What Is A 8801 Form

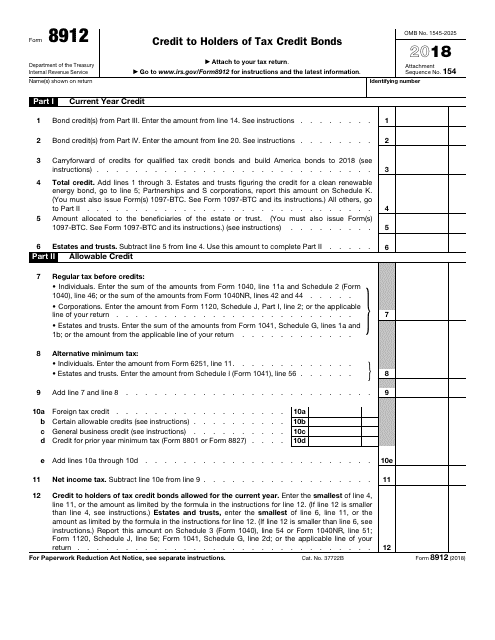

For instructions and the latest information. Form 8801 is the form to report credit from prior year amt.

Form 8801 Credit For Prior Year Minimum Tax Individuals Estates A

Form 8801 Credit For Prior Year Minimum Tax Individuals Estates A

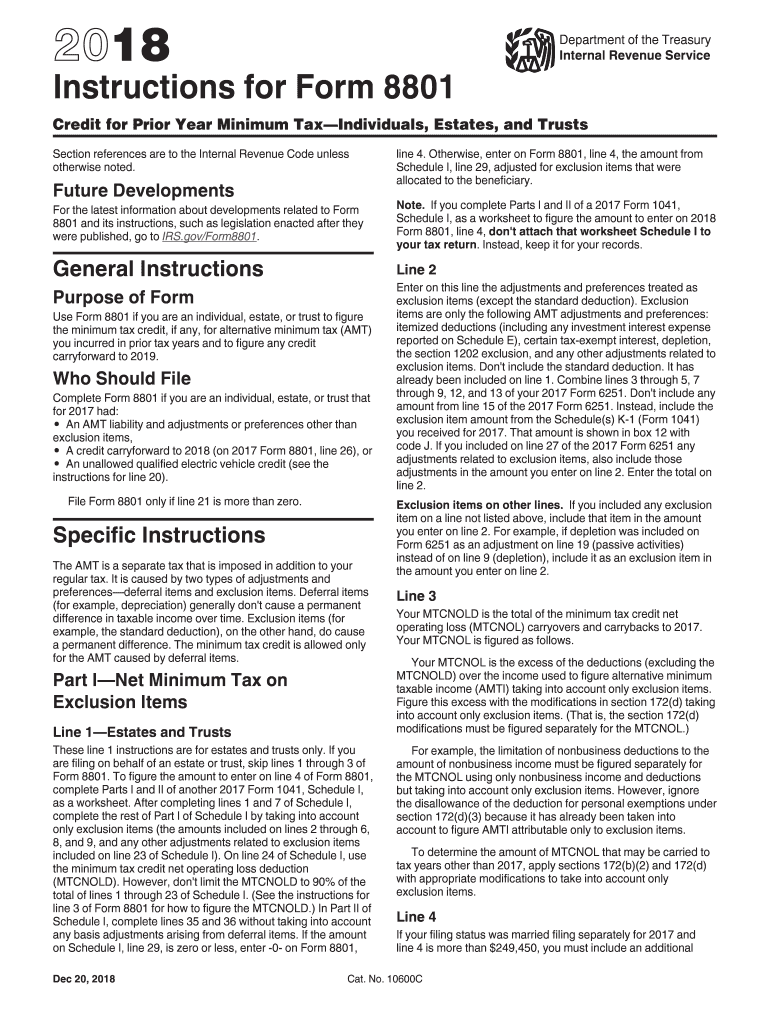

Form 8801 is used to figure the minimum tax credit for amt incurred in prior years and to figure any credit carryforward.

What is a 8801 form. What is the credit for prior year minimum tax form 8801. If you don t owe amt for the tax year but you paid amt in one or more previous years you may be eligible to take a credit for prior year minimum tax. Form 8801 is used to calculate your minimum tax credit for amt that you incurred in prior tax years and to figure any credit carryforward.

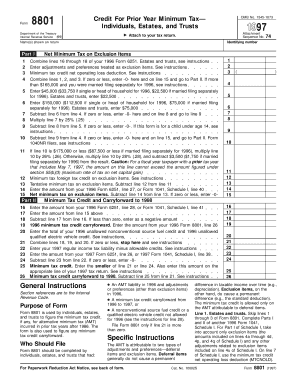

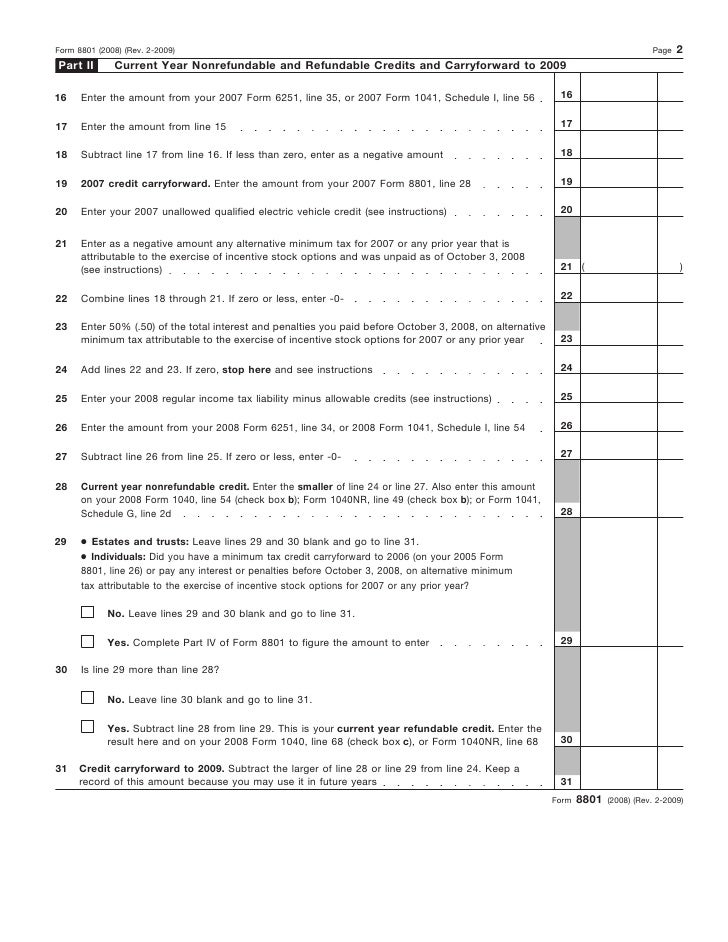

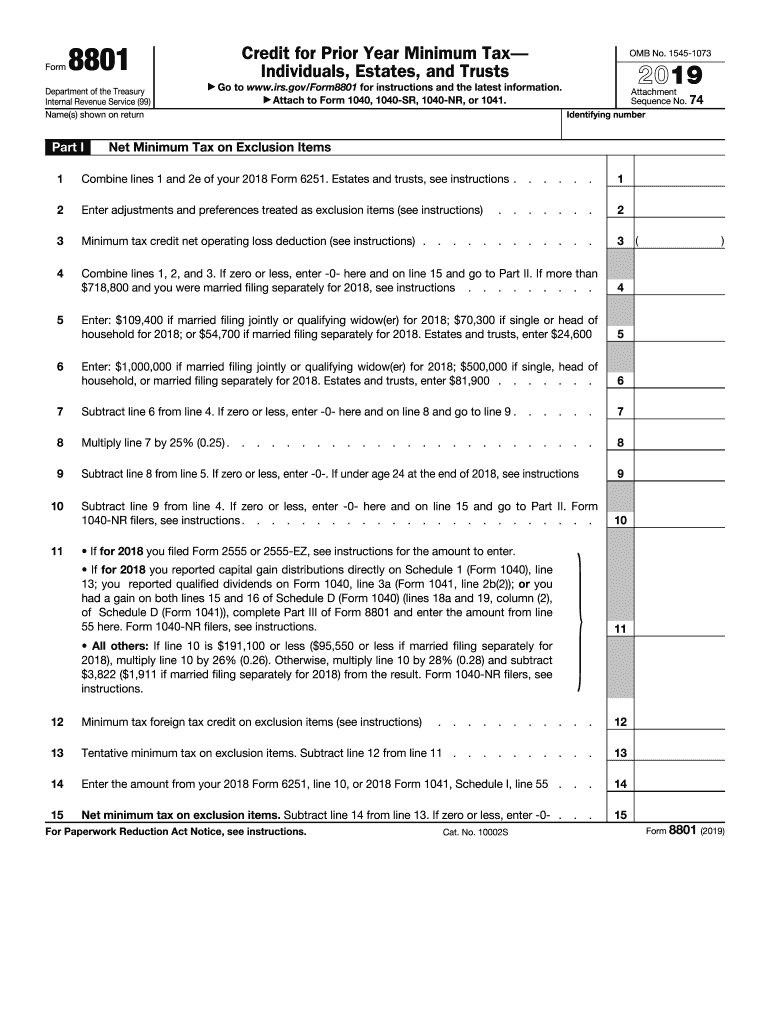

In part i net minimum tax on exclusion items the taxpayer calculates the amount of his amt liability from the previous year that was due to amt permanent exclusion items. Credit for paying the amt two types of adjustments and preference items cause the amt. Individuals estates and trusts use this form to figure the minimum tax credit if any for alternative minimum tax amt they incurred in prior tax years.

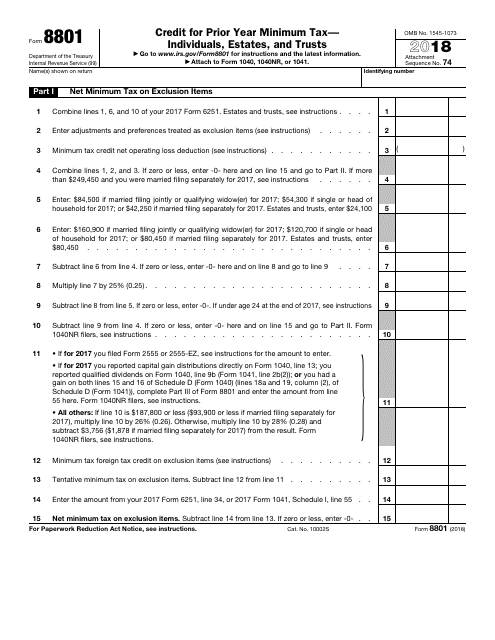

Attach to form 1040 1040 sr 1040 nr or 1041. Who should file complete form 8801 if you are an individual estate or trust that for 2018 had. Form 8801 is used to calculate a taxpayer s refundable in applicable years only and nonrefundable for all years minimum tax credit mtc and mtc carryforward to the next year.

It is caused by two types of adjustments and preferences deferral items and exclusion items. The form 8801 is used to calculate your minimum tax credit for amt that you incurred in prior tax years and to figure any credit carryforward. Information about form 8801 credit for prior year minimum tax individuals estates and trusts including recent updates related forms and instructions on how to file.

File form 8801 only if line 21 is more than zero. You should enter 0 when asked for line 26 of the 2016 form 8801. Https www irs gov pub irs pdf f8801 pdf as you had no prior year amt credit in 2016 and no 2016 amt carried forward to 2017 turbotax did not generate form 8801 as line 26 on form 8801 is 0.

Department of the treasury internal revenue service 99 credit for prior year minimum tax individuals estates and trusts. Purpose of form use form 8801 if you are an individual estate or trust to figure the minimum tax credit if any for alternative minimum tax amt you incurred in prior tax years and to figure any credit carryforward to 2020. Use form 8801 if you are an individual estate or trust to figure the minimum tax credit if any for alternative minimum tax amt you incurred in prior tax years and to figure any credit.

The prior year minimum tax credit is a credit for alternative minimum tax amt that you paid in a prior year. The amt is a separate tax that is imposed in addition to your regular tax. Deferral items and exclusion items.

Form 8801 Fillable Credit For Prior Year Minimum Tax Individuals

Alternative Minimum Tax Amt 6 Things You Should Know Taxact Blog

Alternative Minimum Tax Amt 6 Things You Should Know Taxact Blog

The Amazing Disappearing Amt Creditmichael Gray Cpa Stock Option

Irs Form 8801 Download Fillable Pdf Or Fill Online Credit For

Irs Form 8801 Download Fillable Pdf Or Fill Online Credit For

Other Credits From Forms 2439 8801 And 8885

2019 Form Irs 8801 Instructions Fill Online Printable Fillable

2019 Form Irs 8801 Instructions Fill Online Printable Fillable

I8801 2015 Instructions For Form 8801 Department Of The Treasury

I8801 2015 Instructions For Form 8801 Department Of The Treasury

Irs Form 1040 Simplification Good News And Bad News For Reporting

Alternative Minimum Tax Common Questions Turbotax Tax Tips Videos

Alternative Minimum Tax Common Questions Turbotax Tax Tips Videos

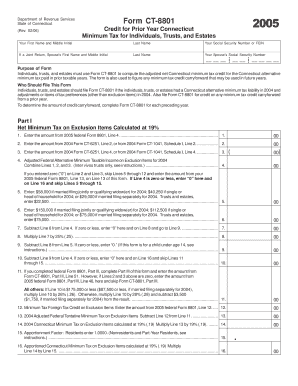

Ct Tax Form Ct 8801 Fill Online Printable Fillable Blank

Ct Tax Form Ct 8801 Fill Online Printable Fillable Blank

How To Claim Amt Credit 8 Steps With Pictures Wikihow

How To Claim Amt Credit 8 Steps With Pictures Wikihow

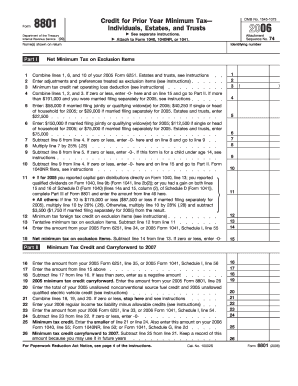

2006 Form 8801 Irs Fill Online Printable Fillable Blank

2006 Form 8801 Irs Fill Online Printable Fillable Blank

Https Portal Ct Gov Media Drs Forms 1 2018 Income Ct 8801 1218 Pdf La En

Irs Form 8801 Download Fillable Pdf Or Fill Online Credit For

Irs Form 8801 Download Fillable Pdf Or Fill Online Credit For

The Amazing Disappearing Amt Creditmichael Gray Cpa Stock Option

Isos Tax Return Tips And Traps Mystockoptions Com

Isos Tax Return Tips And Traps Mystockoptions Com

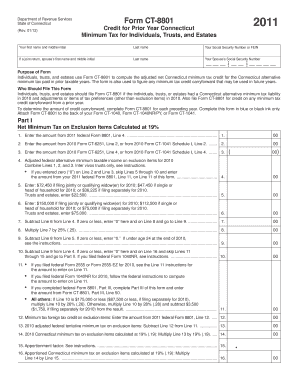

Ct 8801 Fillable Form Fill Online Printable Fillable Blank

Ct 8801 Fillable Form Fill Online Printable Fillable Blank

Form 8801 Credit For Prior Year Minimum Tax Individuals

Form 8801 Credit For Prior Year Minimum Tax Individuals

Form 8801 Credit For Prior Year Minimum Tax Individuals Estates

Irs Form 8801 For 2014 Shaggy Crew

Irs Form 8801 For 2014 Shaggy Crew

1040 Schedule 3 Drake18 And Drake19 Schedule3

1040 Schedule 3 Drake18 And Drake19 Schedule3

Irs Form 8912 Download Fillable Pdf Or Fill Online Credit To

Irs Form 8912 Download Fillable Pdf Or Fill Online Credit To

How To Claim Amt Credit 8 Steps With Pictures Wikihow

How To Claim Amt Credit 8 Steps With Pictures Wikihow

Form 8801 Credit For Prior Year Minimum Tax Individuals

Form 8801 Credit For Prior Year Minimum Tax Individuals

Https Www Irs Gov Pub Irs Prior I6251 2001 Pdf

Fillable Online Irs Form 8801 Irs Irs Fax Email Print Pdffiller

Fillable Online Irs Form 8801 Irs Irs Fax Email Print Pdffiller

Irs 8801 Fill Online Printable Fillable Blank Pdffiller

Irs 8801 Fill Online Printable Fillable Blank Pdffiller

Amt Tax Credit Form 8801 H R Block

Amt Tax Credit Form 8801 H R Block

How To Claim Amt Credit 8 Steps With Pictures Wikihow

How To Claim Amt Credit 8 Steps With Pictures Wikihow

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gct9 Qbaawwclyh845pydeeestbcn7nsxlcusd Bfsbou5uzebnl Usqp Cau

Form 8801 Credit For Prior Year Minimum Tax Individuals Estates A

Form 8801 Credit For Prior Year Minimum Tax Individuals Estates A

Https Www Irs Gov Pub Irs Prior I8801 2013 Pdf

How To Claim Amt Credit 8 Steps With Pictures Wikihow

How To Claim Amt Credit 8 Steps With Pictures Wikihow

Form 8801 2019 Fill Out And Sign Printable Pdf Template Signnow

Form 8801 2019 Fill Out And Sign Printable Pdf Template Signnow

Form 8801 Credit For Prior Year Minimum Tax Individuals

Form 8801 Credit For Prior Year Minimum Tax Individuals

8801 Fill Out And Sign Printable Pdf Template Signnow

8801 Fill Out And Sign Printable Pdf Template Signnow

Posting Komentar

Posting Komentar