Monte Carlo Simulation Stock Trading Systems

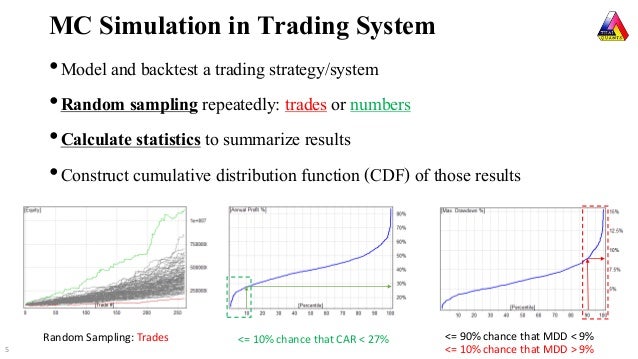

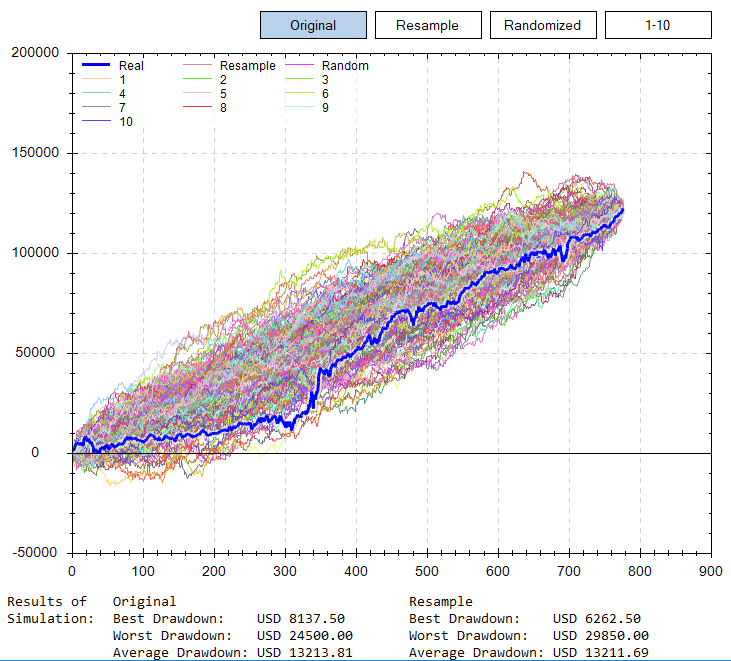

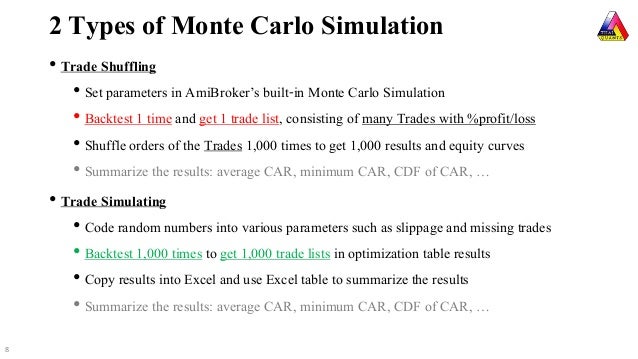

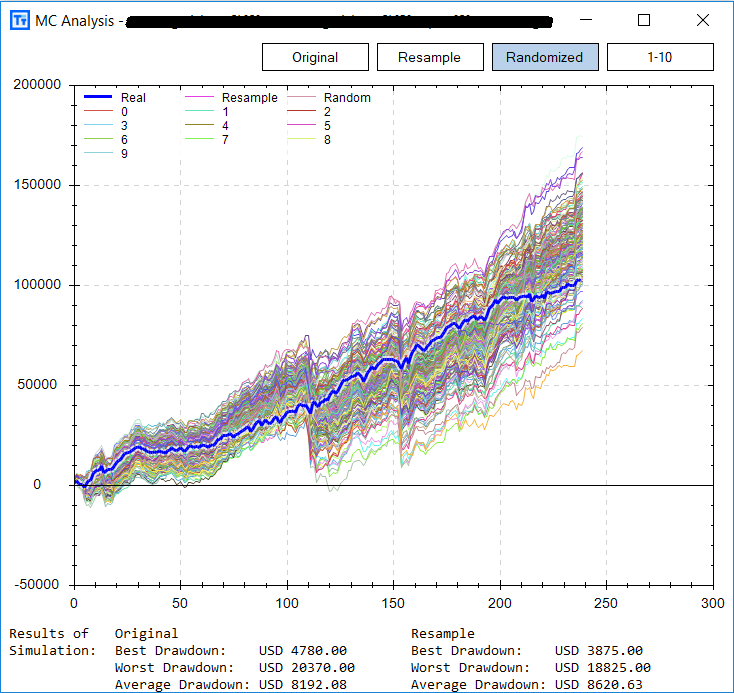

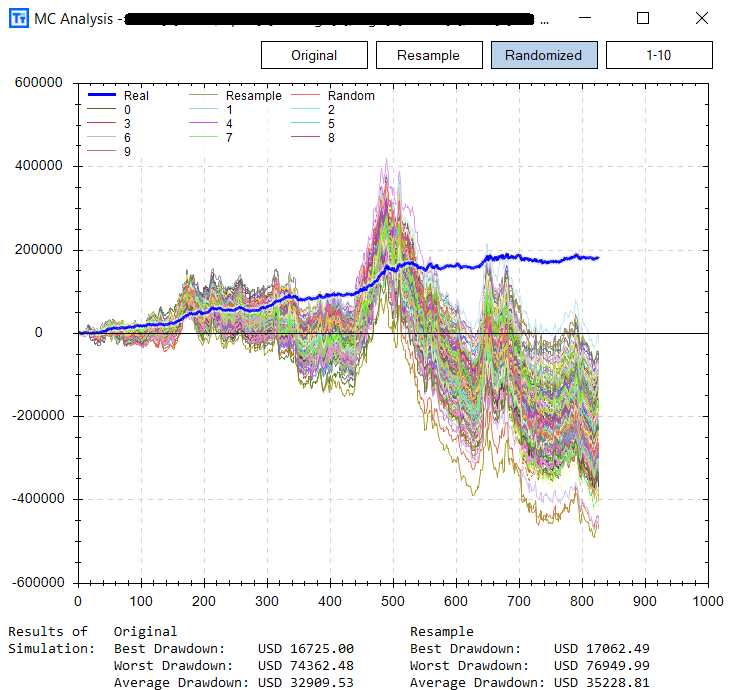

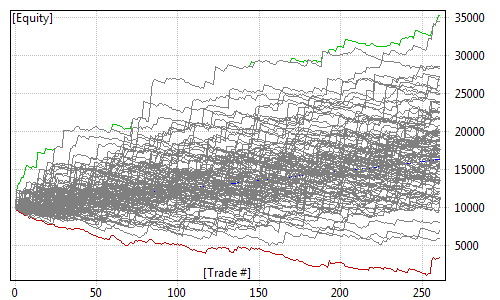

In order to ensure that your trading system is robust backtesting should be performed multiple times by adding variations to your trading rules or data. When using use monte carlo analysis to simulate trading the trade distribution as represented by the list of trades is sampled to generate a trade sequence.

Monte Carlo Analysis How Reliable Is Your Trading Strategy

Monte Carlo Analysis How Reliable Is Your Trading Strategy

In trading terms monte carlo simulation is performed to forecast the success of a backtested trading system.

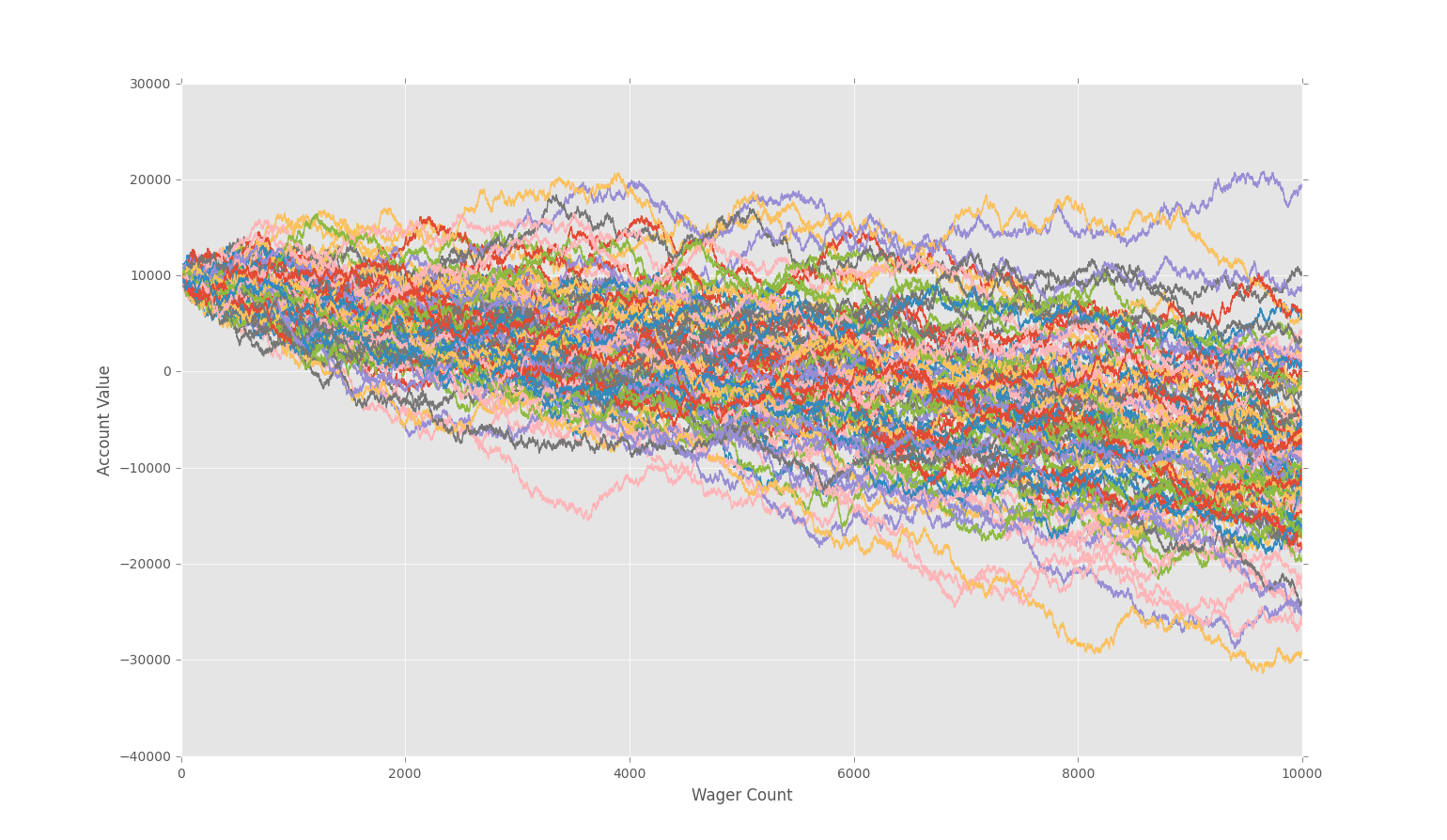

Monte carlo simulation stock trading systems. On the downside the simulation is limited in that. The performance of the original system we conclude that our system provides significantly better returns than chance would provide and we rejoice. Monte carlo simulation builds a list of models of possible results by randomising model parameters with a given probability distribution.

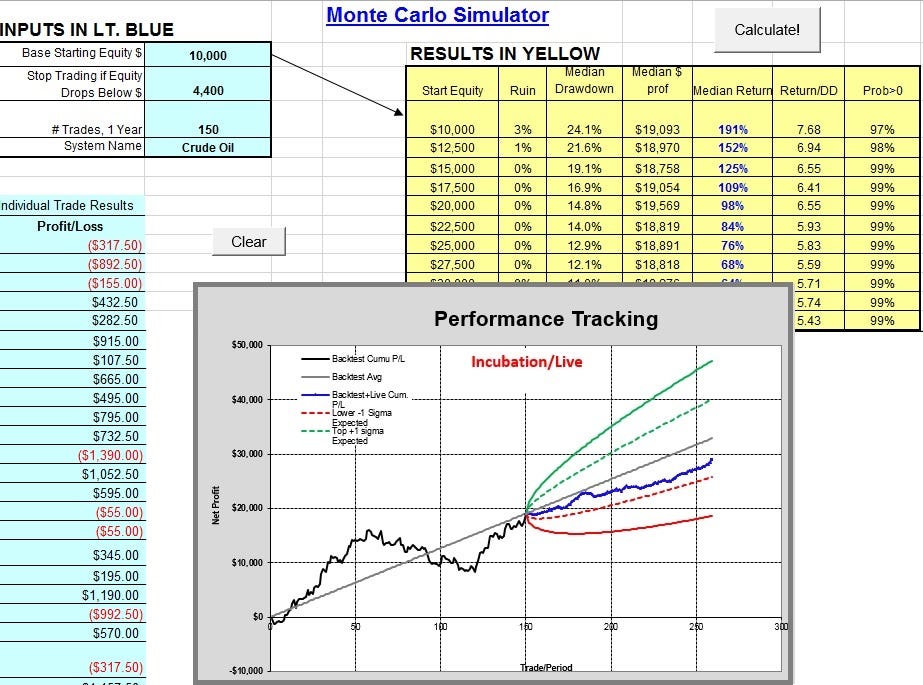

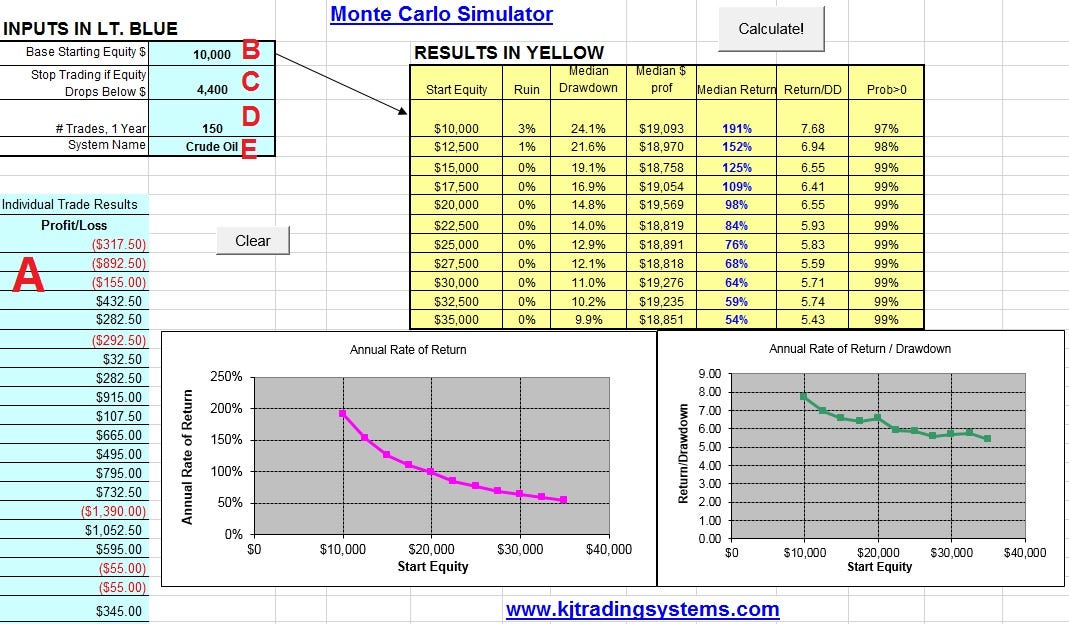

The trading scenario in an automated trading scenario that is amenable to monte carlo simulation the trader is presented with a large number of trading opportunities. Because i could not find a good monte carlo simulation tool in the internet i created my own risk simulatorand made it free for everyone. The beta is calculated from the residuals as the mean absolute distance from the mean.

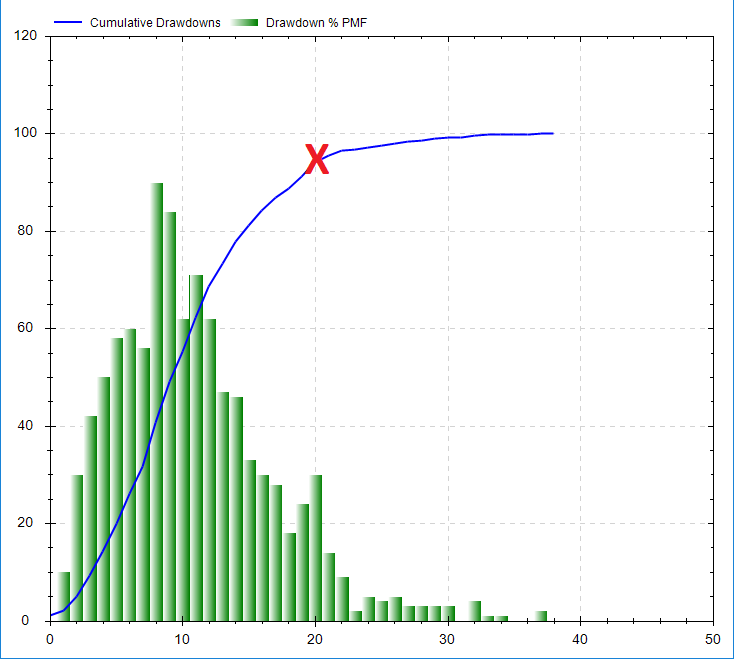

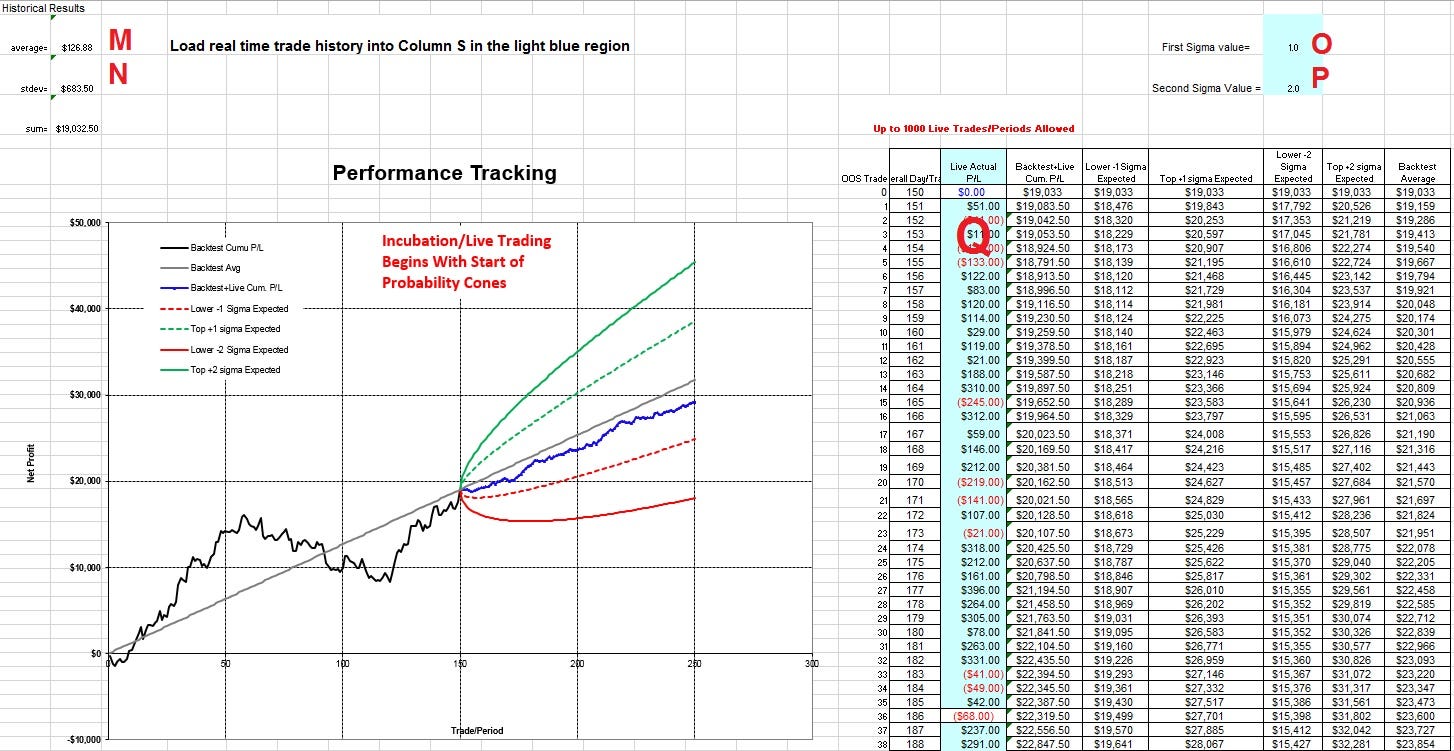

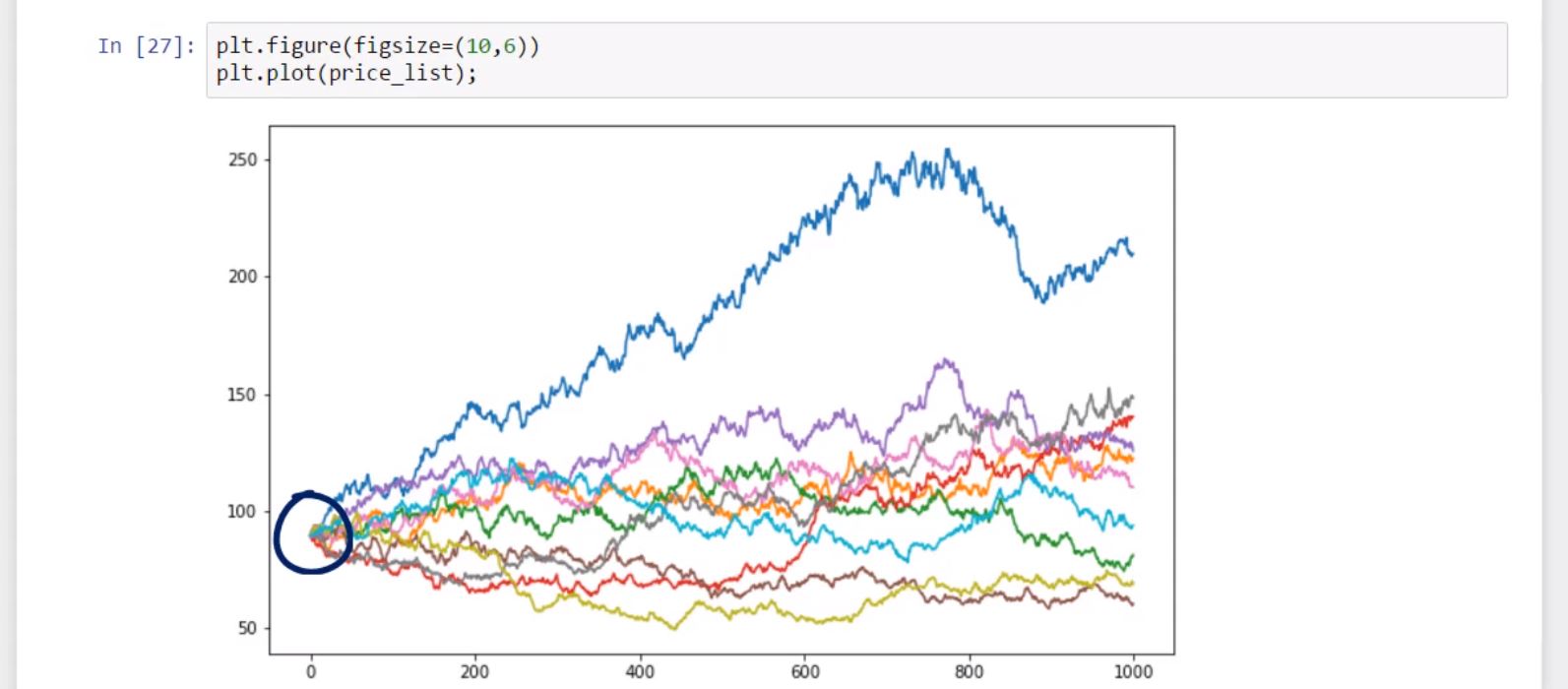

Each such sequence is analyzed and the results are sorted to determine the probability of each result. You only have to know the average loss average win and hitrate of your system. A monte carlo simulation projects your trading system s equity curve into the future.

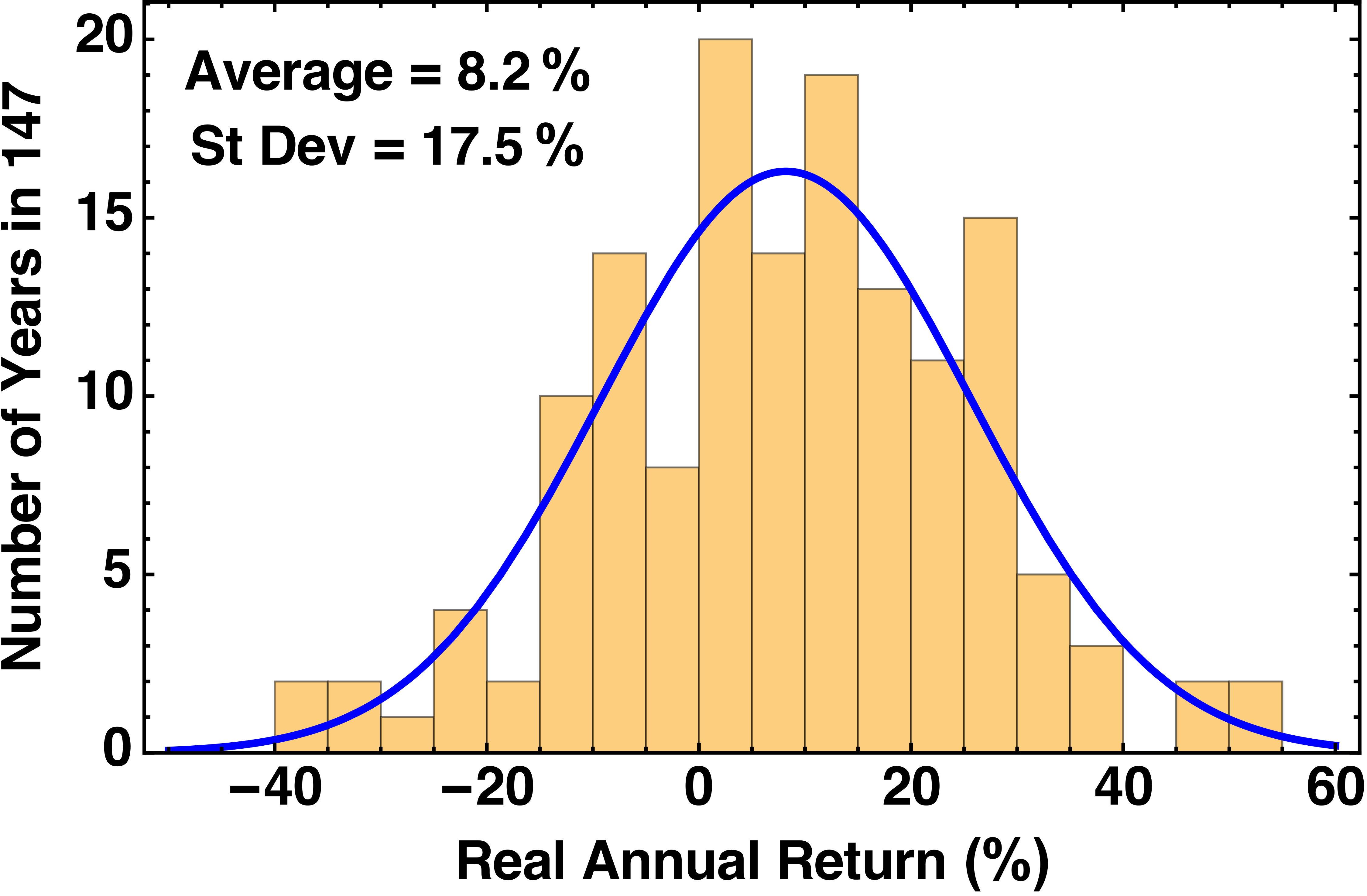

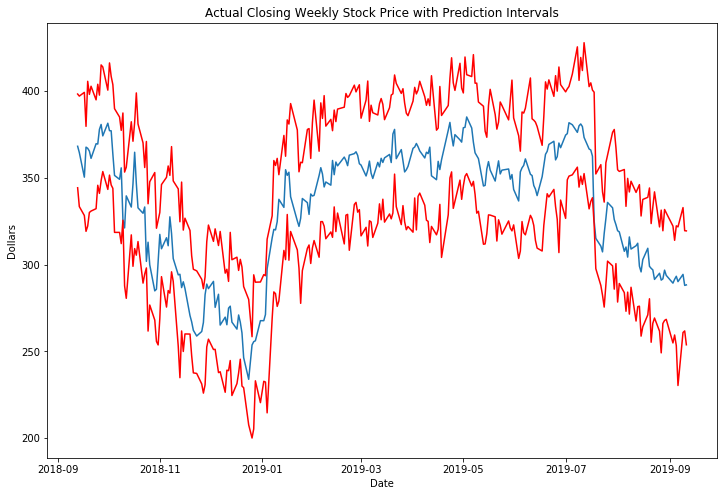

The mean is the predicted stock price because the residuals were centered at zero. It then calculates the results over and over each time using a different set of random values in the model. Using monte carlo simulation to predict stock price intervals now we can generate empirically derived prediction intervals using our chosen distribution laplace.

For information on monte carlo software for trading click here. The monte carlo simulation can be used in corporate finance options pricing and especially portfolio management and personal finance planning.

Amazon Com Building Winning Algorithmic Trading Systems A

Amazon Com Building Winning Algorithmic Trading Systems A

Monte Carlo Simulation For Trading System In Amibroker

Monte Carlo Simulation For Trading System In Amibroker

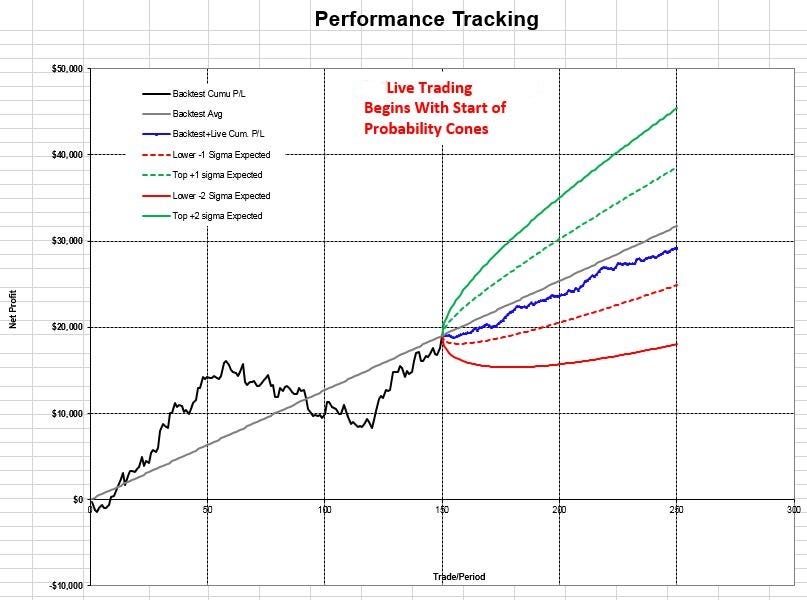

Improving Your Algo Trading By Using Monte Carlo Simulation And

Improving Your Algo Trading By Using Monte Carlo Simulation And

What Good Are Monte Carlo Simulations Anyway Seeking Alpha

What Good Are Monte Carlo Simulations Anyway Seeking Alpha

Fooled By Monte Carlo Simulation This Article Was Originally

Fooled By Monte Carlo Simulation This Article Was Originally

Futures Trading Strategies Books In 2019 Kj Trading Systems

Futures Trading Strategies Books In 2019 Kj Trading Systems

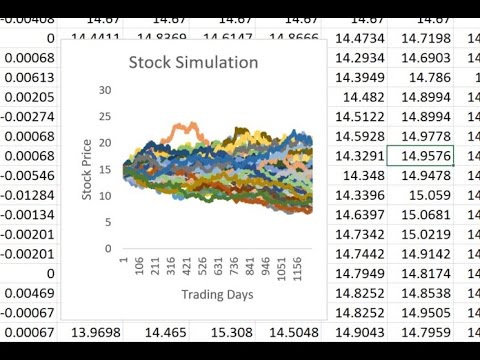

Monte Carlo Simulation Of Stock Price Movement Youtube

Monte Carlo Simulation Of Stock Price Movement Youtube

Stock Market Monte Carlo Simulation Spreadsheet

Stock Market Monte Carlo Simulation Spreadsheet

Improving Your Algo Trading By Using Monte Carlo Simulation And

Improving Your Algo Trading By Using Monte Carlo Simulation And

3 Of Many Uses For Monte Carlo Simulations In Trading See It

3 Of Many Uses For Monte Carlo Simulations In Trading See It

Monte Carlo Simulation For Trading System In Amibroker

Monte Carlo Simulation For Trading System In Amibroker

Improving Your Algo Trading By Using Monte Carlo Simulation And

Improving Your Algo Trading By Using Monte Carlo Simulation And

3 Of Many Uses For Monte Carlo Simulations In Trading See It

3 Of Many Uses For Monte Carlo Simulations In Trading See It

Are Your Backtest Results Fooling You Better System Trader

3 Of Many Uses For Monte Carlo Simulations In Trading See It

3 Of Many Uses For Monte Carlo Simulations In Trading See It

Adaptrade Software Market System Analyzer Msa

Trading A Strategy That Performs Well In The Backtests

3 Of Many Uses For Monte Carlo Simulations In Trading See It

3 Of Many Uses For Monte Carlo Simulations In Trading See It

The Power Of Position Sizing Strategies Sqn Secrets Revealed

Stock Price Prediction Intervals Using Monte Carlo Simulation By

Stock Price Prediction Intervals Using Monte Carlo Simulation By

Amazon Com Modeling Trading System Performance Monte Carlo

Amazon Com Modeling Trading System Performance Monte Carlo

Foundations Of Trading Developing Profitable Trading Systems

Foundations Of Trading Developing Profitable Trading Systems

Improving Your Algo Trading By Using Monte Carlo Simulation And

Improving Your Algo Trading By Using Monte Carlo Simulation And

Monte Carlo Simulation Software Will Help You Become A Better Trader

Monte Carlo Simulation Software Will Help You Become A Better Trader

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsrwfoqnizglgts5ojlyfoatwsf8hljyc4vny Ijpwrbwcn9tw Usqp Cau

Modeling Trading System Performance Blue Owl Press

Monte Carlo Simulation Stock Strategy Test

How To Apply Monte Carlo Simulation To Forecast Stock Prices Using

How To Apply Monte Carlo Simulation To Forecast Stock Prices Using

%2C445%2C291%2C400%2C400%2Carial%2C12%2C4%2C0%2C0%2C5_SCLZZZZZZZ_.jpg) Amazon Com Building Winning Algorithmic Trading Systems

Amazon Com Building Winning Algorithmic Trading Systems

How To Use A Risk Simulator On Your Trading System New Trader U

How To Use A Risk Simulator On Your Trading System New Trader U

Monte Carlo Simulation Of Stock Volatility Youtube

Monte Carlo Simulation Of Stock Volatility Youtube

Monte Carlo Simulation For Trading System In Amibroker

Monte Carlo Simulation For Trading System In Amibroker

Risk Simulation What Can You Expect From Your Trading System

Risk Simulation What Can You Expect From Your Trading System

Position Sizing With Monte Carlo Simulation February 2001

Posting Komentar

Posting Komentar