What Is The Difference Between A Simple Trust And A Complex Trust

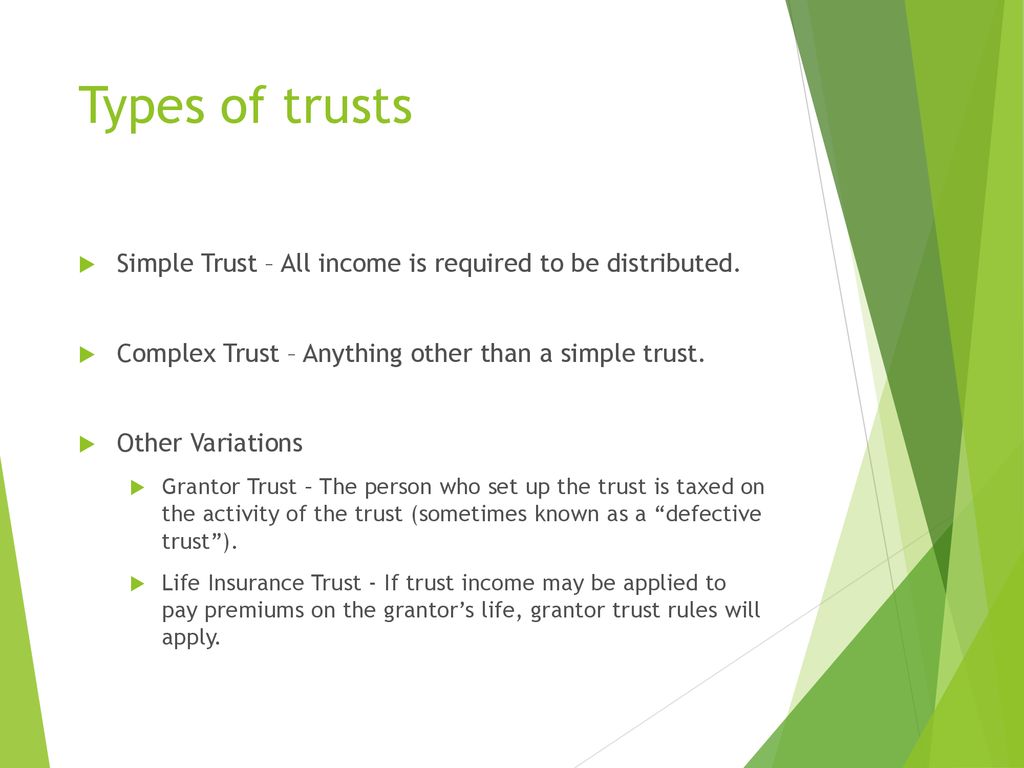

To add another layer of complexity to trusts it s often important to know whether the irs considers your trust to be either simple or complex. A trustee in a complex trust is given a mandate to manage.

27 Trusts 3 Simple V Complex Trusts With Wayne Zell Blueprint

27 Trusts 3 Simple V Complex Trusts With Wayne Zell Blueprint

My sister and i are co successor trustees and the only beneficiaries.

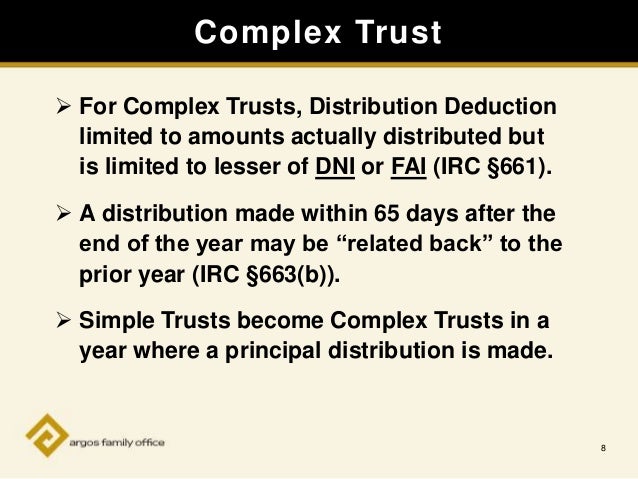

What is the difference between a simple trust and a complex trust. A simple trust that fails to distribute current income can be treated as a complex trust for tax purposes and trusts can flip flop back and forth between the two classifications if the trustee does not handle the income in an appropriate manner. A complex trust actually gives you more flexibility and so may be a better option depending on your goals. This can get complicated and expensive as the simple trust is afforded a higher standard.

The tax designation of a trust can be a bit confusing but it is generally determined by how income generated by the trust is distributed. The trust was established by my mother. A complex trust can take a 100 exemption.

The trust does not distribute amounts allocated to the corpus of the trust. Choosing a trust taxation type. The trust document provides that upon my mother s death the trustee shall pay any taxes or other expenses.

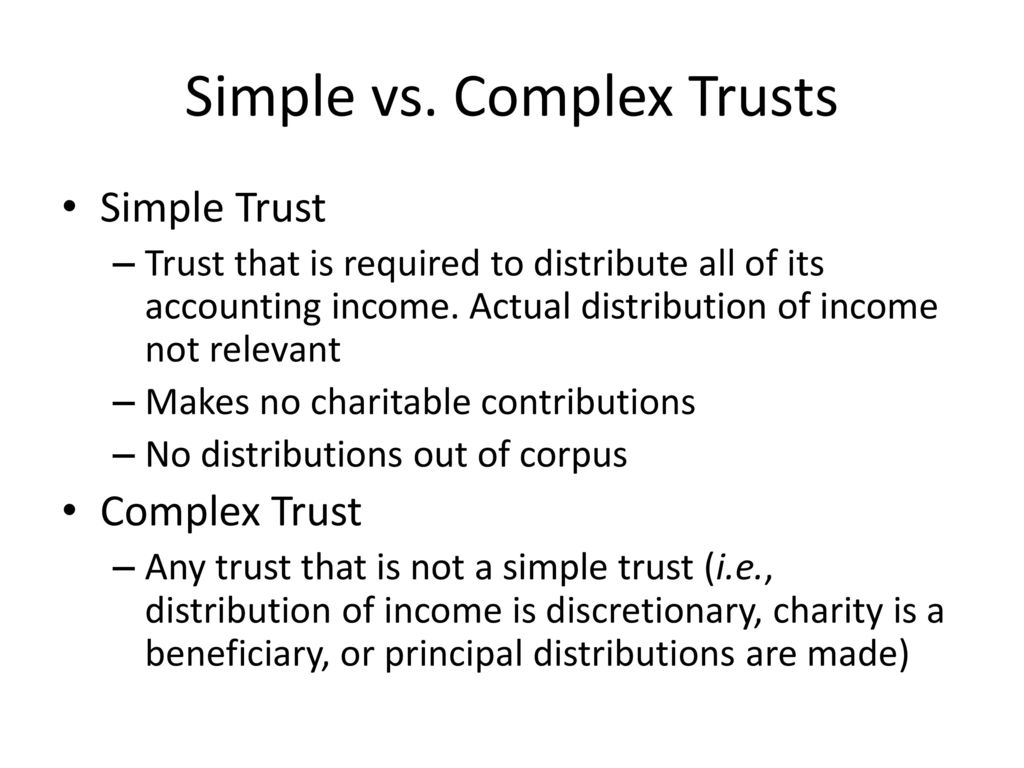

Though it s sometimes difficult to determine which is which the difference between a simple and complex trust is how the trust distributes any income it generates. The alternative to a simple trust is a complex trust. A trust qualifies as a simple trust if.

When setting up your trust don t automatically assume you want a simple trust because it sounds easier. A simple trust can take a 300 exemption. The fundamental difference is that any trusts that do not meet the requirements of a simple trust are classified as a complex trust.

The trust instrument does not provide that any amounts are to be paid permanently set aside or used for charitable purposes. The trust instrument requires that all income must be distributed currently. My question is whether under the circumstances described below the trust whose tax return i m preparing for 2016 is simple or complex.

In a simple trust a trustee is required to do nothing else but to make sure the trust property is distributed at a specified time as stated in the trust.

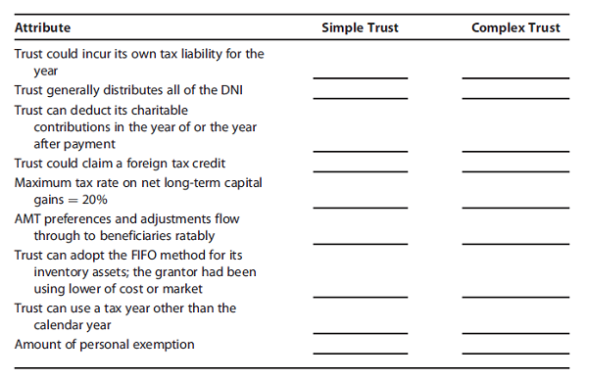

Solved Complete The Following Chart Indicating The Comparativ

Solved Complete The Following Chart Indicating The Comparativ

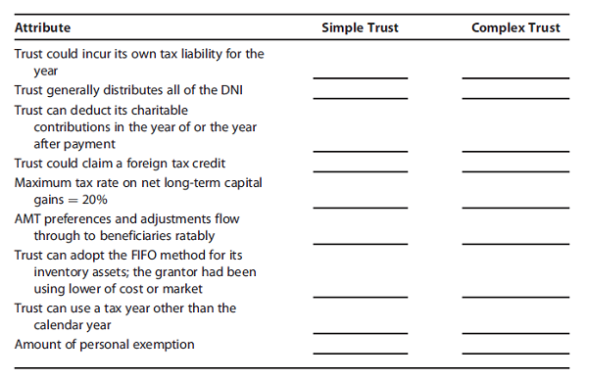

The Difference Between Simple And Complex Trusts

The Difference Between Simple And Complex Trusts

Gs 815 Assignment Ppt Download

Gs 815 Assignment Ppt Download

American Bar Association Section Of Taxation Committee On U S

American Bar Association Section Of Taxation Committee On U S

Oregon Community Foundation Print Ad Origami Simple Trust

Oregon Community Foundation Print Ad Origami Simple Trust

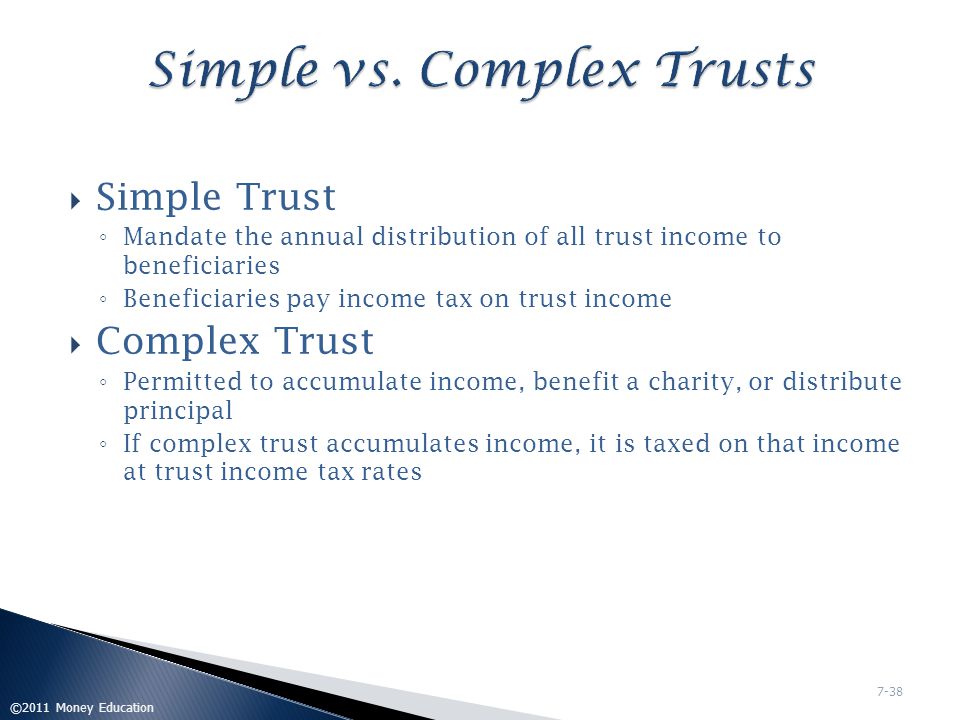

Itemized Deductions Chapter 7 C 2009 Money Education Ppt Download

Itemized Deductions Chapter 7 C 2009 Money Education Ppt Download

How Irrevocable Trusts Work Video Explains Details

How Irrevocable Trusts Work Video Explains Details

Trust Tax Rates Simple Trust Or Complex Trust Will Blow Your

Trust Tax Rates Simple Trust Or Complex Trust Will Blow Your

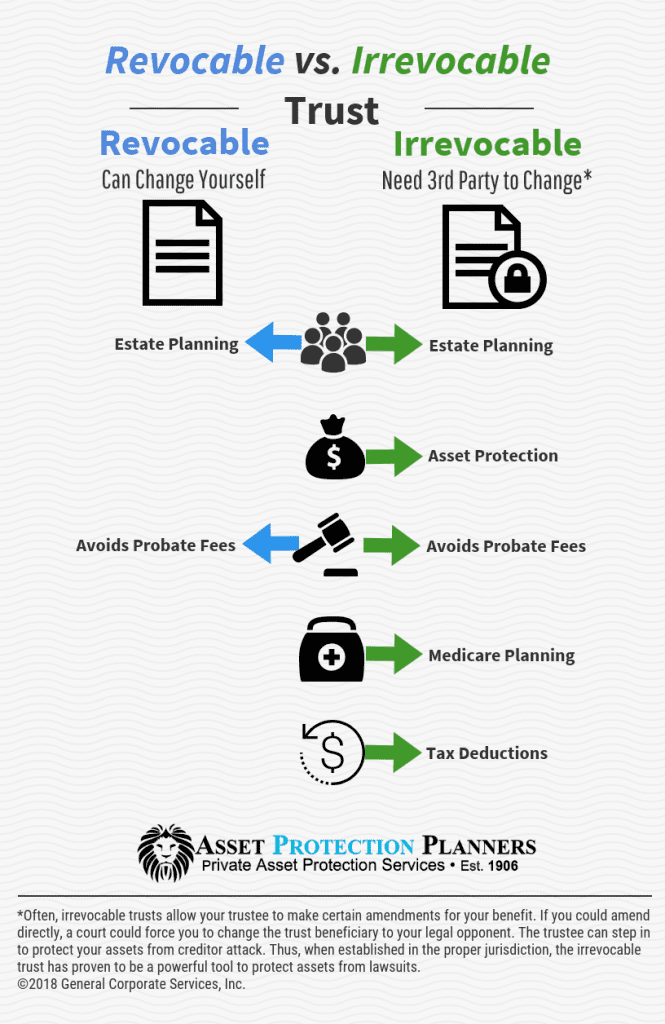

/what-is-a-revocable-living-trust-3505191-v3-5bfd7964c9e77c0026f13d1d.png) Revocable Living Trust And How It Works

Revocable Living Trust And How It Works

Income Tax Planning For Trust And Estate Distributions By

Income Tax Planning For Trust And Estate Distributions By

Simple V Complex Trusts Youtube

Simple V Complex Trusts Youtube

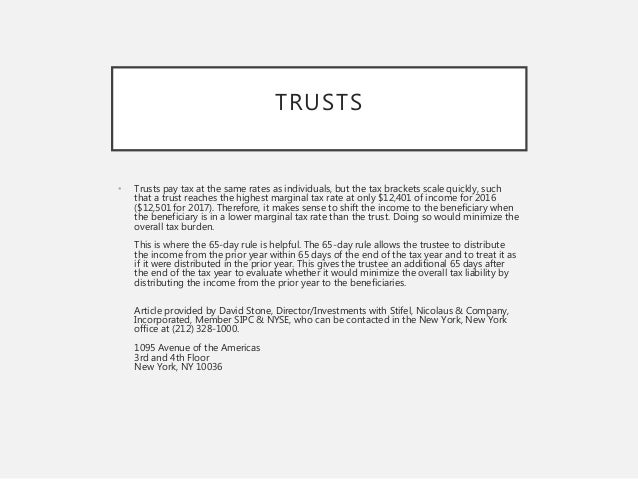

Trusts And Taxation Minimizing Liability

Trusts And Taxation Minimizing Liability

State Income Taxation Of Trusts

State Income Taxation Of Trusts

Session 5 Depaul University Cfp Program Ppt Download

Session 5 Depaul University Cfp Program Ppt Download

Income Taxation Of Trusts And Estates Jeremiah W Doyle Iv

Income Taxation Of Trusts And Estates Jeremiah W Doyle Iv

Https Www Irs Gov Pub Irs Pdf I1041 Pdf

Top Three Benefits Of A Living Trust Legalzoom

Top Three Benefits Of A Living Trust Legalzoom

/tax_question_marks-5bfc3255c9e77c00519be879.jpg) How Are Trust Fund Earnings Taxed

How Are Trust Fund Earnings Taxed

Simple Vs Complex Trust Youtube

Simple Vs Complex Trust Youtube

Https Www Calt Iastate Edu System Files Premium Video Files The 20fundamentals 20of 20trusts 20powerpoint Pdf

Useful Tips For Federal Fiduciary Income Tax Returns Ppt Video

Useful Tips For Federal Fiduciary Income Tax Returns Ppt Video

The Difference Between Simple And Complex Trusts

The Difference Between Simple And Complex Trusts

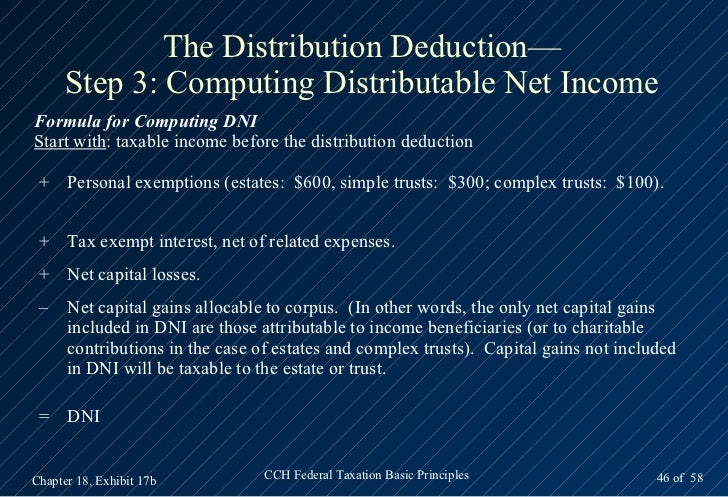

2013 Cch Basic Principles Ch18

2013 Cch Basic Principles Ch18

When Income Isn T Income Or Is It Ppt Download

When Income Isn T Income Or Is It Ppt Download

Income Taxation Of Trusts And Estates Jeremiah W Doyle Iv Senior

Income Taxation Of Trusts And Estates Jeremiah W Doyle Iv Senior

Income Taxation Of Trusts In Missouri

Income Taxation Of Trusts In Missouri

Timely Topics For Attorneys Ppt Download

Timely Topics For Attorneys Ppt Download

The Difference Between Simple And Complex Trusts

The Difference Between Simple And Complex Trusts

Simple Vs Complex Trust Difference

Simple Vs Complex Trust Difference

Simple Vs Complex Trust Difference

Simple Vs Complex Trust Difference

/what-is-the-definition-of-a-trust-3505391-final-v2-9589f9972b8c4482a8cf43fe821f3845.jpg) A Beginner S Guide To Living Trusts

A Beginner S Guide To Living Trusts

American Bar Association Pdf Free Download

Posting Komentar

Posting Komentar