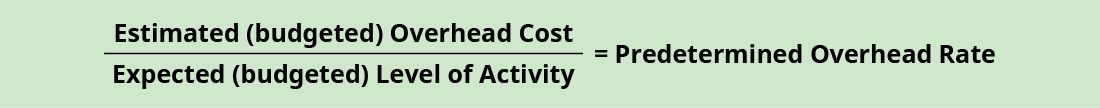

Predetermined Overhead Rate Formula

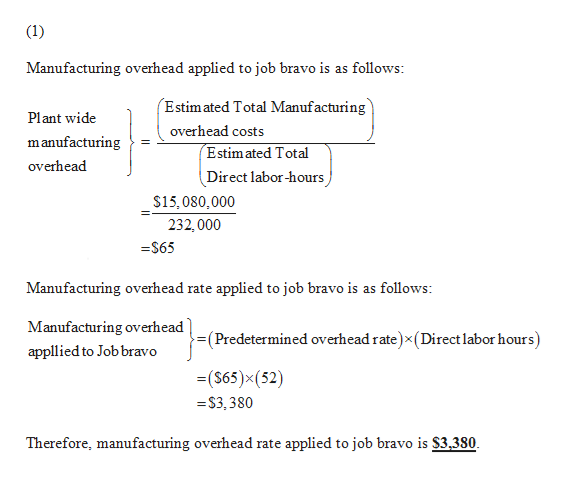

The total manufacturing overhead cost will compose of variable overhead and fixed overhead which is the sum of 145 000 420 000 equals to 565 000 total manufacturing overhead. The predetermined rate is derived using the following calculation.

Predetermined Overhead Rate Top 5 Components Examples

Predetermined Overhead Rate Top 5 Components Examples

Calculating predetermined overhead rate can be done as follow.

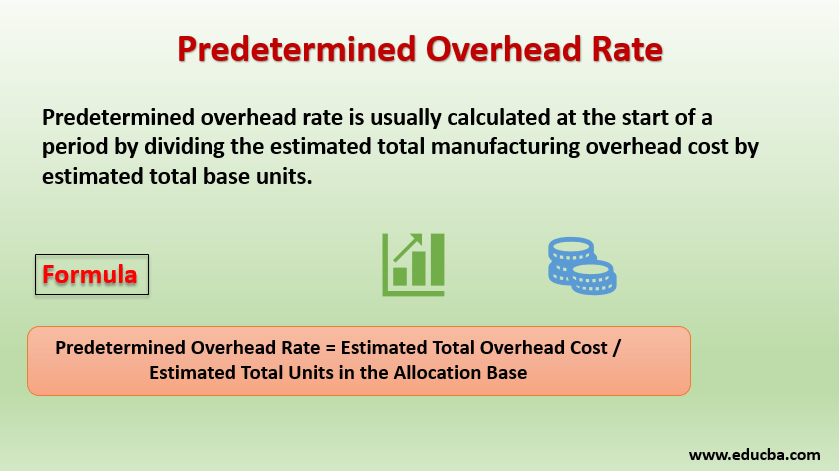

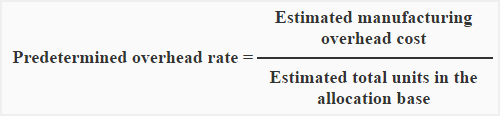

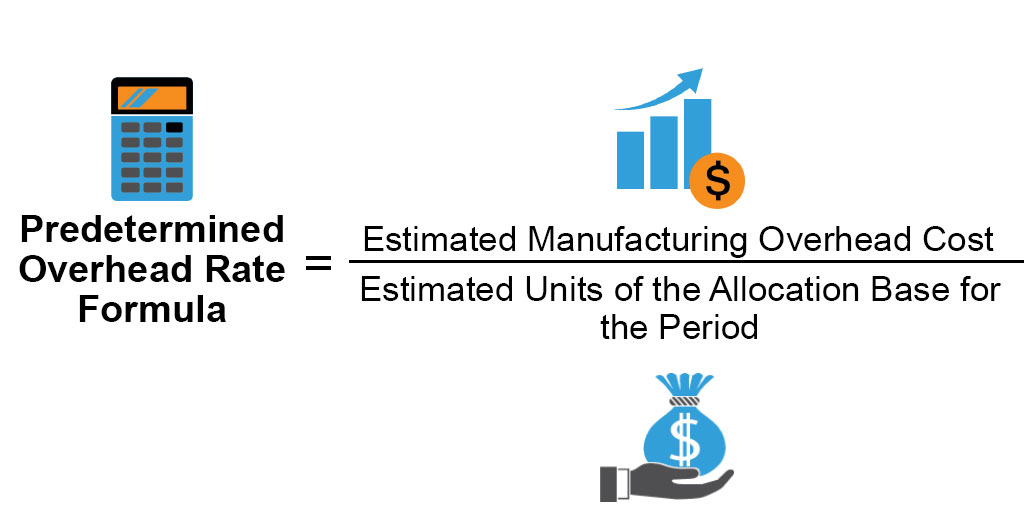

Predetermined overhead rate formula. Overhead allocation rate total overhead total direct labor hours 100 000 4 000 hours 25 00 therefore for every hour of direct labor needed to make books band book applies 25 worth of overhead to the product. For instance if the. Predetermined overhead rate estimated manufacturing overhead cost estimated total units in the allocation base.

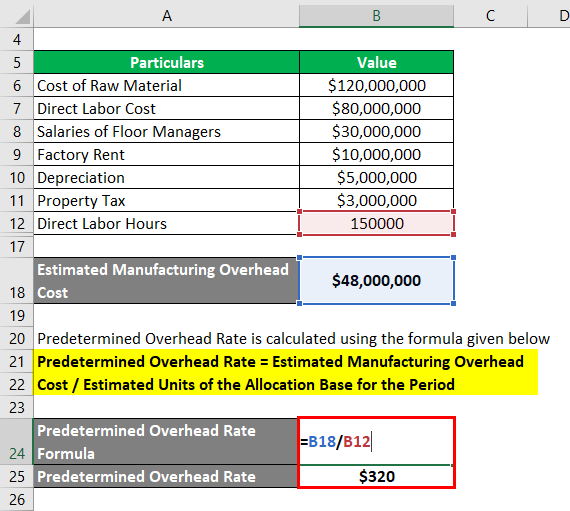

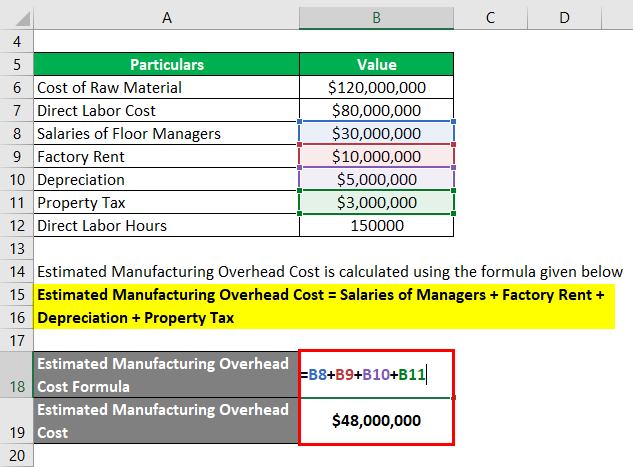

8 00 per direct labor hour. Predetermined overhead rate is calculated using the formula given below predetermined overhead rate estimated manufacturing overhead cost estimated units of the allocation base for the period predetermined overhead rate 48 000 000 150 000 hours predetermined overhead rate 320 per hour. Based on this information the predetermined overhead rate is 25 per labor hour.

Predetermined overhead rate 500 000 20 000 hours 25 per direct labor the product requires 2 hours of labor work so that it will require 50 of overhead 25 2 hours. With the manufacturing overhead costs and the machine hour totals you can calculate the predetermined overhead rate by dividing the overhead costs by the machine hours. The third step is to compute the predetermined overhead rate by dividing the estimated total manufacturing overhead costs by the estimated total amount of cost driver or activity base.

Take direct labor for example. Predetermined overhead rate 8 000 1 000 hours. Common activity bases used in the calculation include direct labor costs direct labor hours or machine hours.

Calculation of total manufacturing overhead. Notice that the formula of predetermined overhead rate is entirely based on estimates. Assume that management estimates that the labor costs for the next accounting period will be 100 000 and the total overhead costs will be 150 000.

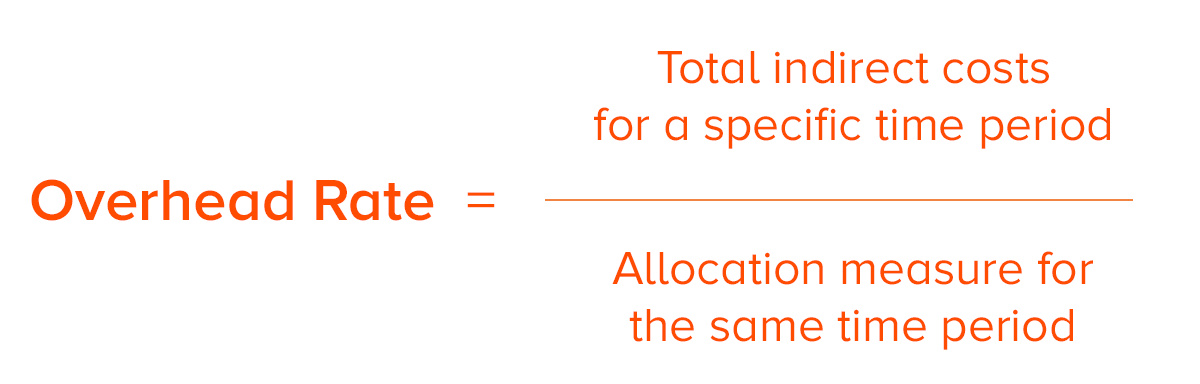

The predetermined overhead rate formula is calculated by dividing the total estimated overhead costs for the period by the estimated activity base. However the difference between the actual and estimated amounts of overhead must be reconciled at least at the end of each fiscal year. To calculate the overhead rate.

Overhead rate 16 66 meaning that it costs the company 16 66 in overhead costs for every hour the. Estimated amount of manufacturing overhead to be incurred in the period estimated allocation base for the period. Divide 500 000 indirect costs by 30 000 machine hours.

Answered Wilmington Company Has Two Bartleby

Answered Wilmington Company Has Two Bartleby

Solved Luthan Company Uses A Plantwide Predetermined Over

Solved Luthan Company Uses A Plantwide Predetermined Over

Using Activity Based Costing To Allocate Overhead Costs

Using Activity Based Costing To Allocate Overhead Costs

Quiz Worksheet Calculating Predetermined Overhead Rate Study Com

Quiz Worksheet Calculating Predetermined Overhead Rate Study Com

Predetermined Overhead Rate Formula Calculator With Excel Template

Predetermined Overhead Rate Formula Calculator With Excel Template

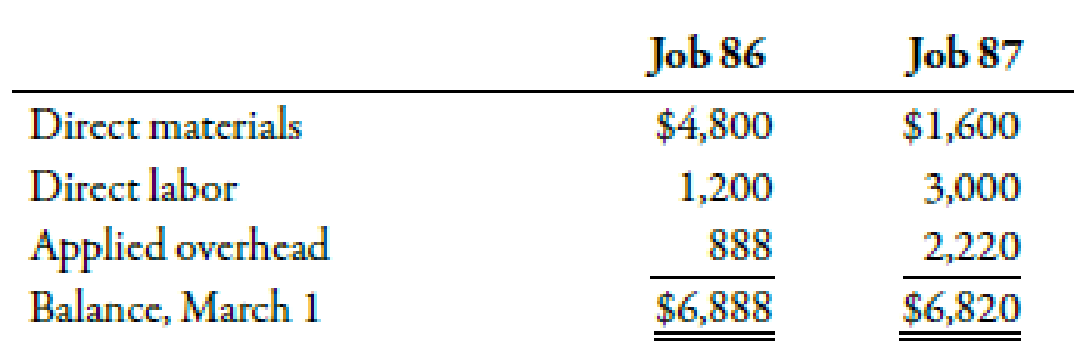

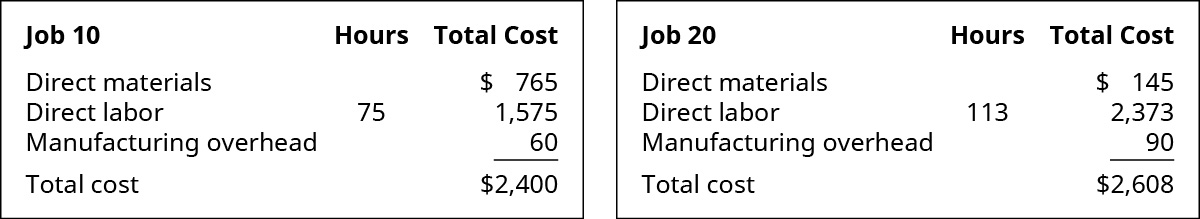

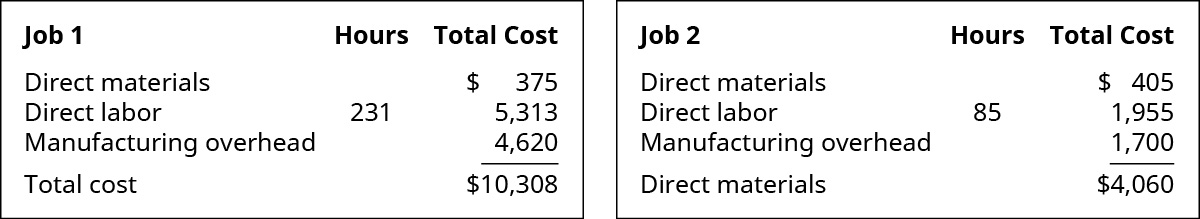

Prepare Job Order Cost Sheets Predetermined Overhead Rate Ending

Prepare Job Order Cost Sheets Predetermined Overhead Rate Ending

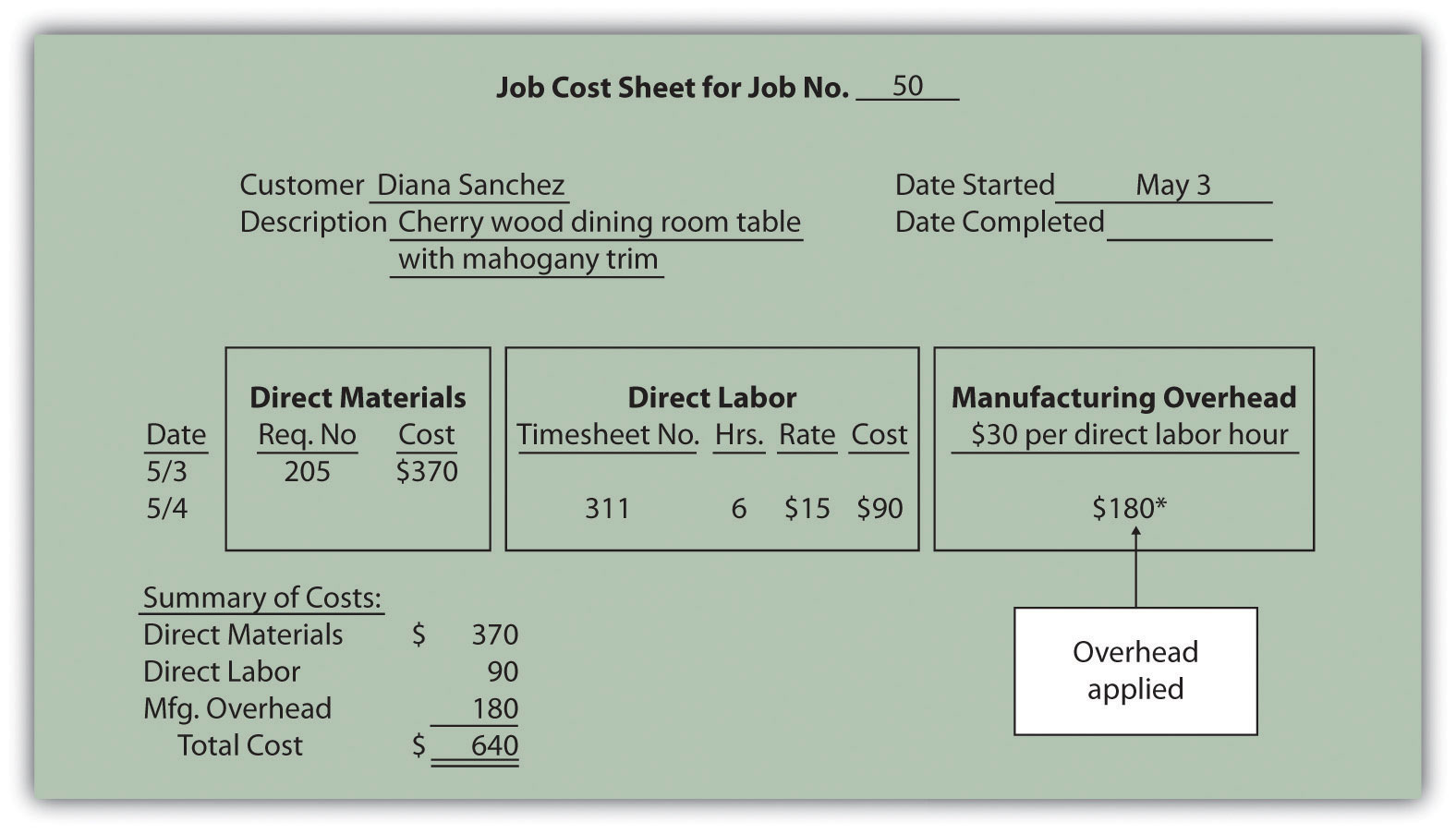

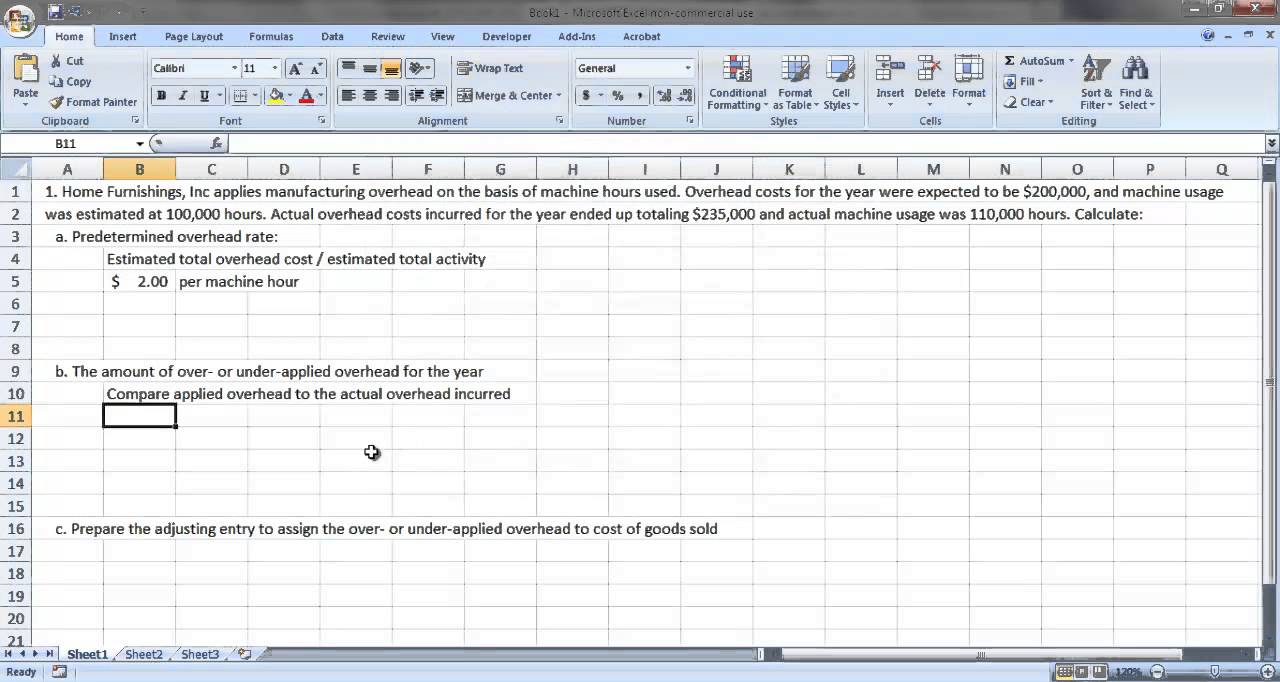

Compute A Predetermined Overhead Rate And Apply Overhead To

Compute A Predetermined Overhead Rate And Apply Overhead To

Predetermined Overhead Rate Formula Calculator With Excel Template

Predetermined Overhead Rate Formula Calculator With Excel Template

Job Order Costing Calculating Predetermined Overhead Rates For

Job Order Costing Calculating Predetermined Overhead Rates For

Job Order Costing And Analysis Ppt Video Online Download

Job Order Costing And Analysis Ppt Video Online Download

6 1 Calculate Predetermined Overhead And Total Cost Under The

Luthan Company Uses A Predetermined Overhead Rate Of 23 40 Per

Solved Calculating The Predetermined Overhead Rate Apply

Solved Calculating The Predetermined Overhead Rate Apply

The Concept Of Predetermined Overhead Rate Formula And Example

The Concept Of Predetermined Overhead Rate Formula And Example

Assigning Manufacturing Overhead Costs To Jobs

Assigning Manufacturing Overhead Costs To Jobs

Osborn Manufacturing Uses A Predetermined Overhead Rate Of 18 20

Osborn Manufacturing Uses A Predetermined Overhead Rate Of 18 20

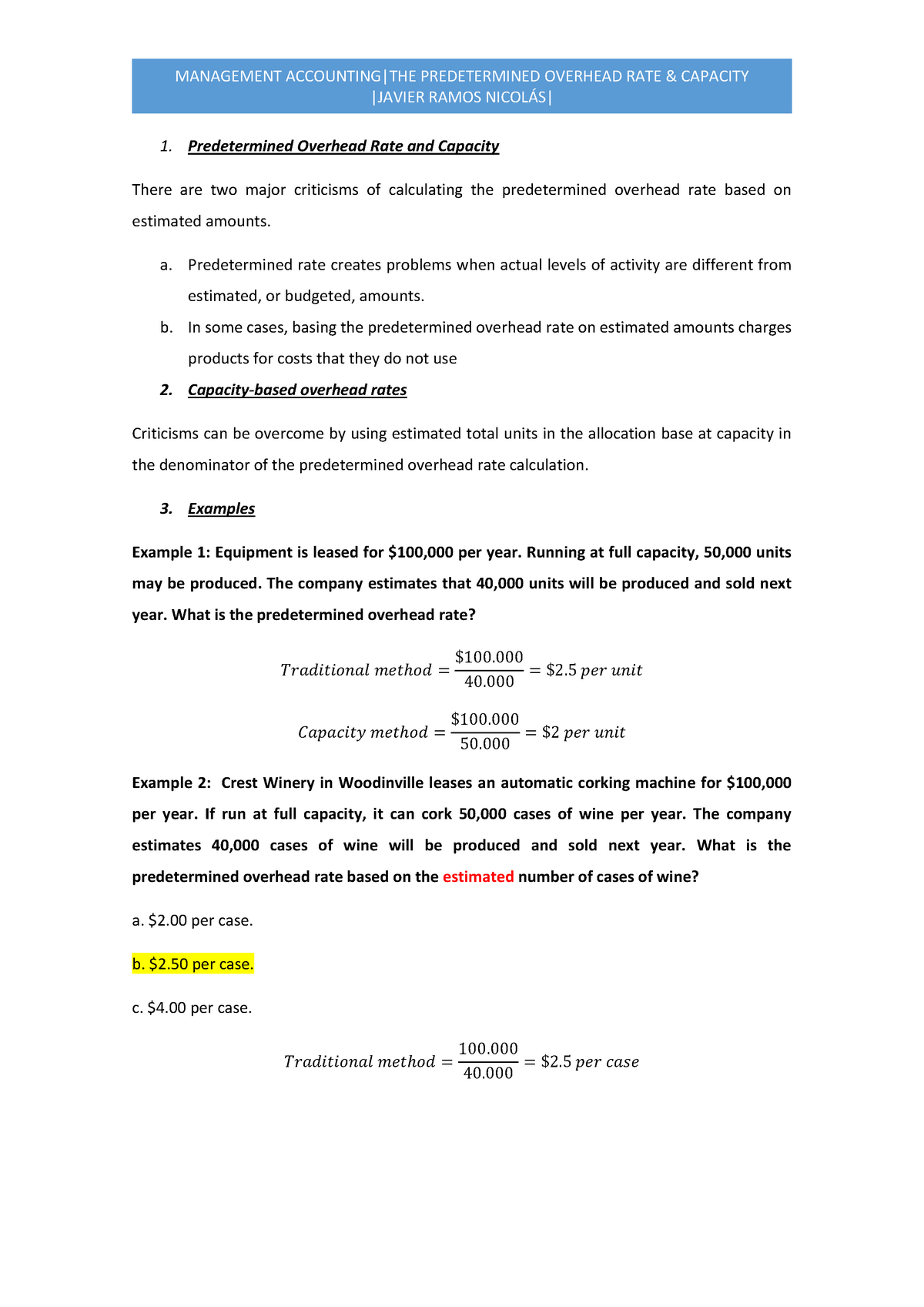

4 Predetermined Overhead Rate And Capacity Ub Studocu

4 Predetermined Overhead Rate And Capacity Ub Studocu

Osborn Manufacturing Uses A Predetermined Overhead Rate Of 18 20

Test Bank For Managerial Accounting 16th Edition By Garrison Ibsn

Test Bank For Managerial Accounting 16th Edition By Garrison Ibsn

Solved Calculating Departmental Overhead Rates And Applyi

Solved Calculating Departmental Overhead Rates And Applyi

Solved Problem 3 12 Predetermined Overhead Rate Disposin

Solved Problem 3 12 Predetermined Overhead Rate Disposin

Acc 121 Calculating Predetermined Overhead Rate And Under Or

Acc 121 Calculating Predetermined Overhead Rate And Under Or

Compute A Predetermined Overhead Rate And Apply Overhead To

Compute A Predetermined Overhead Rate And Apply Overhead To

Predetermined Overhead Rate Definition Examples Types

Predetermined Overhead Rate Definition Examples Types

Please Explain Show Work Luthan Company Uses A Plantwide

Please Explain Show Work Luthan Company Uses A Plantwide

Luthan Company Uses A Plantwide Predetermined Overhead Rate Of

Luthan Company Uses A Plantwide Predetermined Overhead Rate Of

Compute A Predetermined Overhead Rate And Apply Overhead To

Compute A Predetermined Overhead Rate And Apply Overhead To

Predetermined Overhead Rate Formula Explanation And Example

Predetermined Overhead Rate Formula Explanation And Example

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqh Owqpyqziz0p3mot Jqxfqyp9feylsoeqf Hh Uzzeioq4a Usqp Cau

Predetermined Overhead Rate Formula How To Calculate

Predetermined Overhead Rate Formula How To Calculate

Accounting For Factory Overhead

Accounting For Factory Overhead

How To Calculate Restaurant Overhead Rate On The Line Toast Pos

How To Calculate Restaurant Overhead Rate On The Line Toast Pos

Pre Determined Overhead Rate Qs Study

Pre Determined Overhead Rate Qs Study

Managerial Accounting Ed 15 Chapter 10a

Managerial Accounting Ed 15 Chapter 10a

Predetermined Overhead Rate Formula Calculator With Excel Template

Predetermined Overhead Rate Formula Calculator With Excel Template

Calculate Predetermined Overhead Allocation Rate Example Youtube

Calculate Predetermined Overhead Allocation Rate Example Youtube

Predetermined Overhead Rate Double Entry Bookkeeping

Predetermined Overhead Rate Double Entry Bookkeeping

Posting Komentar

Posting Komentar