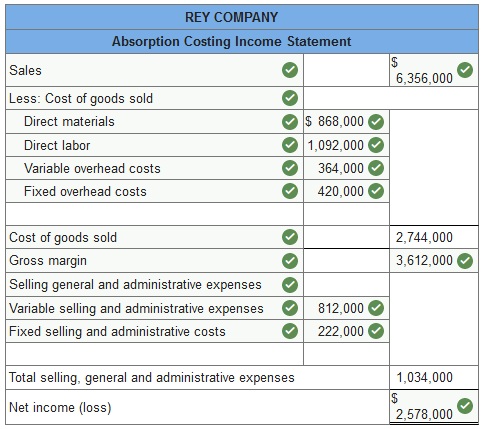

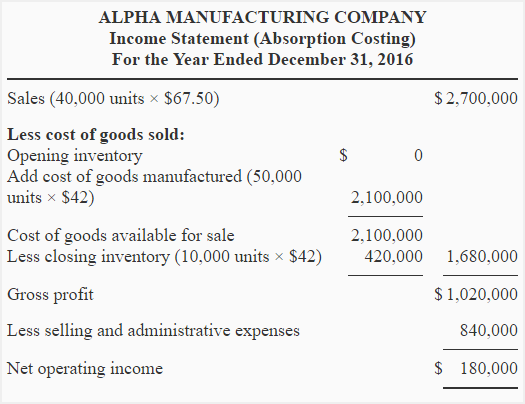

Absorption Costing Income Statement

With the absorption costing income statement you accounted for the costs of your beginning inventory twice. In order to complete this statement correctly make sure you understand product and period costs.

Answered Absorption Costing Income Statement On Bartleby

Answered Absorption Costing Income Statement On Bartleby

Marginal cost statement offers an alternative layout to the traditional income statement prepared under absorption costing.

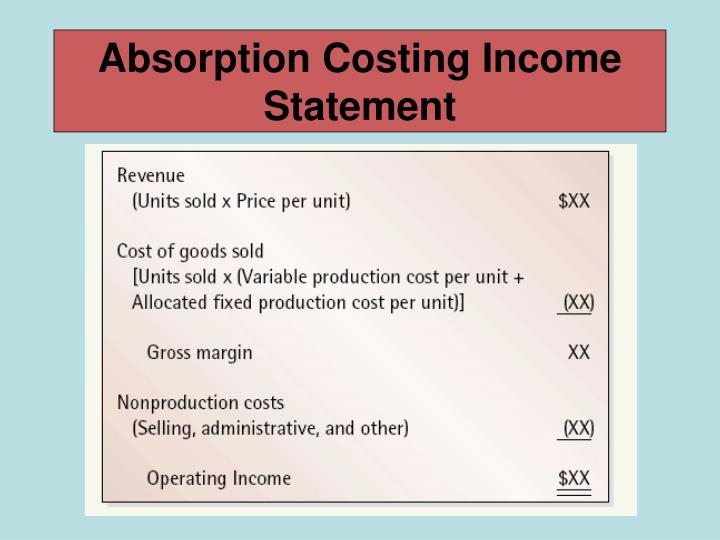

Absorption costing income statement. Inventory represents items where. The absorption costing income statement is a necessary tool that helps manufacturing companies by breaking down those costs in a way that allows an in depth review of profitability. Absorption costing means that ending inventory on the balance sheet is higher but expenses on the income statement are lower.

Hence absorption costing can be used as an accounting trick to temporarily increase a company s profitability by moving fixed manufacturing overhead costs from the income statement to the balance sheet. The traditional income statement also called absorption costing income statement uses absorption costing to create the income statement. Also see the predetermined overhead rate to see how companies estimate the production costs of a product in advance.

Variable costing the differences between. Absorption costing also called full costing is what you are used to under generally accepted accounting principles. You should have multiplied the total costs by 80 000 and then subtract that number by your ending inventory costs.

Absorption costing is the costing method used for financial accounting and tax purposes because it reflects a more comprehensive net income on income statement and a more complete cost of inventories on balance sheet by shifting costs between different periods in accordance with the matching concept. Absorption costing statement assumes that fixed costs attach to products so all the production costs whether fixed or variable should become part of product cost. Income statement impact in absorption costing fixed manufacturing overhead is allocated to the finished product and becomes part of the cost of inventory.

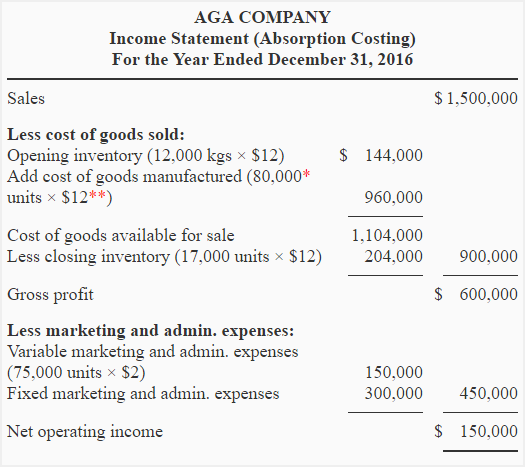

80 000 x 12 960 000 17 000 x 12 204 000. An absorption costing income statement requires a company to expense all overhead costs to the company s inventory. This means costs associated with the manufacturing process such as labor or materials are counted as part of the product inventory cost incurred by the company.

By allocating fixed costs into the cost of producing a product the costs can be hidden from a company s income statement. This income statement looks at costs by dividing costs into product and period costs. Under absorption costing companies treat all manufacturing costs including both fixed and variable manufacturing costs as product costs.

Solved Absorption Costing Income Statement On June 30 20

Solved Absorption Costing Income Statement On June 30 20

Solved B Prepare A Variable Costing Income Statement For

Solved B Prepare A Variable Costing Income Statement For

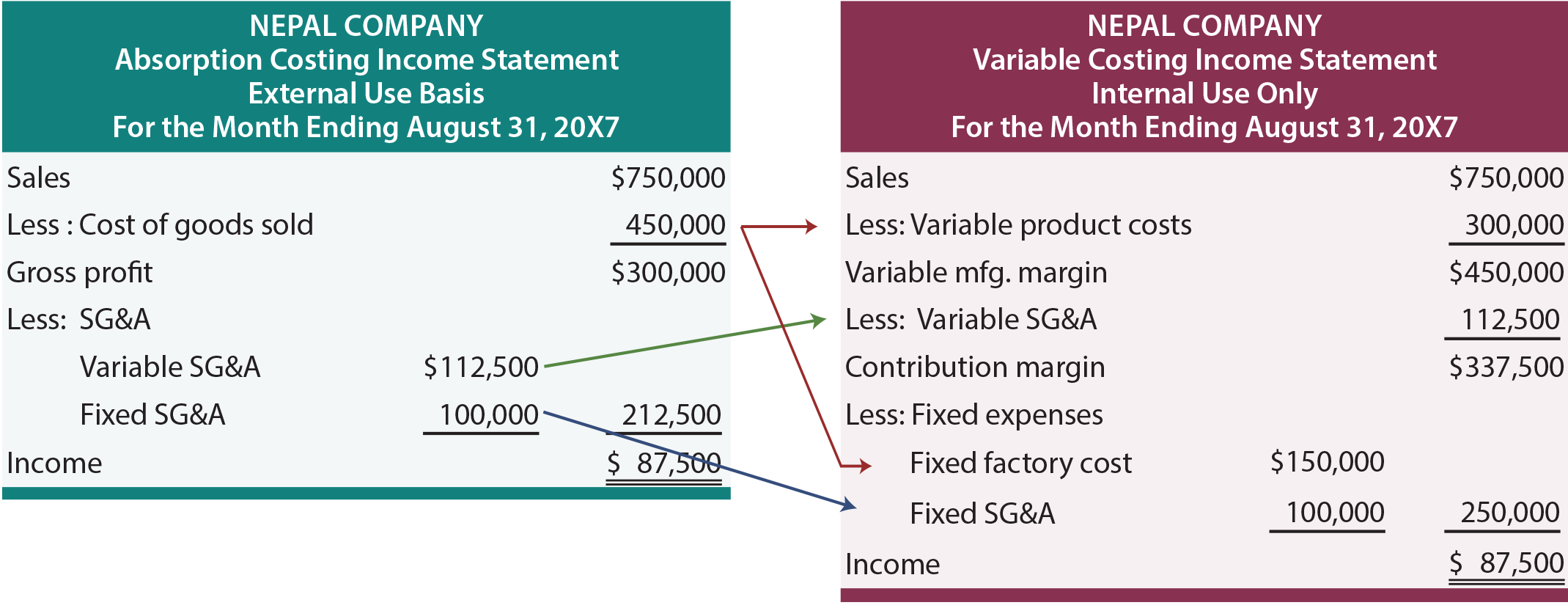

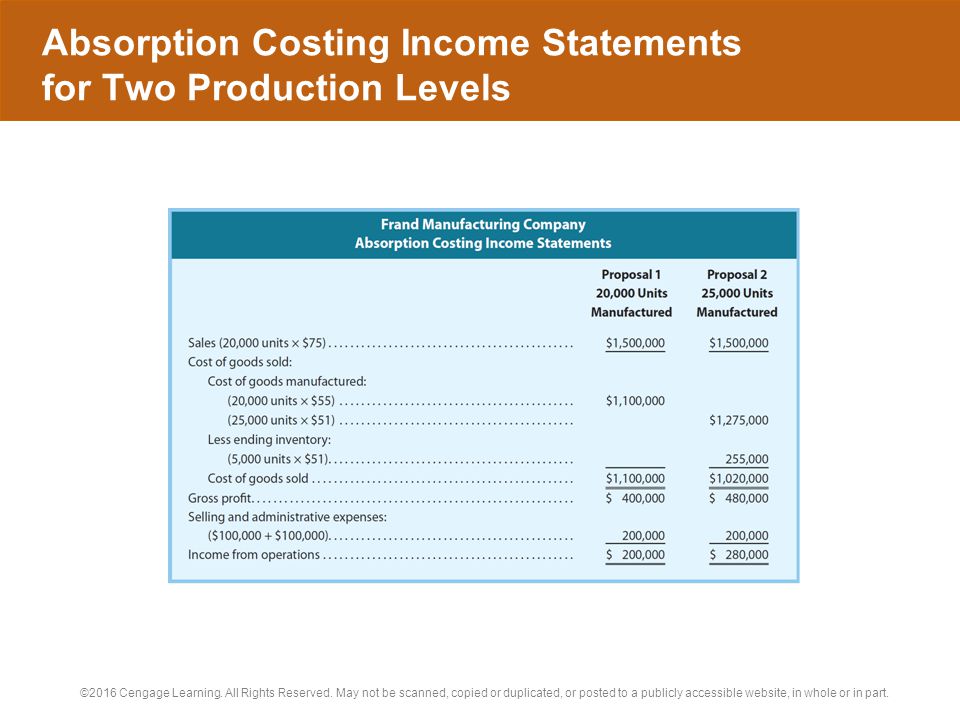

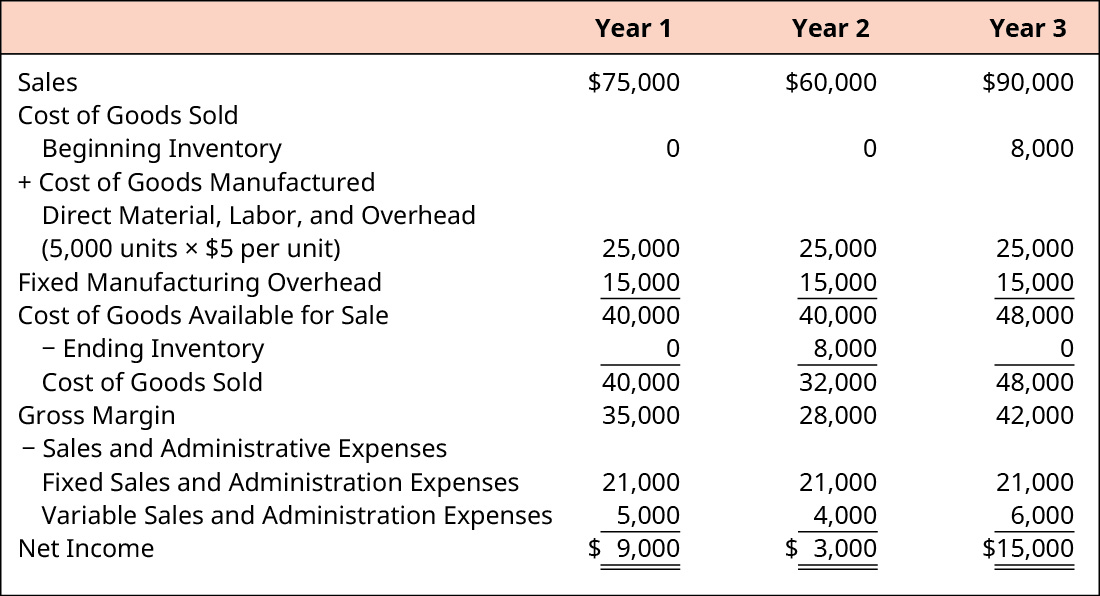

Variable Versus Absorption Costing Principlesofaccounting Com

Variable Versus Absorption Costing Principlesofaccounting Com

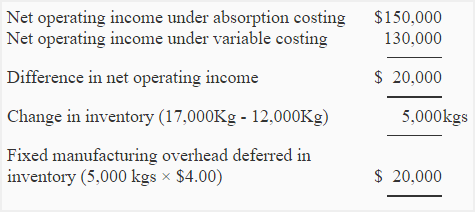

Absorption Costing And Variable Costing The Differences

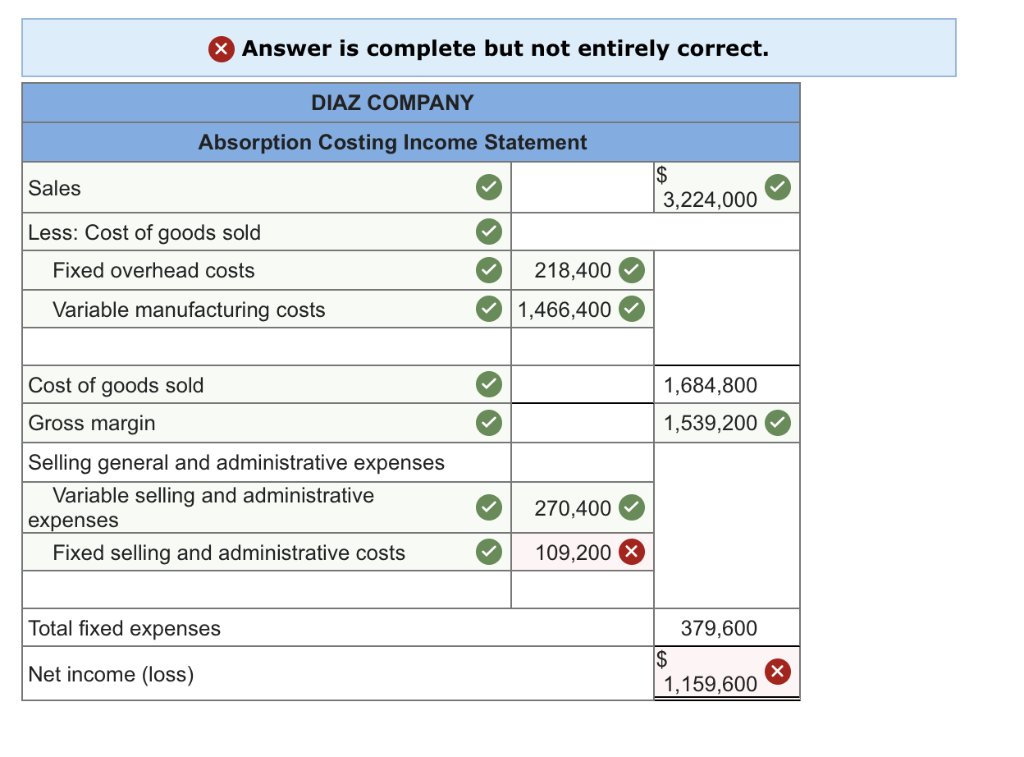

Solved Diaz Company Reports The Following Variable Costin

Solved Diaz Company Reports The Following Variable Costin

Exercise 5 Variable And Absorption Costing Income Statement

Exercise 5 Variable And Absorption Costing Income Statement

Exercise 2 Variable Costing Income Statement Reconciliation Of

Exercise 2 Variable Costing Income Statement Reconciliation Of

Connect Managerial Accounting Chapter 6 Ask Assignment Help

Connect Managerial Accounting Chapter 6 Ask Assignment Help

6 1 Absorption Costing Managerial Accounting

6 1 Absorption Costing Managerial Accounting

Solved Quick Study 19 4 Absorption Costing Income Statement Lo P2

Confused An In Depth Comparison Of Variable Costing And

Confused An In Depth Comparison Of Variable Costing And

Ppt Chapter 14 Measuring And Assigning Costs For Income

Ppt Chapter 14 Measuring And Assigning Costs For Income

The Traditional Income Statement Absorption Costing Income

The Traditional Income Statement Absorption Costing Income

Solved Diaz Company Reports The Following Variable Costin

Solved Diaz Company Reports The Following Variable Costin

Ex 20 5 Variable Costing Income Statement On June 30 The End Of

Ex 20 5 Variable Costing Income Statement On June 30 The End Of

Solved Variable Costing Income Statement Absorption Costi

Solved Variable Costing Income Statement Absorption Costi

Chapter 19 Variable Costing And Analysis Connect Assignment

Chapter 19 Variable Costing And Analysis Connect Assignment

Problem 1 Variable Costing Income Statement And Reconciliation

Problem 1 Variable Costing Income Statement And Reconciliation

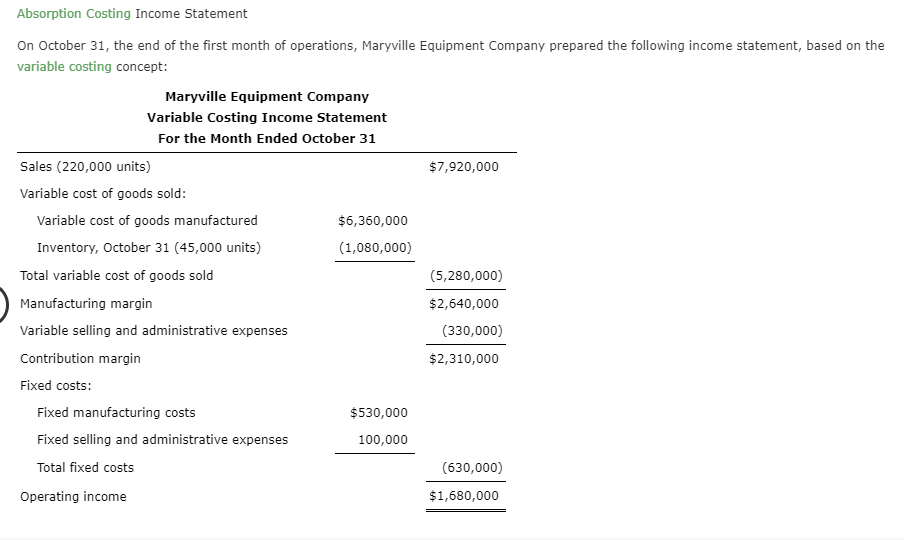

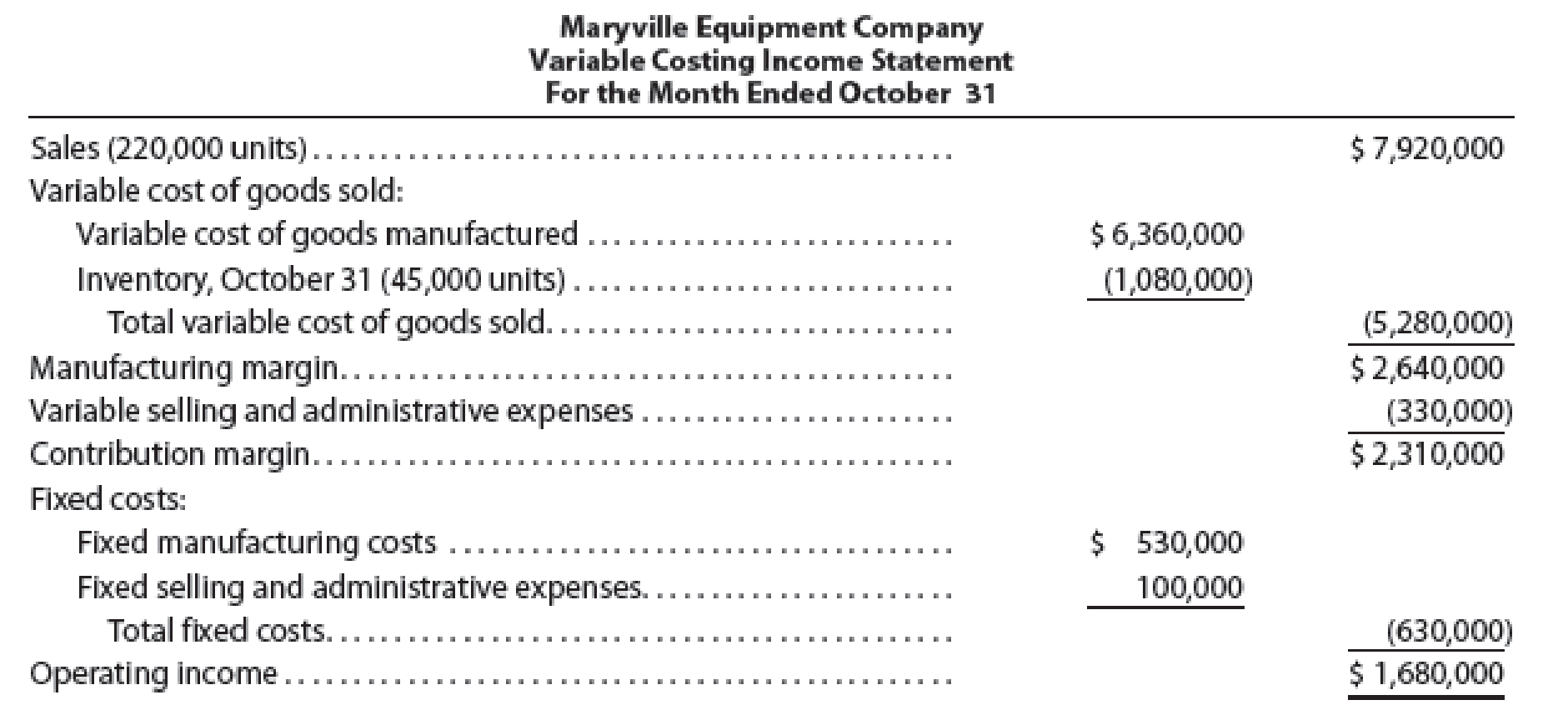

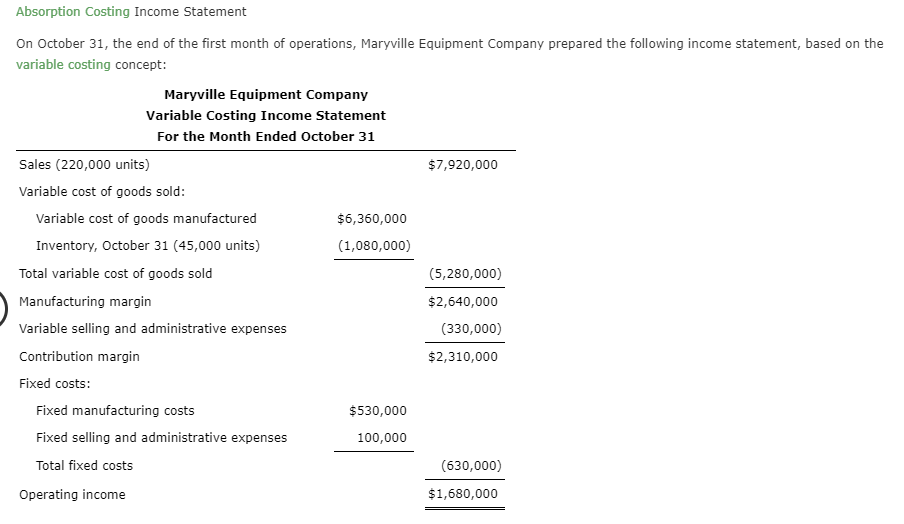

On October 31 The End Of The First Month Of Operations Maryville

On October 31 The End Of The First Month Of Operations Maryville

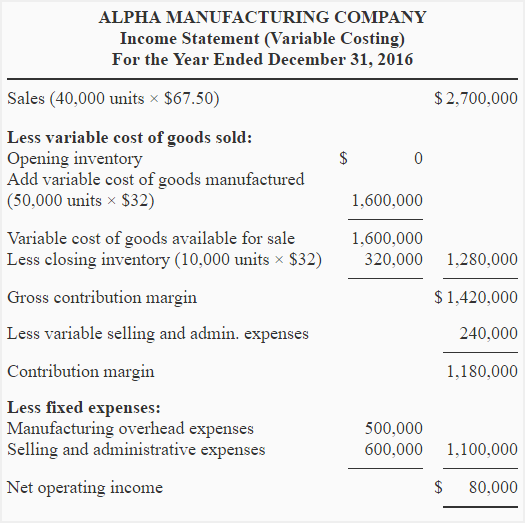

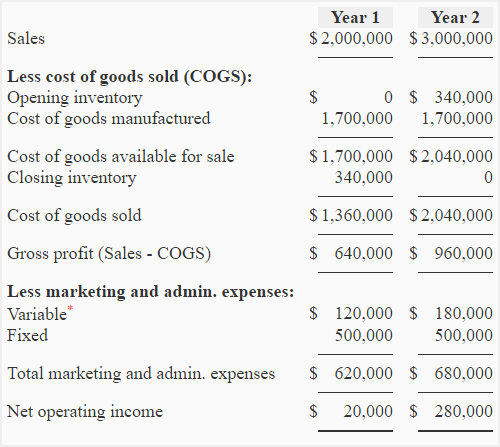

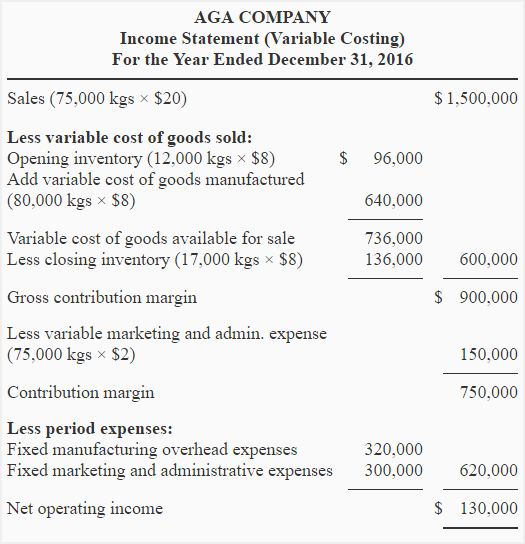

Income Statements Under Marginal Variable And Absorption Costing

20 Variable Costing For Management Analysis Ppt Video Online

20 Variable Costing For Management Analysis Ppt Video Online

What Is The Net Operating Income Under Absorption Costing لم يسبق

What Is The Net Operating Income Under Absorption Costing لم يسبق

Answered Absorption Costing Income Statement On Bartleby

Answered Absorption Costing Income Statement On Bartleby

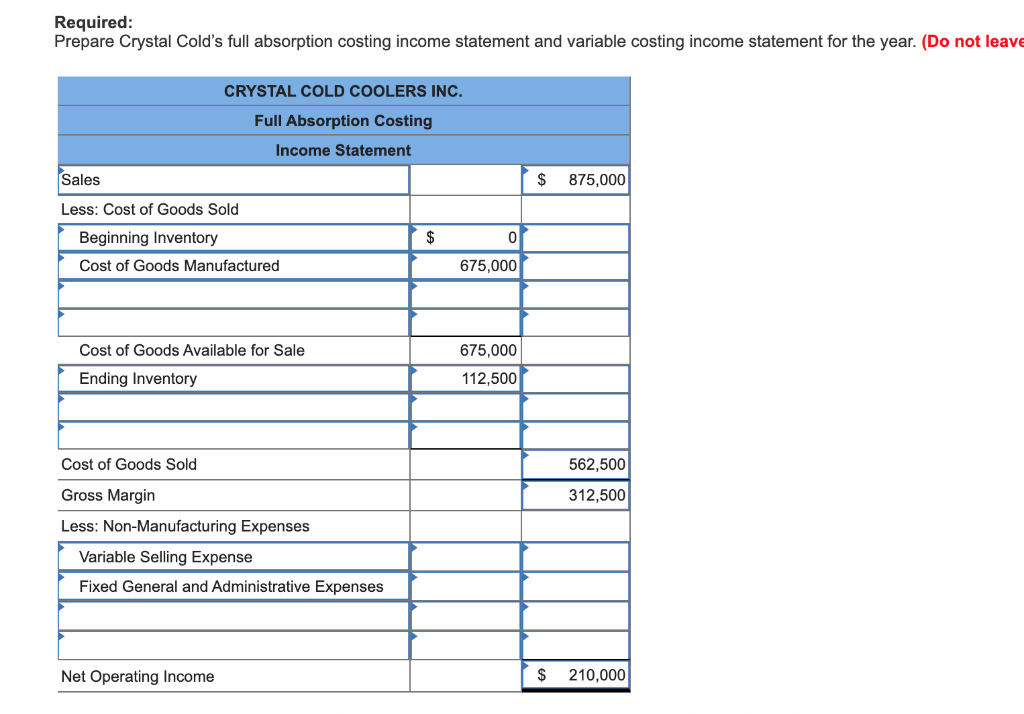

Solved Prepare An Absorption Costing Income Statement For

Solved Prepare An Absorption Costing Income Statement For

Solved E5 20 Comparing Full Absorption Costing And Variab

Solved E5 20 Comparing Full Absorption Costing And Variab

Exercise 5 Variable And Absorption Costing Income Statement

Exercise 5 Variable And Absorption Costing Income Statement

The Traditional Income Statement Absorption Costing Income

The Traditional Income Statement Absorption Costing Income

Absorption Costing Income Statement During The Most Recent Year

Absorption Costing Income Statement During The Most Recent Year

Compare And Contrast Variable And Absorption Costing Principles

Compare And Contrast Variable And Absorption Costing Principles

Confused An In Depth Comparison Of Variable Costing And

Confused An In Depth Comparison Of Variable Costing And

Exercise 2 Variable Costing Income Statement Reconciliation Of

Exercise 2 Variable Costing Income Statement Reconciliation Of

Answered Absorption Costing Income Statement On Bartleby

Answered Absorption Costing Income Statement On Bartleby

Exercise 5 Variable And Absorption Costing Income Statement

Exercise 5 Variable And Absorption Costing Income Statement

Whitman Company Has Just Completed Its First Year Of Operations

Whitman Company Has Just Completed Its First Year Of Operations

Posting Komentar

Posting Komentar