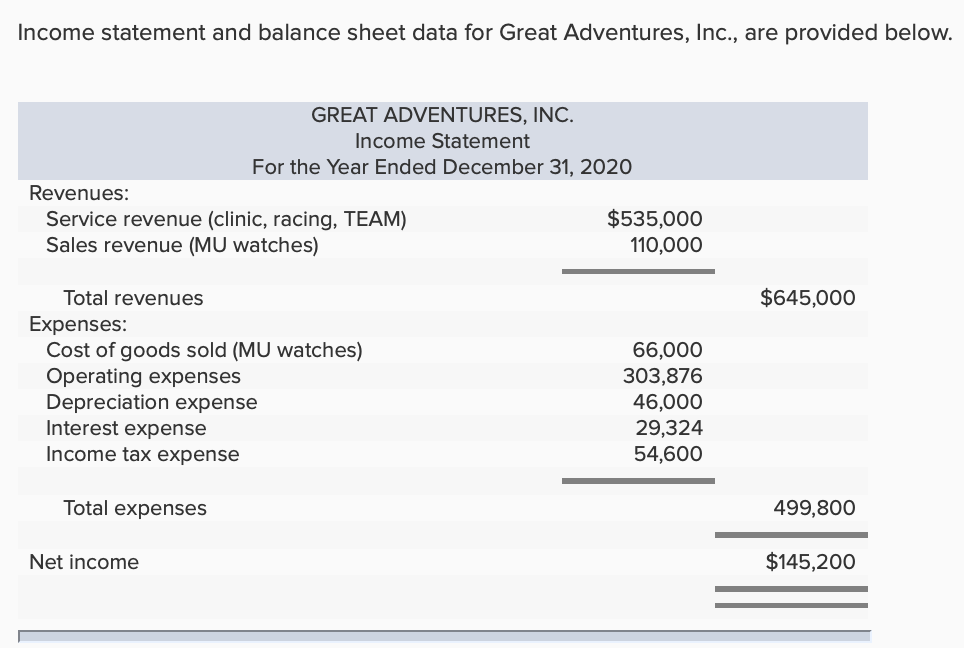

Solved Income Statement And Balance Sheet Data For Great

Solved Income Statement And Balance Sheet Data For Great

Solved The Partial Work Sheet For Camelback Consulting At June 30

Balance Sheet Example Accountingcoach

Balance Sheet Example Accountingcoach

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrgkujvq6ddnyfas Trquy3a Rjyszotsopvylyj Nglhylz3bo Usqp Cau

What Is Unearned Revenue A Definition And Examples For Small

What Is Unearned Revenue A Definition And Examples For Small

Revenue Definition Formula Example Role In Financial Statements

Revenue Definition Formula Example Role In Financial Statements

What Are The Differences Between Assets And Revenue The Motley Fool

What Are The Differences Between Assets And Revenue The Motley Fool

Deferred Revenue Understand Deferred Revenues In Accounting

Deferred Revenue Understand Deferred Revenues In Accounting

Accrued Revenue Definition How To Record In Balance Sheet

Accrued Revenue Definition How To Record In Balance Sheet

What Are The Differences Between Assets And Revenue The Motley Fool

What Are The Differences Between Assets And Revenue The Motley Fool

4 5 Prepare Financial Statements Using The Adjusted Trial Balance

Services On Account Double Entry Bookkeeping

Services On Account Double Entry Bookkeeping

Solved Great Adventures Problem 11 1 The Income Statement

Solved Great Adventures Problem 11 1 The Income Statement

Chapter 3 Intermediate 15th Ed

Chapter 3 Intermediate 15th Ed

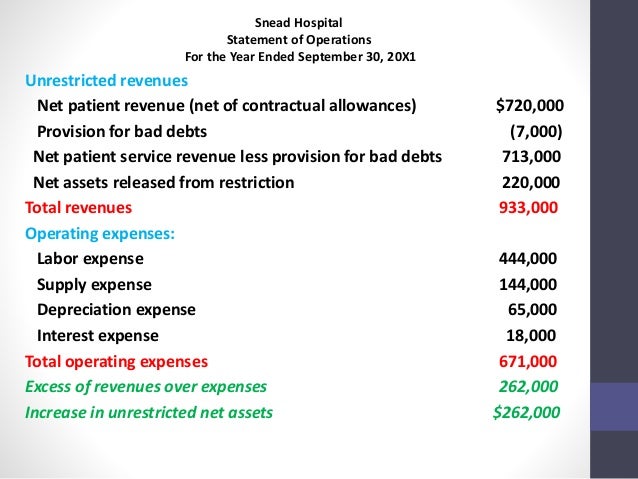

Chapter 2 Health Care Financial Statements

Chapter 2 Health Care Financial Statements

Solved The Income Statement Balance Sheets And Additional

Solved The Income Statement Balance Sheets And Additional

How Do The Income Statement And Balance Sheet Differ

Prepare Financial Statements Using The Adjusted Trial Balance

Prepare Financial Statements Using The Adjusted Trial Balance

Income Statement And Balance Sheet Data For Great Adventures Inc

Income Statement And Balance Sheet Data For Great Adventures Inc

Balance Sheet Liabilities Comprehensive Guide For Financial Analysts

Balance Sheet Liabilities Comprehensive Guide For Financial Analysts

How Do The Income Statement And Balance Sheet Differ

Unearned Revenue On Balance Sheet Definition Examples

Unearned Revenue On Balance Sheet Definition Examples

How Transactions Impact The Accounting Equation

How Transactions Impact The Accounting Equation

Accounting Equation Expense And Revenue Accountingcoach

Accounting Equation Expense And Revenue Accountingcoach

Adjusting Entries For Asset Accounts Accountingcoach

Adjusting Entries For Asset Accounts Accountingcoach

Solved Law Management Services Began Business On January 1

Solved Law Management Services Began Business On January 1

The Adjusting Process And Related Entries Principlesofaccounting Com

The Adjusting Process And Related Entries Principlesofaccounting Com

Posting Komentar

Posting Komentar